The benchmark Indian indices traded in the red as markets entered a correction phase. On the expiry day, the Bank Nifty showed initial weakness, finding support at the 47,250 levels. Analysts suggest avoiding aggressive long bets as the market appears vulnerable to a correction long overdue.

At 10:30am, the Bank Nifty was down 163 points or 0.35 percent to 647,595, and the Nifty was down 94.10 points or 0.43 percent to 21,571.70. About 1,631 shares rose, 1,399 fell, and 111 remained unchanged.

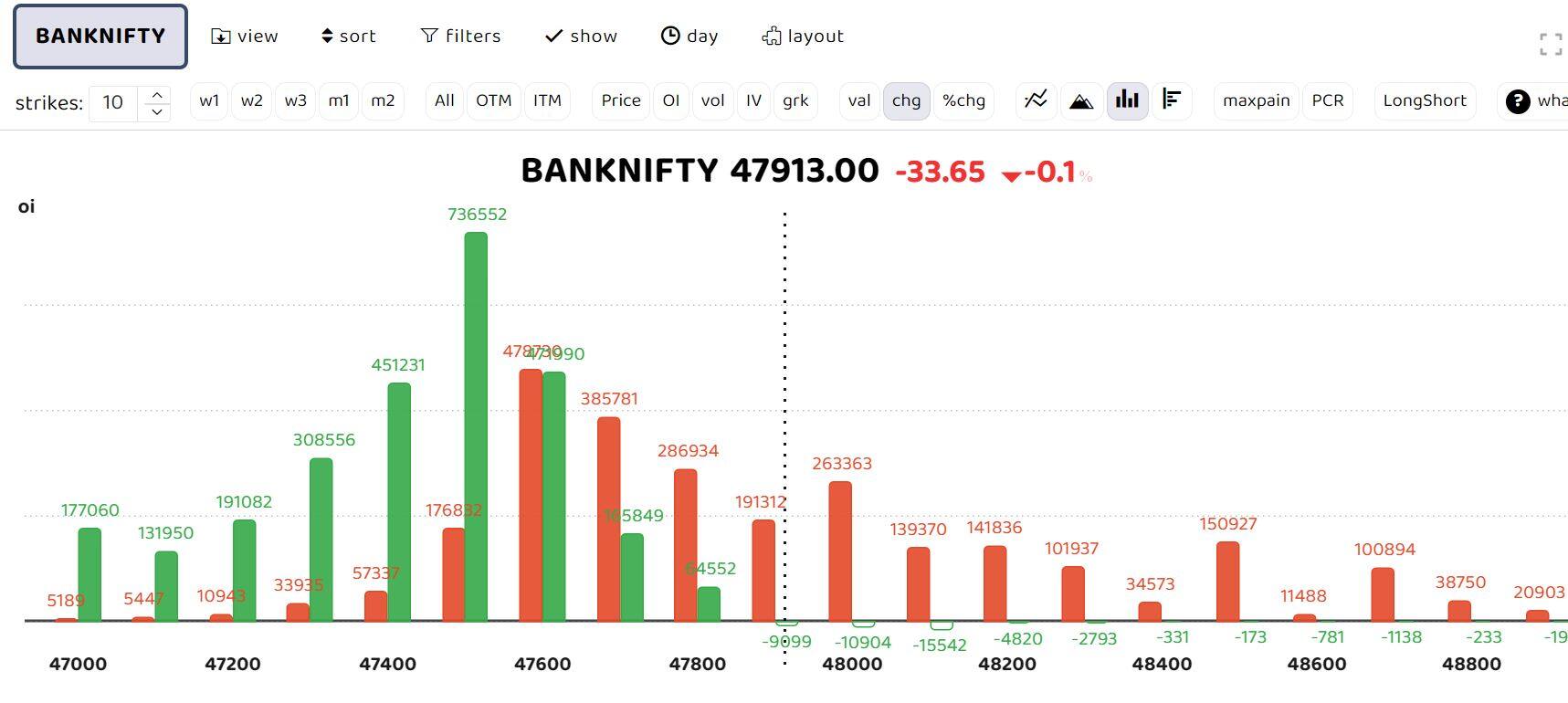

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

The Bank Nifty has seen an increase in open interest of 45.65 percent with a decrease in price of -0.85 percent, indicating a short build-up. "The Bank Nifty underperformed the Nifty, led by selling pressure seen in heavyweight banks. For today's expiry, we expect the Bank Nifty to sustain below 48,000 levels as at-the-money (ATM) and near ATM Call strikes witnessed substantial OI addition," ICICI Securities said.

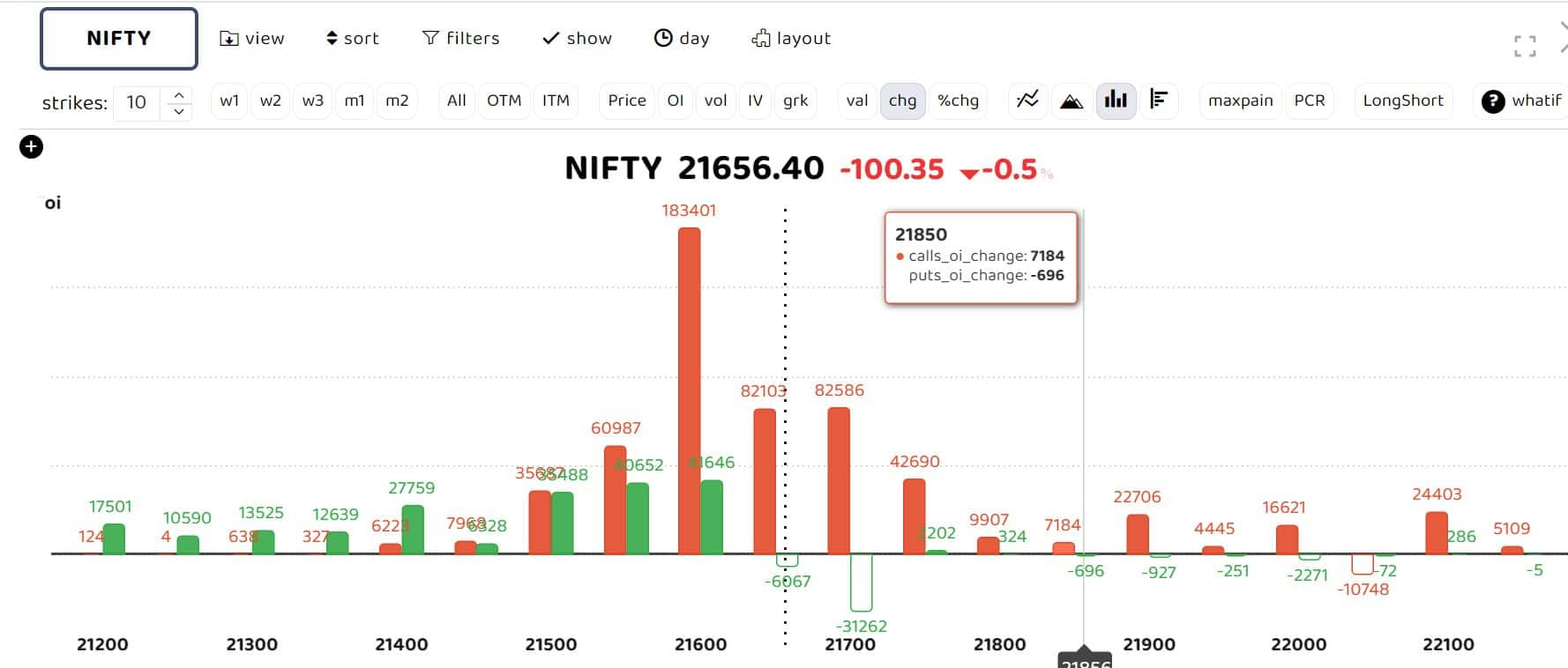

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

Options data shows that call writers are dominant for the day with call build-up at 21,650 and 21,700 levels. "A series of small candle formations near the lifetime highs signifies a breather for our markets after the recent rally. Also, market participants chose to take some money off the table, which seemed long due in our market. Technically, there are no significant alterations in the price action in the index, but brakes seem to have been applied to the recent momentum," Angel One said.

On the levels front, Angel One said: "The immediate resistance is intact near 21800-21850, and a decisive breach would only trigger the next leg of the rally to propel the index for another milestone. On the lower end, 21600-21500 withholds the cushion, and sustenance above the same is likely to augur well for the bulls in the near period. While a plunge below these levels could attract further correction for the 21200 zone. The upcoming FOMC meet could be seen as the next trigger for the markets to set up a near trend. Till then, some consolidation could be seen with strong support near 21500."

Among individual stocks, Nationalum, JSW Steel, BHEL, and Motherson witnessed a short build-up, while Biocon, Bandhan Bank, and Adani Ent saw long build-up.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.