The market opened higher on February 24, triggering hopes of a recovery that participants have been waiting for. At 10.20 am, the Nifty was 80 points, or 0.46 percent, at 17,591 but some traders said the index would likely give up the gains in the second half of the session.

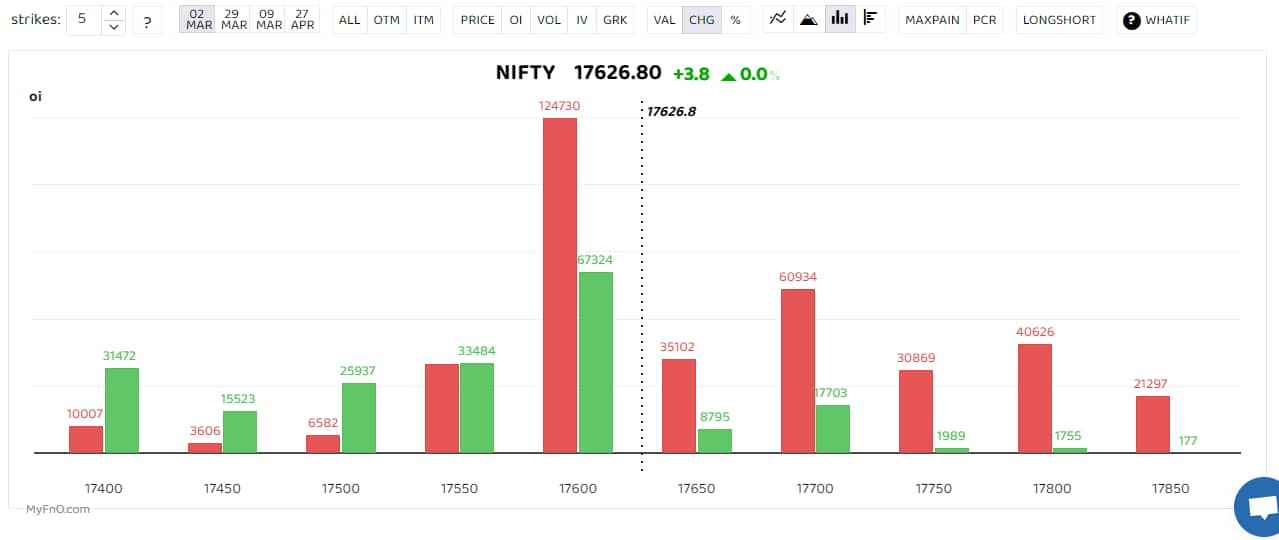

On the options front, 17,600 was seeing heavy call writing as bears created pressure, while 17,550 was seeing both put and call writing, indicating the creation of the Straddle at that level.

Bars reflect changes in OI during the day. The red bars show call option OI and the green put option OI.

Bars reflect changes in OI during the day. The red bars show call option OI and the green put option OI.

“Nifty will give up all gains today. The index will likely hit the 17,500 level,” said Rajesh Sriwastava, a Bengaluru-based derivatives trader.

India VIX, the gauge of volatility in the market, slipped a further 3 percent to 15 levels.

Vodafone Idea saw a long buildup, a bullish scenario when open interest and stock price rise in tandem. GAIL, Whirlpool of India, HDFC AMC and Dixon Tech were other names to see a long buildup.

Hindalco Industries, Adani Enterprises, NMDC and National Aluminium saw a short buildup in which prices fall but open interest rises. This comes amid profit booking in the metal sector.

Sector-wise, metals and auto saw a short buildup, while realty, telecom and chemicals saw a long buildup.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.