The domestic market mirrored its global counterparts and posted a modest recovery in the early hours of trade on March 21 amid some easing of concerns regarding the health of the global financial system. A deal brokered by the Swiss government to rescue Credit Suisse and hopes of a lower rate hike from the US Federal Reserve bolstered some confidence among investors. Traders chose to wait for clear signs of a breakout to initiate fresh bets.

At 10.18am, the Nifty was up 79.60 points or 0.47 percent at 17,068.00, while Nifty futures climbed 81.65 points or 0.5 percent to 17,110.55.

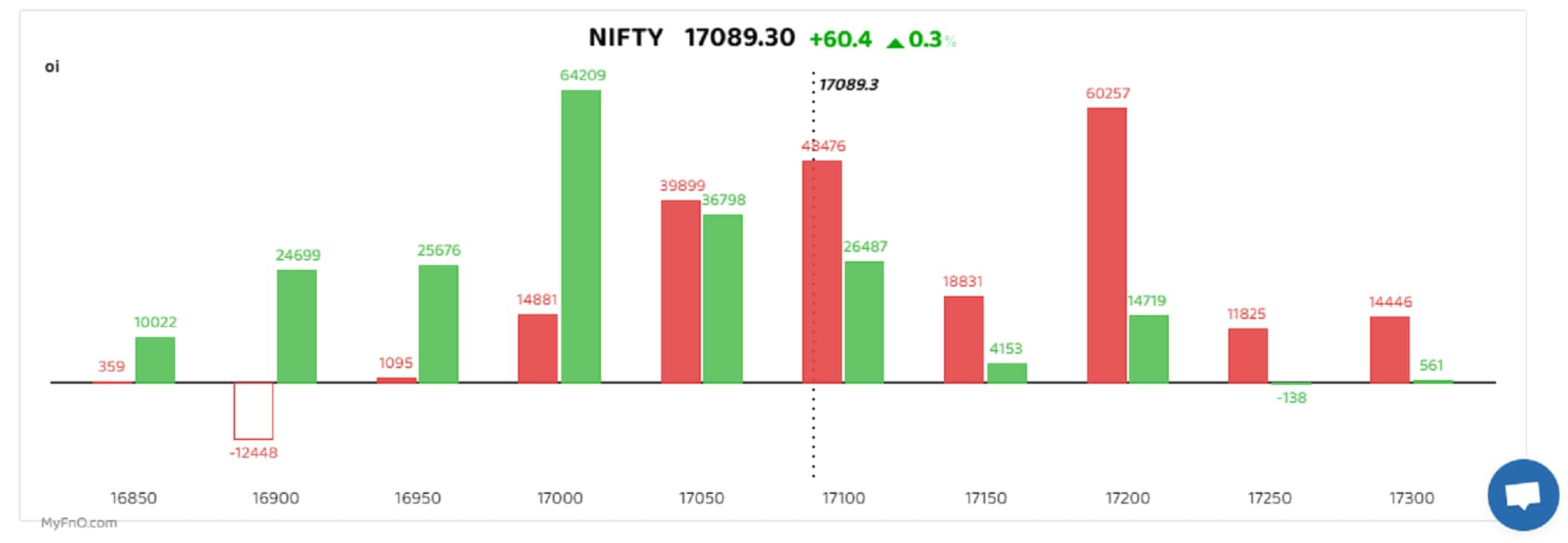

Among call options, heavy writing was seen at 17,200, which suggests the level will act as an immediate resistance to limit recovery in the market. On the Put options front, the maximum accumulation of writers was seen at 17,000 as bulls tried to defend this level.

Ankush Bajaj, a Chhattisgarh-based trader who uses an algorithm-based trading system, said one should wait for a move above 17,150 to think of this as a sustainable recovery. "Investors should wait for a surpassing of that level to add fresh positions as momentum is yet to gather pace," Bajaj said.

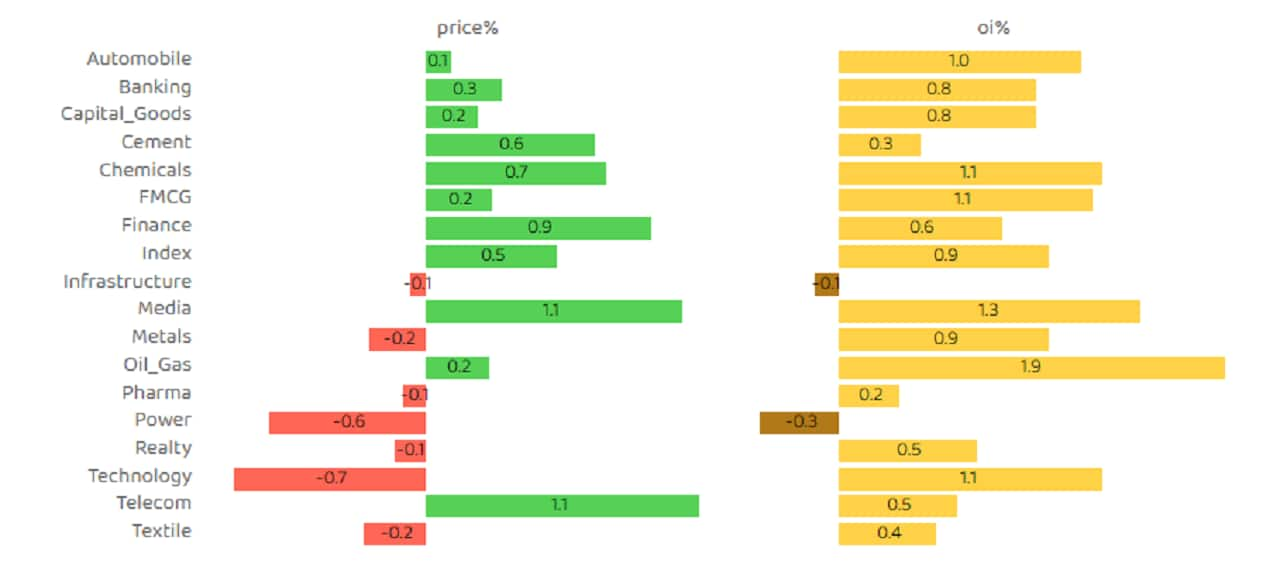

Frontline sectors like banking, automobiles, and FMCG witnessed a recovery, while IT and metals continue to remain under some pressure. Likewise, in the F&O segment, the former sectors saw long additions. while the latter witnessed a rise in short positions.

ICICI Prudential witnessed the maximum addition of long positions as open interest in the counter rose 3.2 percent, highest in a month. The jump in open interest was also accompanied by gains in the cash market as the stock climbed above its 20-day exponential moving average.

Indraprastha Gas, Crompton Greaves, IndiaMART InterMESH, PVR and Mahanagar Gas were other counters that saw long buildup. Long additions is a bullish sign which happens when price increases along with rise in open interest and volumes.

The recovery in the market also triggered short-covering in certain counters that include index heavyweight Reliance Industries, HDFC AMC, HDFC Life Insurance, and Bajaj Finance. Short-covering is a bullish phenomenon which happens when prices rise along with a fall in open interest.

Most IT and metal counters witnessed addition of short positions. Those include, National Aluminium Co, NMDC, Tech Mahindra, Mphasis and JSW Steel. However, maximum short buildup was seen in GAIL, which is a bearish sign. The stock also slipped below its 20-day simple moving average which reflects a weak momentum in the counter.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.