The market was trading flat on April 3 morning, as analysts see a lack of activity due to two holidays during the week. Some traders expect the market to move lower before rising to March 31 level. At 10.40 am, the Nifty was trading flat at 17,359.65.

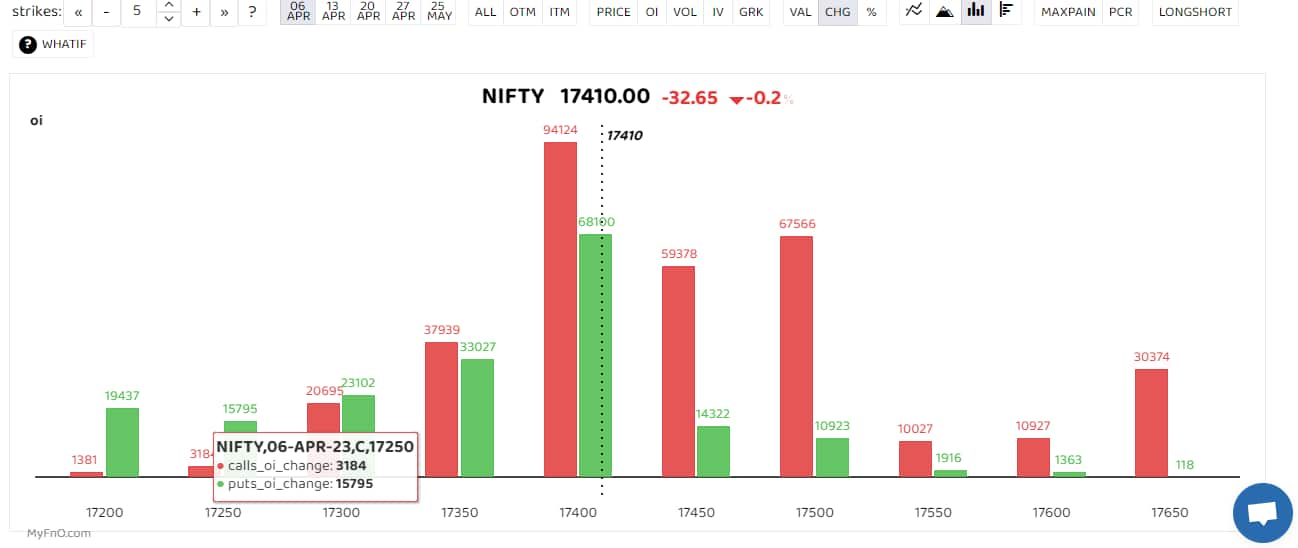

On the options front, 17,400 strike on the Nifty saw both put and call accumulations, a sign that traders are employing the Straddle strategy at this strike. The straddle is a neutral strategy that tends to deliver profits if the market trades sideways.

The bars reflect a change in open interest (OI) during the day. The red show call option OI and the green put option OI.

“I think the Nifty will likely dip till 17,250-17,270 levels before seeing a bit of buying,” said Santosh Pasi, an investment adviser and a derivatives trader. He expects flattish trade throughout this week.

The market will be closed on April 4 for Mahavir Jayanti and then on April 7 on Good Friday, leaving just three working days for traders. Traders are also seeing a slow buildup of positions, as we are at the beginning of a new series and financial year 2023-24.

Also read: $100 oil to tighter markets: Here’s what analysts see after OPEC+ shock cut

Among individual stocks auto, power and oil and gas were in focus.

ONGC, Hero Moto, Tata Power, GMR Infra were among those seeing a long buildup. This means traders are accumulating bullish positions in these stocks.

On the other hand, downstream companies like Mahanagar Gas, Indraprastha Gas and Bharat Petroleum were seeing a short buildup as traders preferred to short these stocks.

Also read: ONGC, Oil India’s gain as crude prices spike over 5%; OMCs take a beating

The churn in the oil and gas sector was fuelled is by OPEC and its allies surprise moved to cut production to prop up crude prices. This is positive for upstream companies but negative for those that buy crude and market them to consumers.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.