With investors clocking strong listing gains in the case of IKIO Lightings and design-led manufacturing solutions provider Cyient DLM set to make a debut on the bourses soon, electronic manufacturing service (EMS) companies are now the undoubted celebrities.

EMS players provide services such as design, manufacturing, testing, distribution, and servicing in the electronics sector for original equipment manufacturers (OEMs).

LED lighting solutions provider IKIO Lighting made a remarkable market debut with a 38 percent listing gain in mid-June, while Cyient DLM mopped up Rs 259.64 crore from 20 anchor investors ahead of its Monday debut.

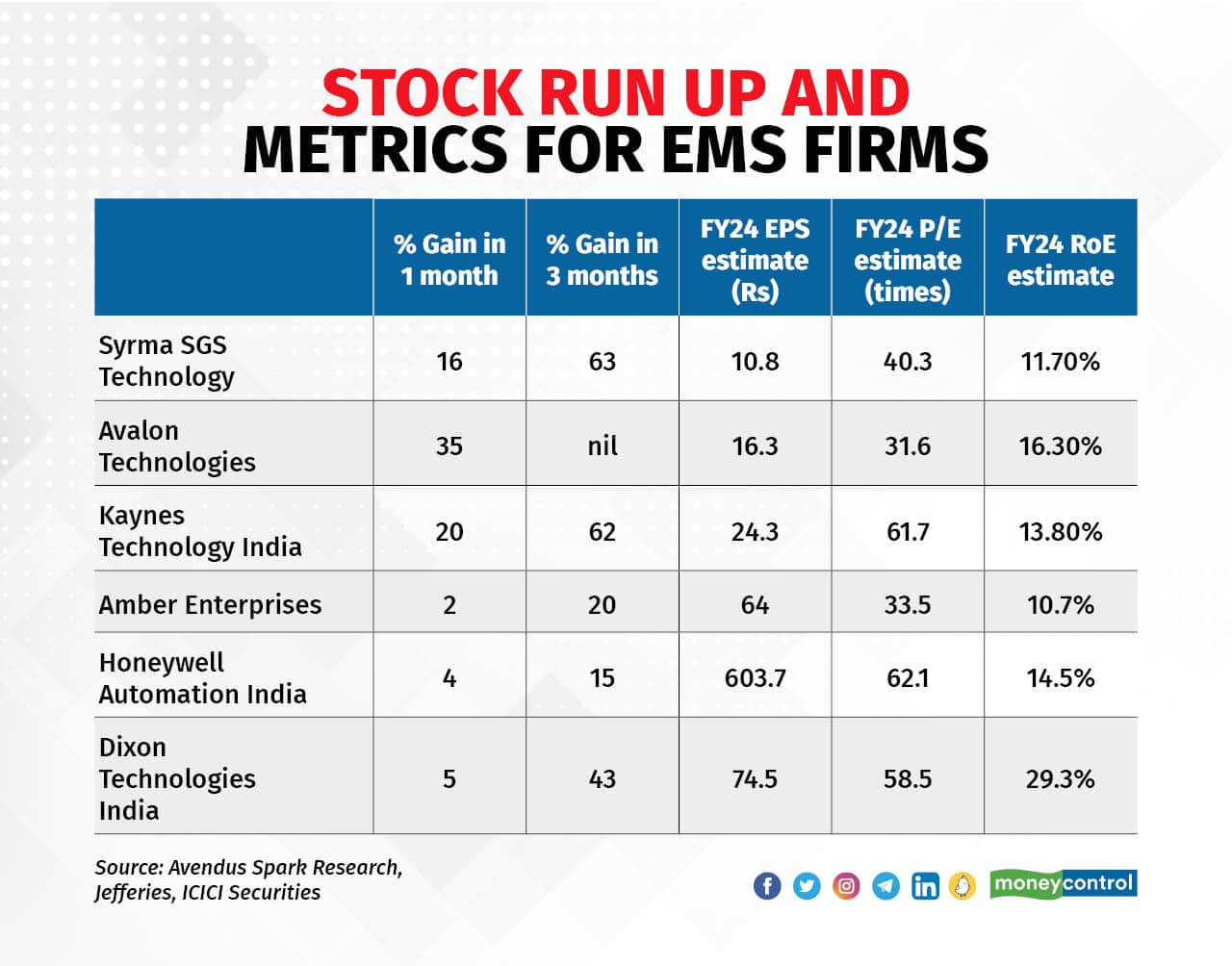

EMS firms stock run up and valuationSector in full swing

EMS firms stock run up and valuationSector in full swingThere is a huge need for electronics in industries like electrical vehicles, infrastructure, industrials, automotive, and consumer goods, among others. As a result, there is strong potential for growth in electronics manufacturing.

India's EMS market is predicted to grow almost six times its current size in five years -- from $14 billion in FY21 to $81 billion in FY26. This implies a yearly growth rate of 41 percent, according to BOB Capital Markets.

This growth is likely to be fuelled by strong demand, a conducive policy framework, including incentive boosters like the production-linked incentive (PLI) scheme, and the China Plus One strategy.

EMS industry compositionChina’s loss, India’s gain

EMS industry compositionChina’s loss, India’s gainSupply chain diversification by global companies away from China, the world’s biggest EMS host country currently, has also put India in a sweet spot.

Trade tensions, allegations of currency manipulation, and economic patriotism in the US, UK, and other western nations have intensified scrutiny of China's EMS business. To reduce risk, OEMs are diversifying their supply chains, fuelling the expansion of the EMS industry in countries like India.

Additionally, a growing trend towards import substitution also presents opportunities for domestic EMS players to cater to the local market.

Moreover, the booming demand has coaxed most EMS players to jack up their production capacities.

Read more | The pain at the bottom of the corporate sector pyramid

Scope of EMS players in industrials & infraApart from the PLI scheme, improving electronics supply chain and assembly industry, advancements in energy infrastructure, the production of renewable energy, and energy-efficient portable electronics components are key drivers for the EMS players catering to industrials.

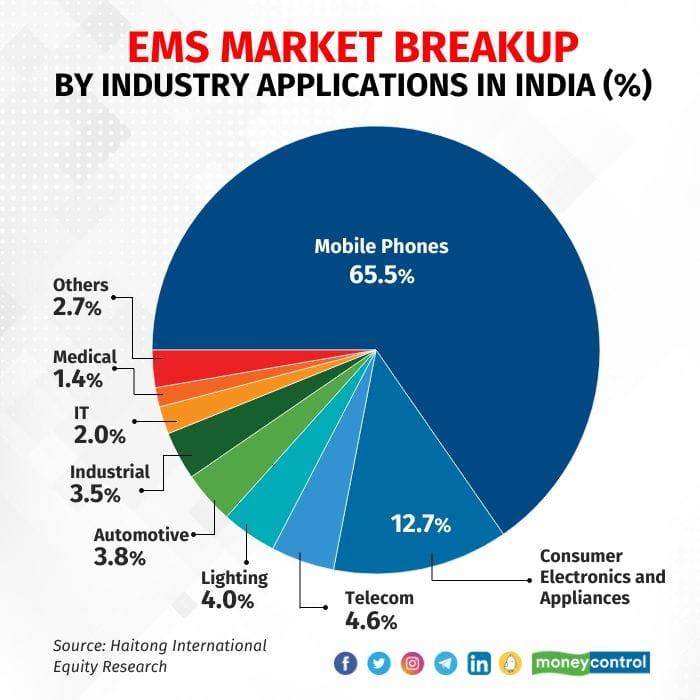

EMS market - India application break up

EMS market - India application break upThe scope of EMS companies in the infra, capital goods, and engineering space is also expected to grow in the coming years given the increasing demand for complex infrastructure projects and the need for high-quality capital goods products, said Vinit Bolinjkar, Head of Research, Ventura Securities.

Along with improving the quality and reliability of capital goods products, EMS companies can also help reduce costs and shorten lead times, he explained.

Particularly in industrials, the shift from analog to smart metres, and the adoption of digital displays in capital goods equipment are contributing to the growth of the electronic component industry segment, pointed out Avendus Spark Research.

For Kaynes Technology, revenue from industrials formed 27 percent of overall FY23 sales, whereas the figure stood at 31 percent for Syrma, and 29 percent for Avalon.

Read more | Gallium, Germanium: How much is at stake for India’s chip strategy?

Investment betsNirav Karkera, Head of Research at Fisdom, said some of the companies in the EMS sector are well-discovered investment ideas, which means the alpha that was expected to be generated in these stocks has already been baked in.

Nonetheless, he still sees some steam left in a few stocks. Despite some of these having already skyrocketed, Karkera believes that the premium in these stocks is justified.

"But EMS is not an underrated theme now. Rather, it is a key investment theme," Karkera pointed out.

Recently, Avendus Spark Research initiated coverage of Technology India with an ‘add’ recommendation and a ‘buy’ call on the shares of Syrma SGS Technology and Avalon Technologies.

The positive view is on the back of robust growth prospects, favourable return metrics, and attractive valuations. The brokerage added that all three players focus on low-volume and high-margin categories which is a positive.

Avendus Spark Research has set a target price of Rs 1,637 for Kaynes and Rs 598 and Rs 679 for Syrma SGS and Avalon, respectively.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.