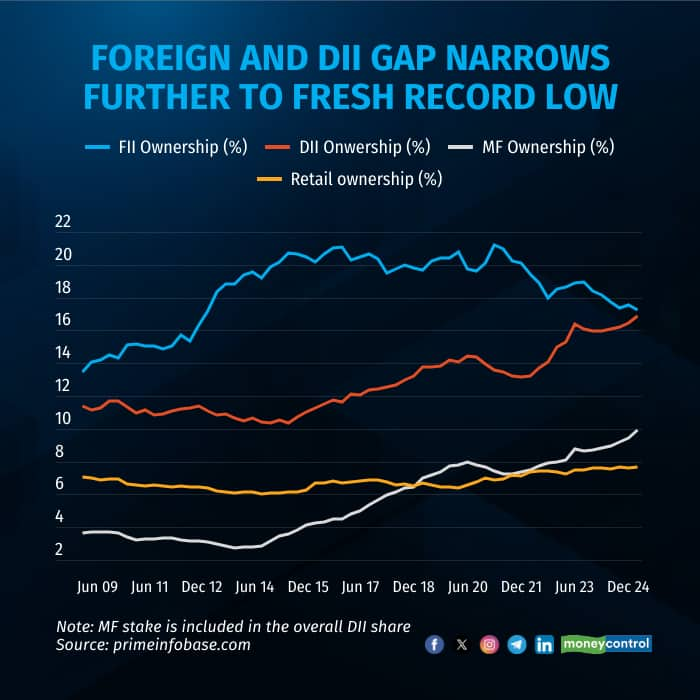

The ownership gap between foreign institutional investors (FIIs) and domestic institutional investors (DIIs) in Indian equities has shrunk to its lowest level ever in the December quarter, as FIIs continued to reduce their exposure while their domestic counterparts have been flush with liquidity.

Foreign investor holdings in National Stock Exchange (NSE)-listed companies fell to a 12-year low of 17.23 percent. Meanwhile, growing domestic investor participation has pushed overall domestic holdings to 16.9 percent, with domestic mutual funds reaching an all-time high of 9.93 percent.

At the end of the December quarter, the gap between FII and DII ownership of Indian equities stood at just 0.3 percentage points, a sharp decline from the 10.3 percentage points gap recorded in March 2015 -- when foreign holdings were more than double that of domestic investors, as per data from PrimeInfobase.

With this, DIIs now hold nearly as much of Indian equities as FIIs. The assets under custody (AUC) for FIIs stood at Rs 74.91 lakh crore, declining from Rs 81.88 lakh crore in the September quarter. Meanwhile, DIIs’ AUC stood at Rs 73.47 lakh crore, down from Rs 76.78 lakh crore in the previous quarter.

During the quarter, FIIs sold Indian shares worth Rs 1.56 lakh crore in secondary markets while purchasing Rs 55,582 crore in primary markets. In contrast, domestic institutions, including mutual funds and other financial entities, bought shares worth Rs 1.86 lakh crore, according to Bloomberg data.

Both benchmark indices, Sensex and Nifty, declined by 8.7 percent and 9.7 percent, respectively, during the December quarter.

On a different note, private promoter holdings declined to 41.08 percent, driven by stake sales amid bullish market conditions. Retail investor participation surged to a record high of 7.69 percent, while high-net-worth investor (HNI) participation reached a three-year high of 2.09 percent.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.