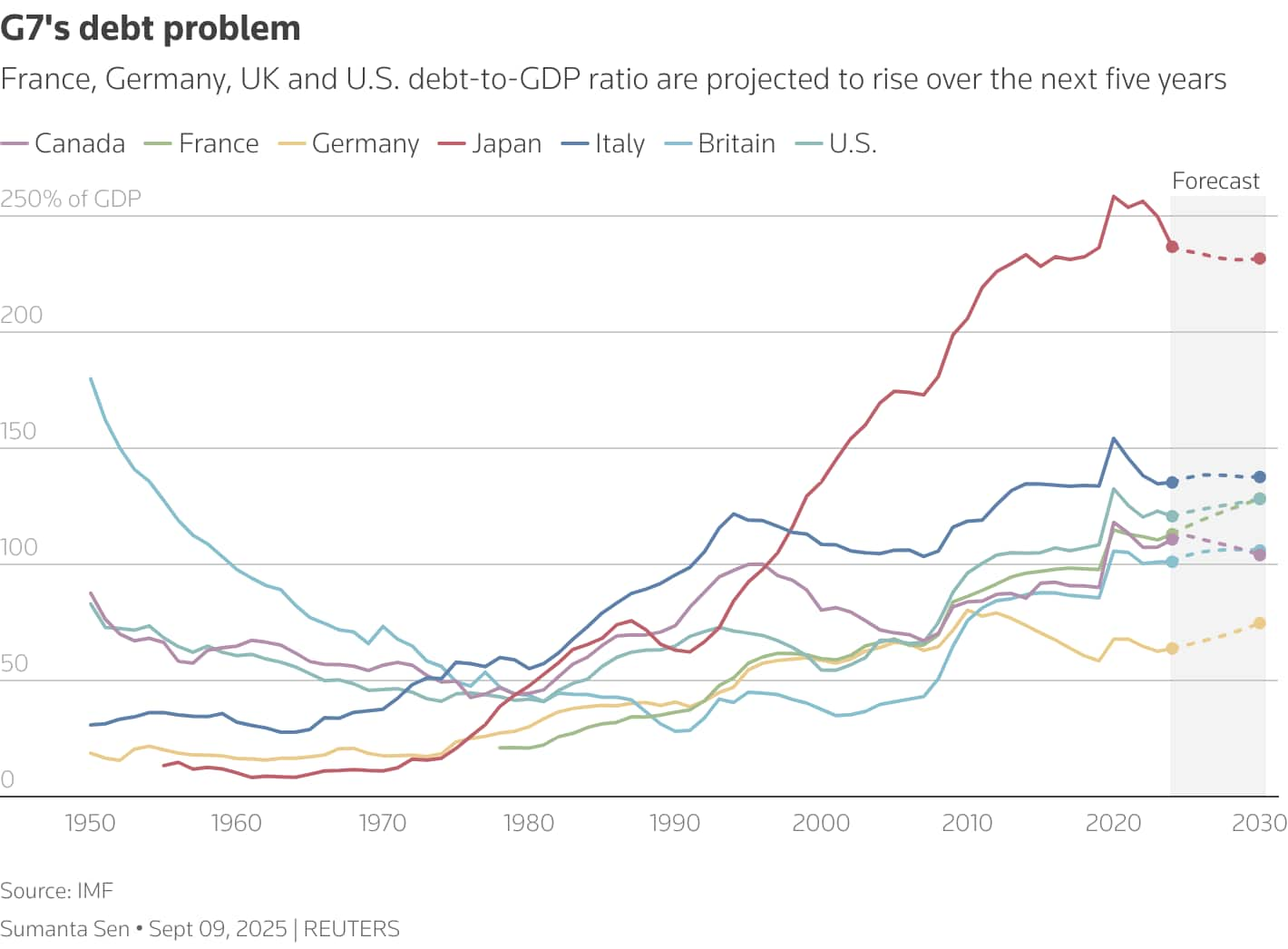

The world's richest countries seem prepared to run their economies hot, leaving money and budget policies loose despite elevated inflation and mountainous debt piles. Stocks and gold get the picture and it's a jarring prospect for bonds.

Aided by seemingly new waves of excitement around artificial intelligence, and despite ever-present bubble worries, the new policy constellation is supercharging record-high world stock prices in a staggering turnaround in sentiment over the summer.

Just six months ago, as Washington ratcheted up tariff plans and financial markets had a near heart attack on the implications, many assumed the risk of a U.S. and global recession would rise dramatically as the year progressed.

But that has turned almost 180 degrees.

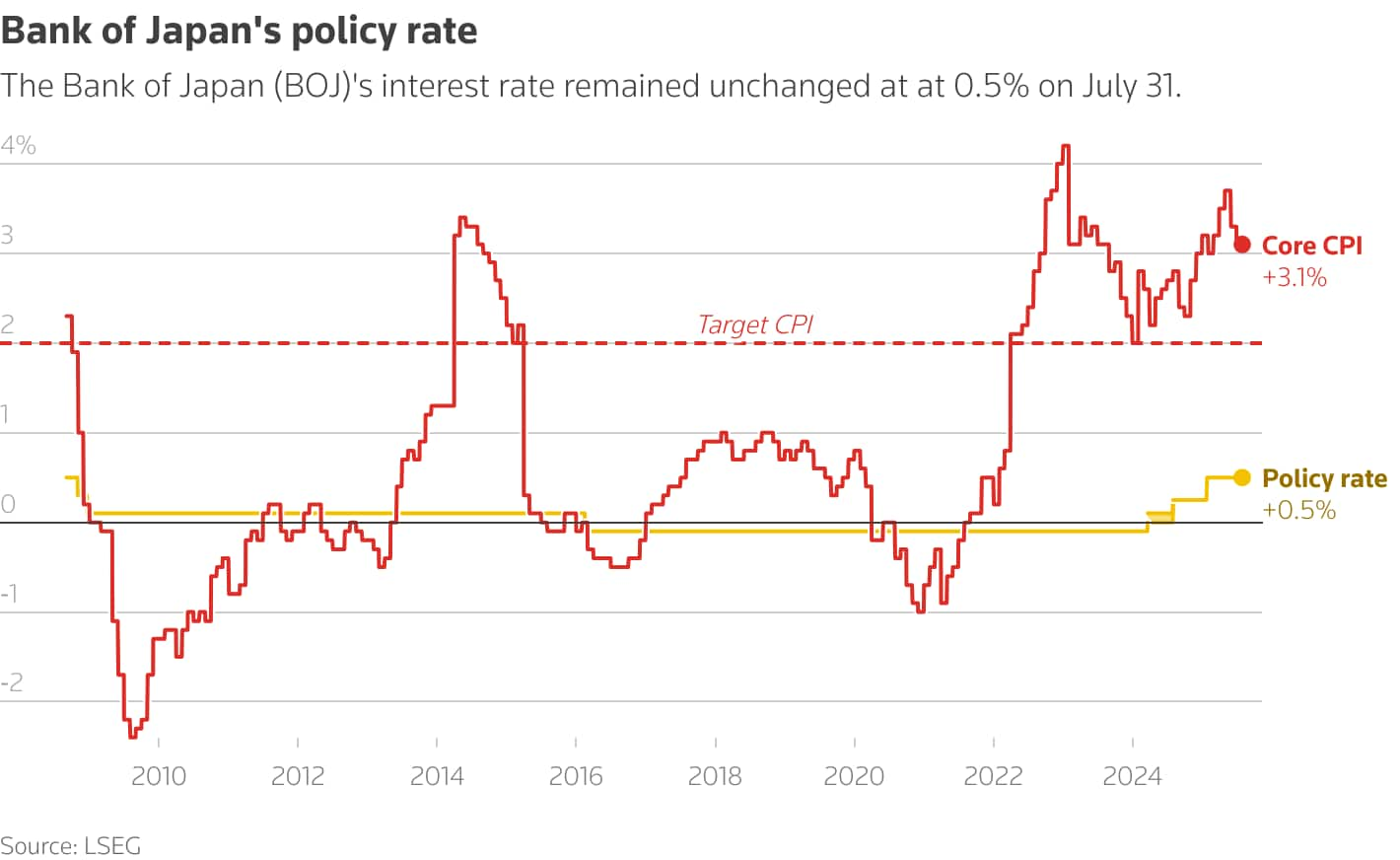

The latest twist came this weekend in Japan - the only G7 economy even considering tighter monetary policy.

The surprise election of Sanae Takaichi as head of the ruling Liberal Democratic Party, and now likely Japan's first woman prime minister, is expected to lean against further Bank of Japan rate rises and in favor of further fiscal stimulus.

If BOJ tightening was put on ice now with its rates still only 0.5%, then wider G7 monetary settings are very loose indeed. European Central Bank rates are already back near three-year lows of 2% and the Federal Reserve has resumed its easing campaign after a nine-month hiatus and expected to lop another 50 basis points off its policy rate to near 3.5% by year-end.

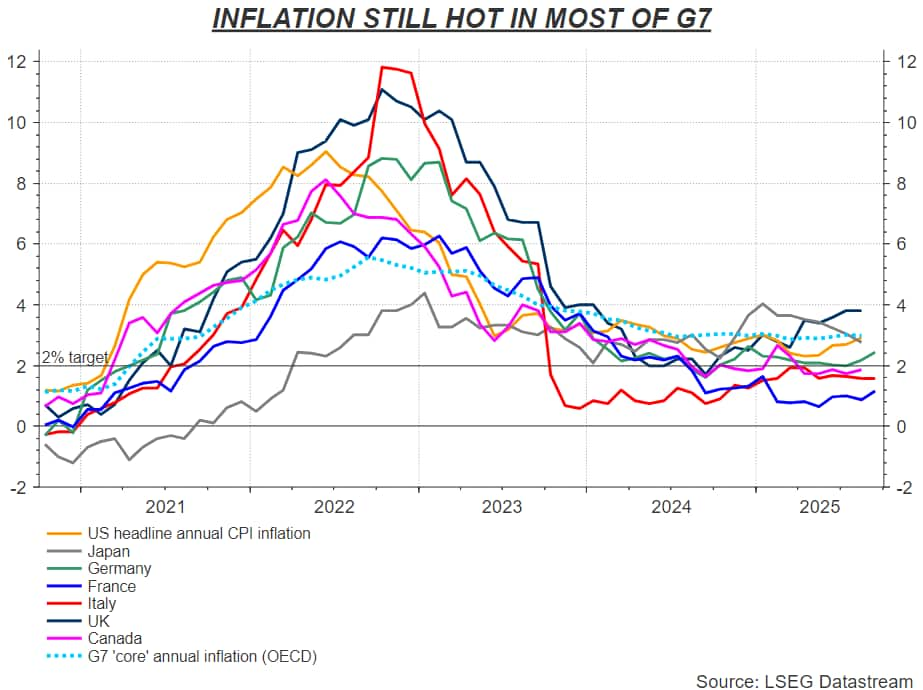

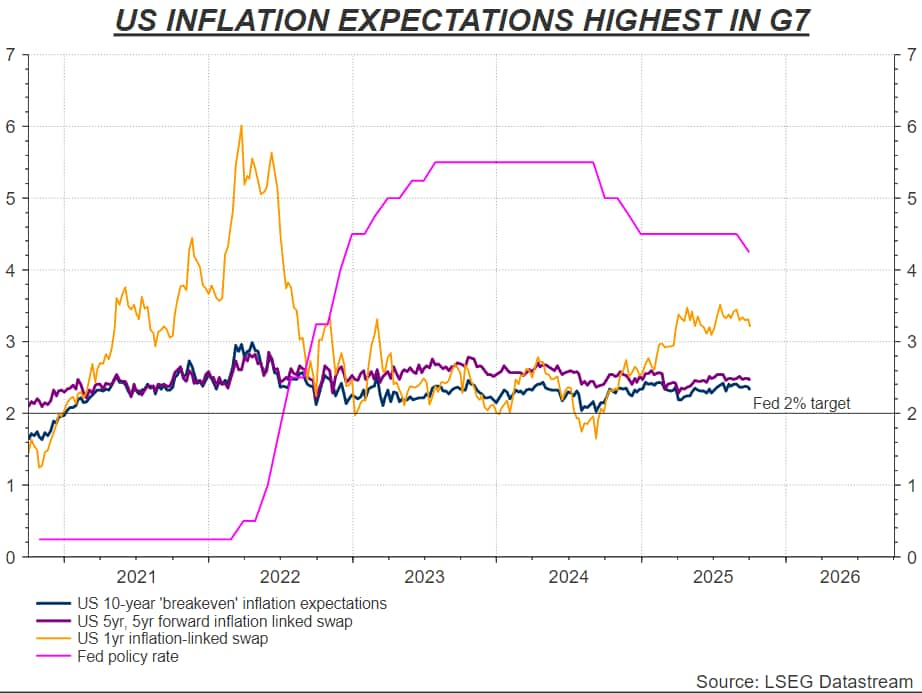

That may all seem fine if inflation was back in its box or underlying economies spluttering. But the United States, Japan, Germany and the wider euro zone are still seeing inflation running above central banks' 2% targets, with the U.S. and Japan now closer to 3% than 2% and U.S. long-term inflation expectations among investors still as high as 2.4% or higher.

According to the Organisation for Economic Cooperation and Development, "core" inflation that excludes volatile food and energy prices remained stuck at 3% in August for the G7 as a whole - barely below 2024's average of 3.2% and fueling speculation that 2% goals are being softened.

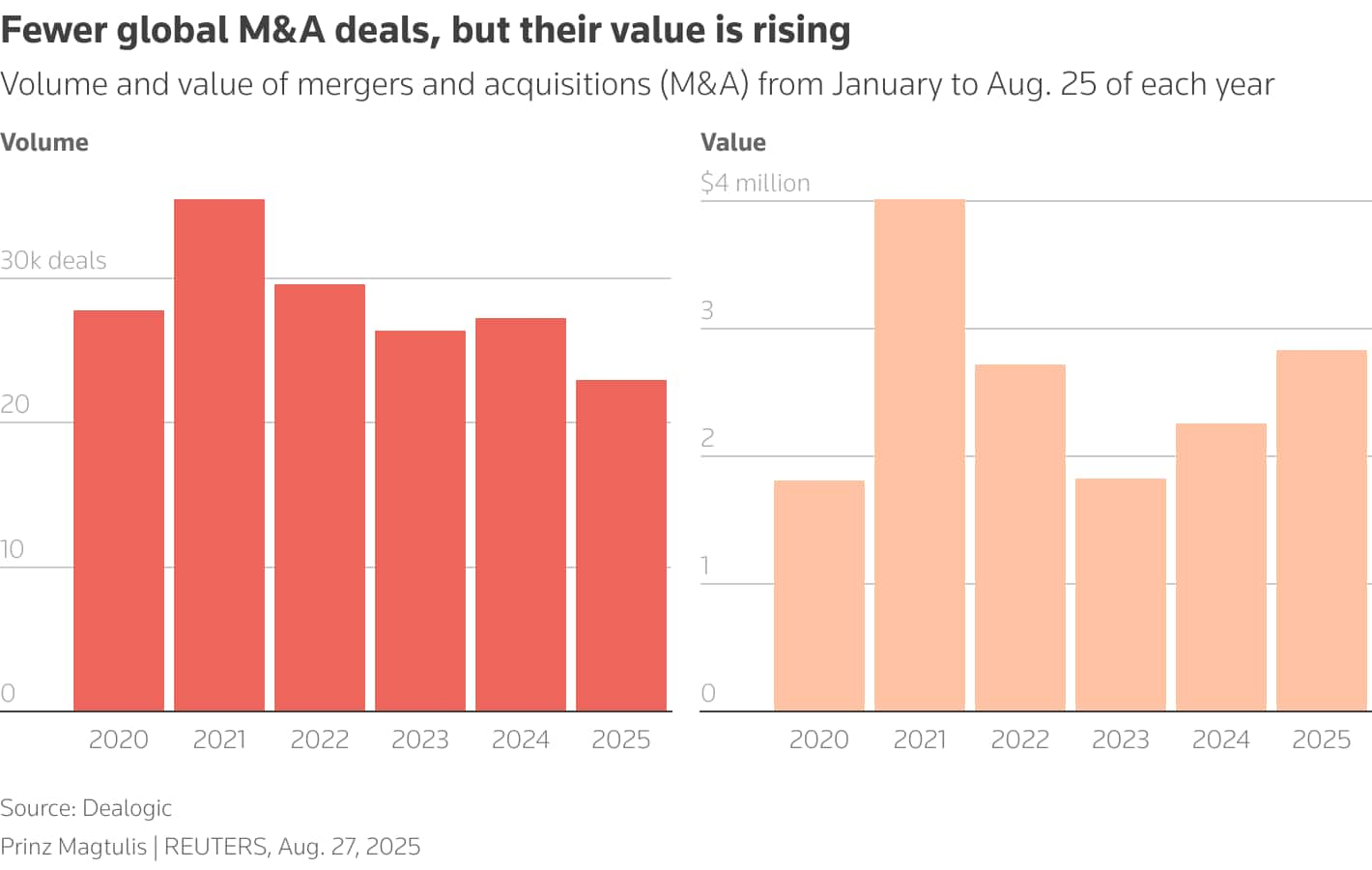

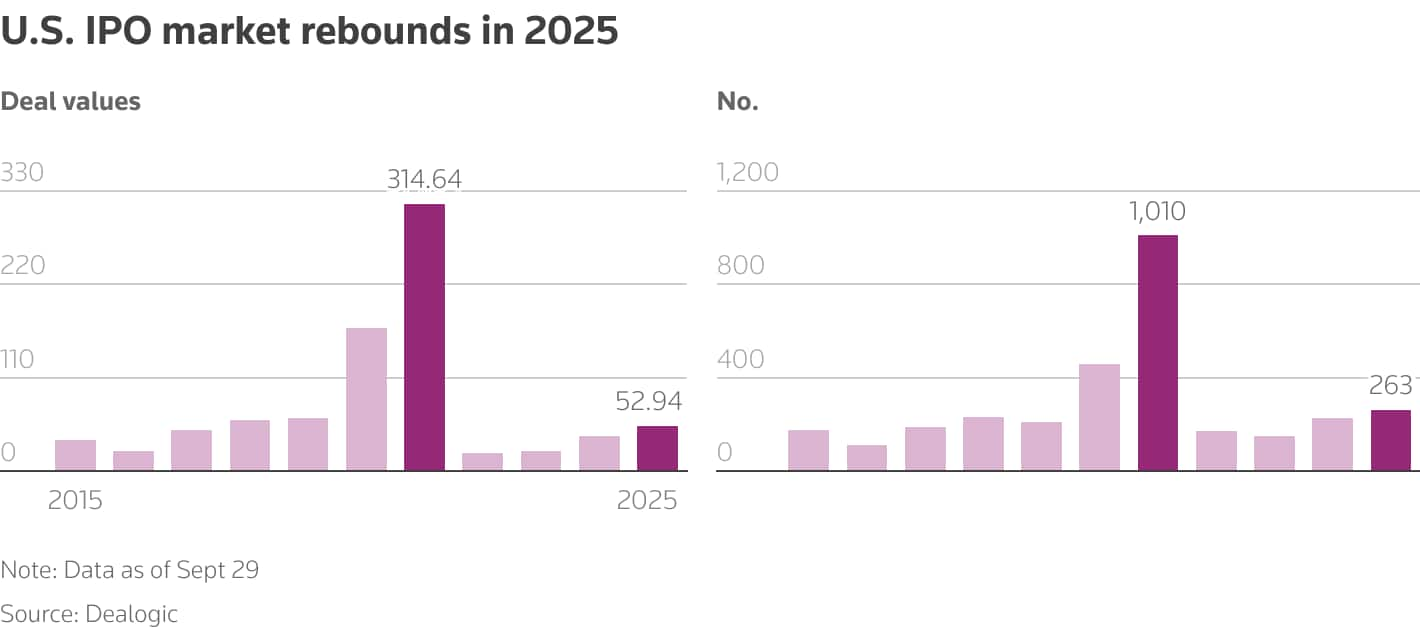

Perhaps just as testing, monetary settings are loosening again into very frothy financial conditions - double-digit stock index gains for the year, record-low credit risk premia, rapidly rising corporate deal activity and new stock listings. What's more, we are again seeing outsized single-stock price gains on even the mere mention of any AI-related tie-ups or orders.

NO BRAKES

Surely fiscal policy is now doing the hard work? Not at all - it's doing the opposite, if anything.

Alongside the likely new trajectory in Japan, Germany's historic near trillion-euro fiscal spree is about to kick in this quarter, France's ongoing political muddle leaves it running annual deficits of 5% of GDP and U.S. President Donald Trump's signature fiscal bill this summer is delivering tax cuts and deregulation to spur an economy already tracking 4% growth.

Throw in the boom in AI infrastructure and defense spending worldwide and you can see why global growth rates may well now pick up steam despite all of the early-year fear and trepidation about the U.S. trade shock and wider geopolitical uncertainties.

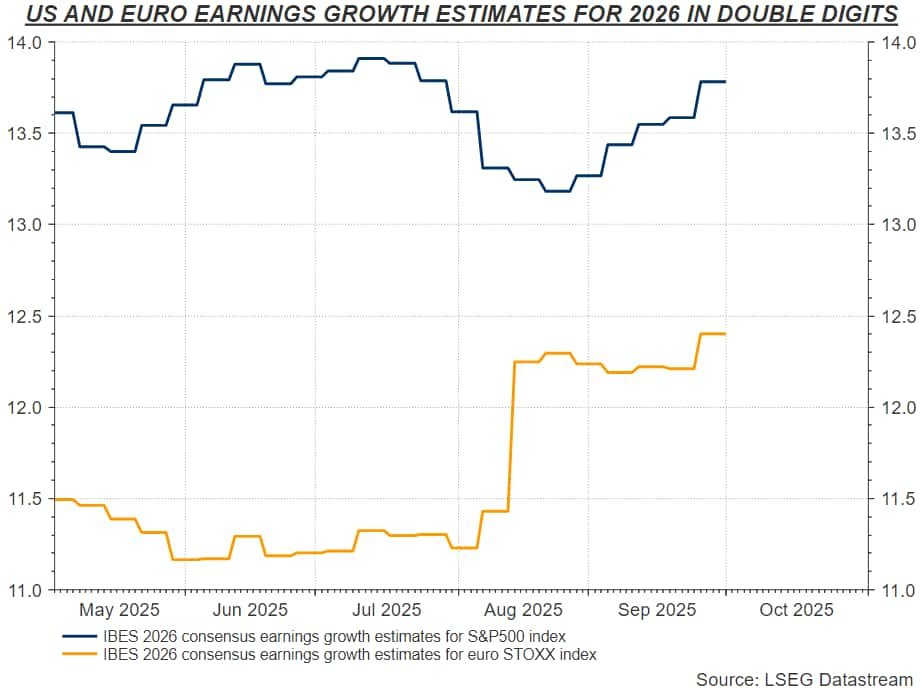

As it stands, corporate earnings growth estimates for the United States and Europe for calendar 2026 are running at 13.8% and 12.4%, respectively.

Beyond the G7, China's ruling Communist Party is also due to meet later this month to map out its latest five-year economic plan and both stimulus and domestic tech development seem likely to be high on the agenda amid global trade worries - and with ripple effects from that set to go worldwide.

The whole picture could possibly be resolved if the rapid adoption of AI results in a significant pickup in economy-wide productivity growth - which, along with continued softness in energy prices, could allow output growth to be sustained without aggravating inflation.

But it mostly remains in the realms of guesswork for now.

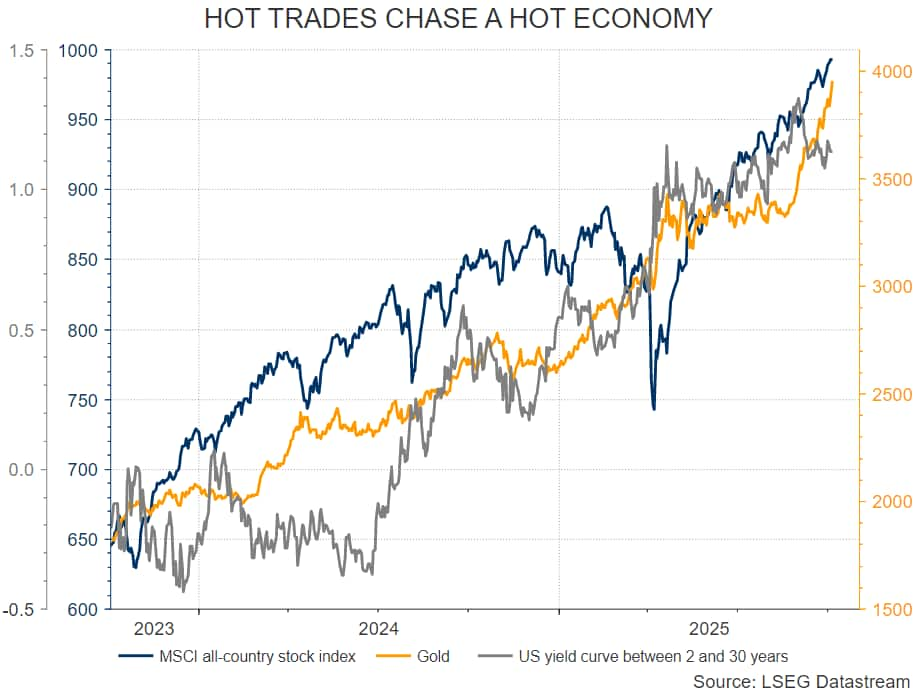

For investors, these "hot" economy settings underscore the simultaneous rush to both stocks and inflation hedges such as gold since midyear.

They also support one of the year's favored bets on a steepening bond yield curve, where long-dated borrowing rates rise on inflation worries even as - or perhaps because - central banks are dragging short rates before nailing inflation down.

Bubble fears will be hard to shake in that environment.

In any event, the hyper-confrontational and competitive global environment means no country wants to apply the brakes and macro policy lights are now firmly switched to "go."

The opinions expressed here are those of the author, a columnist for Reuters.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.