The market continued to trade on a weak note on February 28 morning. At 10.20 am, the Nifty was trading flat at 17,390.85 and was on course to end the month of February lower.

On the options front, 17,400 saw both fresh put and call writing as many traders deployed a neutral Straddle strategy. The strategy is profitable as long as the market does not move in any one direction.

Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.

Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.

“I have a bearish view on the Nifty,” said Rajesh Sriwastava, a Bengaluru-based derivatives trader, who has taken short positions in the Nifty as well as the Bank Nifty. “It may move lower as the day progresses.”

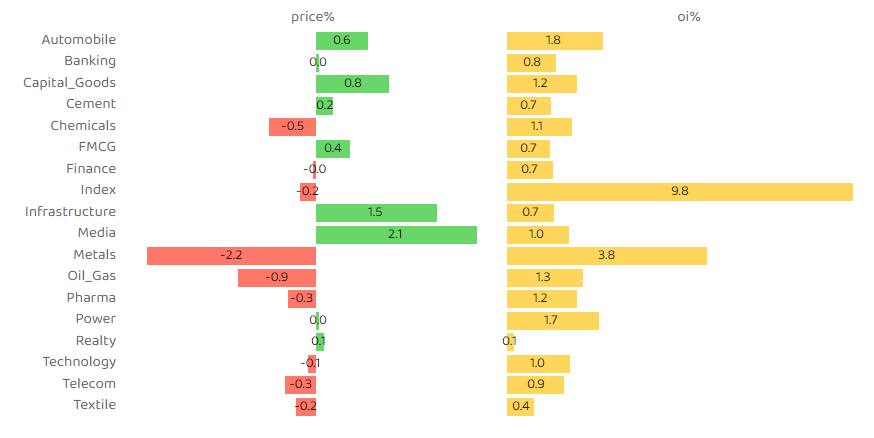

Media sector, thanks to the refound zeal in Zee Entertainment, saw a long buildup, a bullish scenario when price and open interest rise in tandem. Infra and capital goods also saw a long buildup.

Metals, oil & gas and pharma were seeing a short buildup, a bearish scenario when price fall but open interest rise. Vedanta was among those that saw the biggest bearish pressure, followed by Hindalco Industries, Coal India and Glenmark Pharma.

Adani Group stocks were seeing some low-level buying. Traders also adjusted their positions accordingly. Samvardhana Motherson and Ashok Leyland also saw a long buildup.

Sriwastava said he has taken a long position on Voltas. Manish Shah, a certified research analyst, said it was becoming difficult to find trading opportunities.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.