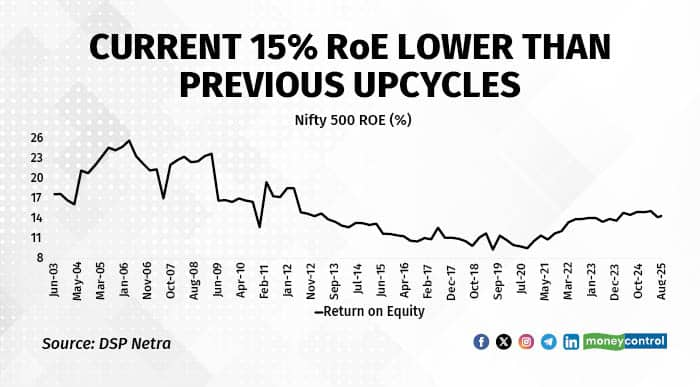

Corporate India’s profitability story is showing cracks, according to a report. Despite robust sales growth, resilient margins and healthy profits in the post-Covid period, return on equity (RoE) is stuck near 15 percent, well below the 20–25 percent delivered during the mid-2000s boom.

DSP Netra’s latest report suggests the weakness stems from declining asset turnover. In the 2003–07 cycle, for instance, the report notes that companies generated nearly Rs 150 in sales for every Rs 100 of assets. Today, that figure has slipped to Rs 120–130.

The decline shows up clearly in long-term data. Median asset turnover for NSE 500 companies (excluding BFSI and IT) peaked at around 1.5 times in the mid-2000s, the report shows. Since then, it has steadily eroded, slipping below 1.2 times after FY2015 and falling further to just about 1.1 times by FY2025.

The report suggests this fall is not cyclical but structural. With leverage reduced, assets are no longer geared up to deliver higher sales, while intensifying competition has also made it harder for companies to sweat existing capacities. The result is that even with peak margins and healthy profit growth, ROEs remain capped at around 15 percent.

The slowdown has been compounded by deleveraging, the report explained. Over the past decade, Indian companies have systematically pared debt and cleaned up their balance sheets. This has improved resilience and lowered financial risk, but it has also expanded equity bases, leaving less room for financial leverage to boost returns.

Pragati Aggarwal, Product Manager at DSP Mutual Fund, explained to Moneycontrol that this shift has reshaped the way companies generate profitability. “Corporates have cleaned up their balance sheets and deleveraged significantly. With little to no debt, the potential to leverage assets for growth is limited, and the revenue generated must now support returns on equity on a larger equity base,” she said.

She added that many companies today are sitting on cash reserves after years of deleveraging, giving them the firepower to expand without tapping banks or bond markets. But that strength is of little use if demand visibility doesn’t improve. “While companies now have the cash to fund expansions without borrowing, demand visibility remains uncertain, and future growth depends on the trajectory of demand coming back,” Aggarwal said.

The report suggests that while the current 15 percent ROE may look comfortable compared with global peers, history shows it is modest for India. During earlier upcycles, double-digit nominal GDP growth and buoyant credit expansion supported both higher asset turns and stronger earnings momentum. The picture today is different. Nominal GDP growth slowed to below 10 percent in FY25 and dipped under 9 percent in the first quarter of FY2026, raising doubts about the ability of companies to deliver the 20 percent earnings growth that markets are pricing in.

This shift is also visible in market leadership. The report points out that India’s premium valuations in the past were supported by high-ROE sectors such as FMCG, IT, oil & gas (excluding Reliance), and consumer durables. In the current cycle, however, much of the rerating has been driven by cyclicals like metals, mining and construction materials. These were businesses that typically struggle to sustain returns through a full cycle. That makes today’s multiples more vulnerable if growth momentum weakens.

The report suggests there is little assurance that even the current 15 percent ROE will hold. Companies could return to using leverage to lift asset turns, but such a move depends on stronger visibility of demand.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.