Indian indices were trading lower on July 28 amid mixed global cues. The Nifty slid below 19,600. The bears have taken charge for the day causing discomfort in the bulls' camp. The weakness was attributed to overbought conditions as global cues remained buoyant. Throughout the week, key indices exhibited some sluggishness, while the broader markets remained active.

At noon, the Sensex was down 285.96 points or 0.43 percent at 65,980.86, and the Nifty was down 69.70 points or 0.35 percent at 19,590.20. About 1,671 shares advanced, 1,372 shares declined, and 127 shares were unchanged.

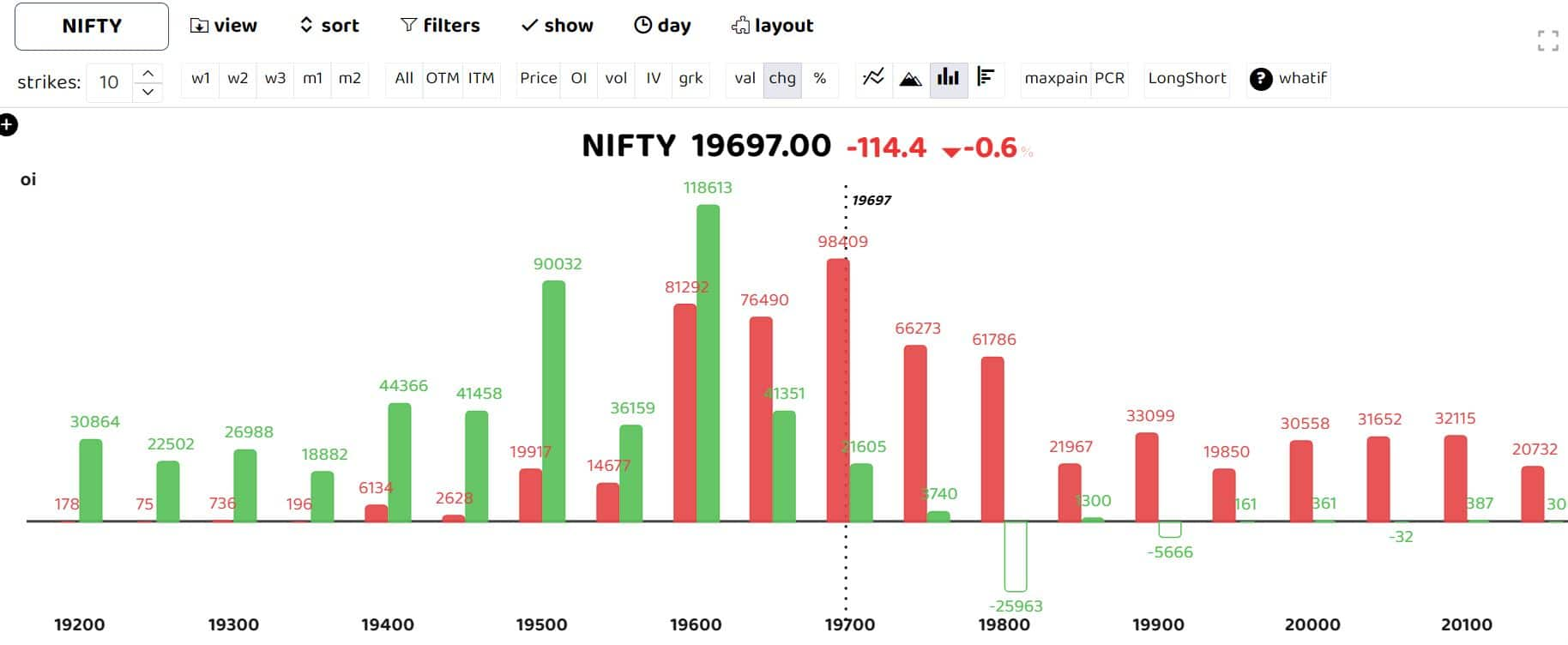

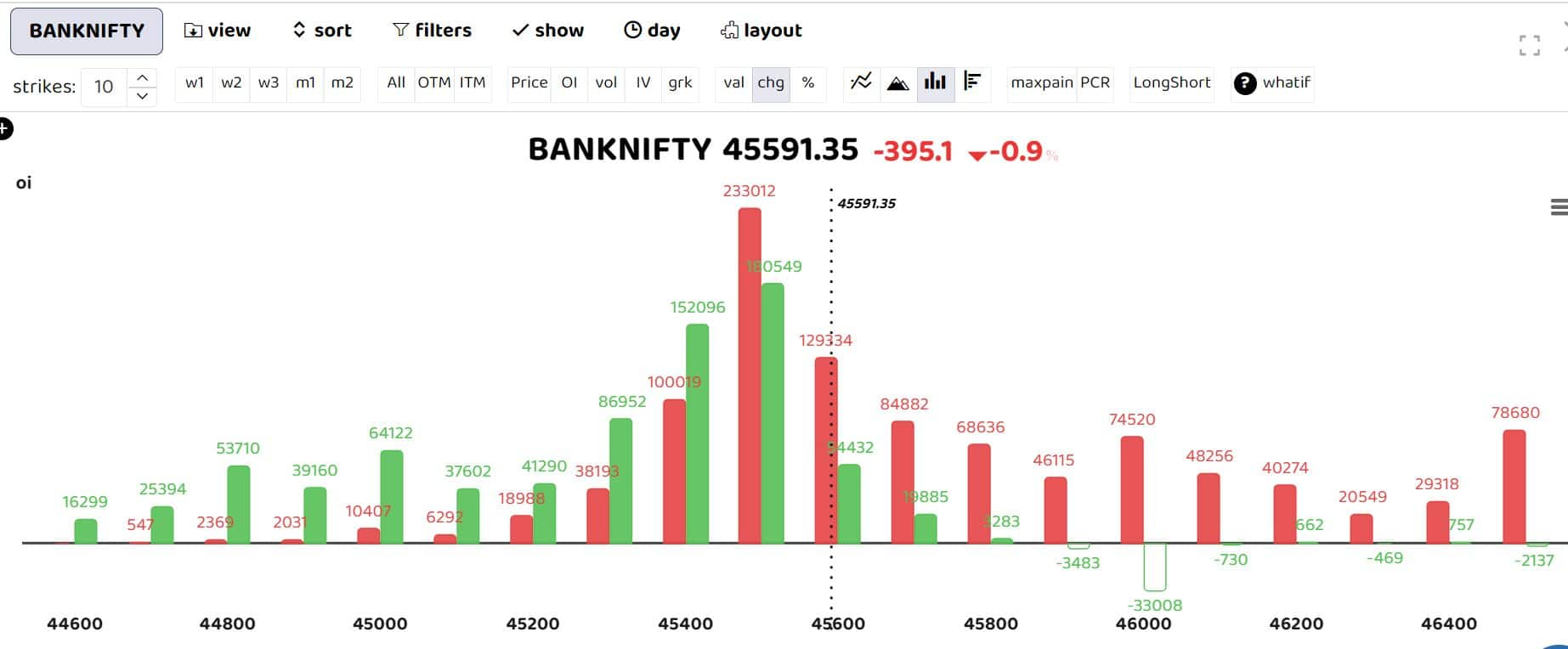

Bars reflect the change in OI during the day. Red bars show call option OI, and green bars show put option OI.

Going ahead, analysts expect the profit booking to extend with the support level of 19,500 (20EMA) likely to get challenged in this scenario. This average has proven to be a strong base during previous price corrections in May and June, resulting in significant positive momentum. Therefore, it holds pivotal importance for the upcoming sessions, as a break below it may lead to meaningful profit booking in days to come.

Sameet Chavan, Head Research, Technical and Derivatives, Angel One believes that 19,850 – 19,880 is expected to act as a stiff resistance, and only a breakthrough would trigger an upside momentum. The bulls have enjoyed a winning streak for four consecutive expiries, with July recording gains of more than 3.5 percent. This optimism is expected to persist, but the next leg of the upward move might not be as smooth as it has been, Chavan added.

Chavan advises traders to wait for some consolidation or a decent price dip before considering aggressive long positions.

Bank Nifty Call writers are dominant for the day. A tussle of Call and Put writers can be seen around 45,500 levels. The downside support for Bank Nifty is placed around 45,200 zones while key resistance is at 45,700 followed by 45,800 and 46,000 levels.

Among individual stocks Tata Power, Tata Chem and IPCA labs saw a long buildup, while HindPetro and IOC saw a short buildup.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.