Investors are usually on the lookout for stocks that can deliver healthy returns and hence go in for those that are performing in-line with markets and ignore those which lag behind. However, history suggests that stocks which are lagging have a better risk-to-reward ratio than stocks following the trend.

Betting on stocks against the prevailing market trend is known as contrarian investing. But not every stock trending against the market is a buy or a sell. Investors should be careful and do their research before picking stocks that are moving against the trend.

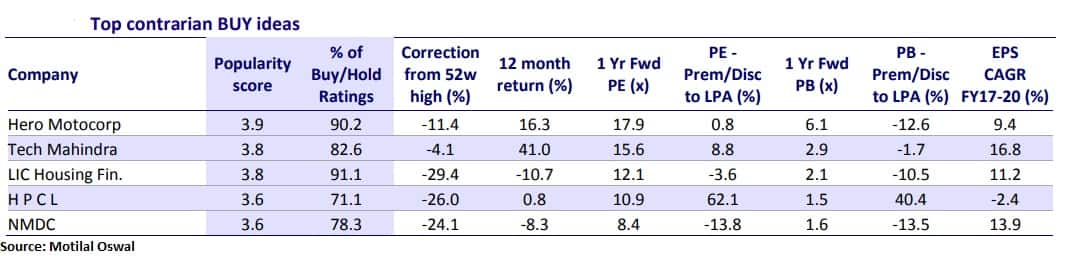

To make this job easier, Motilal Oswal has handpicked five buy and sell contrarian calls for portfolio investors. Over the longer term, if found that neutral to moderately popular stocks delivered significant outperformance, better than that of most popular stocks.

For the quarter-ended March, neutral to moderately popular stocks as well as the most popular stocks failed to beat the benchmark. The least popular stocks delivered the worst return, followed by popular quintiles. The neutral to moderately popular stocks delivered the second best return, the brokerage highlighted.

Top contrarian buy calls include Hero MotoCorp, Tech Mahindra, LIC Housing Finance, Hindustan Petroleum Corporation (HPCL) and NMDC.

While the top contrarian sell calls include Tata Motors, HCL Technologies, UltraTech Cement, JSW Steel and ZEE Entertainment.

Popularity is one filter to find stocks which can deliver maximum returns or outperform benchmark indices. Apart from popularity, investors should also use high profitability, high asset efficiency and low beta to filter their stock selection universe.

“Our analysis shows that companies with high profitability, high asset efficiency and low beta have outperformed over the last three months. Given the prevailing market conditions, we expect the same parameters to work over the near-term,” Harendra Kumar, Managing Director-Institutional Equities at Elara Equities, said.

Based on these three parameters, he likesIndraprastha Gas, Ashok Leyland, TVS Motor, Crompton Greaves Consumer Electricals, Eicher Motors, Nestle India, Crisil, Amara Raja BatteriesandHindustan Unilever.

Deepak Jasani, Head – Retail Research at HDFC Securities, feels investors should look at housing and gold finance companies. “Here one may be able to shortlist a few contrarian stocks where the recent sell-off may have resulted in attractive valuations.”

What is stock popularity?

Bloomberg collects analyst recommendations on each stock and assigns a consensus rating based on these recommendations. It assigns 5 points for every buy recommendation, 3 points for every hold recommendation and 1 point for every sell recommendation, said the Motilal Oswal report.

A consensus rating is arrived at by taking the average of these scores.

* A stock with a consensus rating of 5 would have all buy recommendations.

* A stock with a consensus rating of 3 would have an equal number of sell and buy recommendations, apart from hold/neutral recommendations.

* A stock with a rating change from <3 to >3 has a recommendation change from a net sell to a net buy.

* A stock with a consensus rating of 1 would have all sell recommendations.

Similarities between contrarian and value investing

Contrarian investing is similar to value investing because both strategies involve looking for discrepancies in the price which could be because of the external environment and not because of individual company fundamentals.

There are times when sectors, as well as stocks, go through a correction because either foreign investors are selling or there is some news which could impact the sector directly or indirectly. In this process, many stocks undergo healthy correction belonging to that sector.

One sector which has been under pressure for some time is the pharma space, experts said. “A sector which could be a dark horse in FY19 is the Indian pharma sector, which has been facing adverse conditions in both the domestic and global markets since 2016. All major Indian pharma giants were impacted due to stricter norms of US Food and Drugs Association leading to subdued earning and underperformance by the sector,” Vinod Nair, Head of Research at Geojit Financial Services, said.

At the stock-specific level, we see value in Avenue Supermarts, Bharat Electronics, Natco Pharma and Tata Consultancy Services.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.