The market extended rally for third consecutive week ended September 19, rising nearly 0.9 percent along with strong momentum in broader markets. The healthy consistent DIIs buying and slowing down FIIs selling, and hope of strong festive season following GST rationalisation (and monetary easing) effective September 22 leading to likely better earnings growth and improving consumption from second half of FY26 onward lifted sentiment.

The coming week starting from September 22 is also expected to be positive for the market with focus on further developments with respect to India-US trade deal talks, US GDP & Core PCE numbers (for cues on the Fed’s policy trajectory), manufacturing & services PMI flash data for September and FIIs mood, according to experts.

The Nifty 50 soared 213 points (0.85 percent) to 25,327, and the BSE Sensex jumped 722 points (0.88 percent) to 82,626, while there was strong momentum in the broader space with the Nifty Midcap and Smallcap 100 indices rising 1.5 percent and 2.86 percent, respectively.

Siddhartha Khemka - Head of Research, Wealth Management at Motilal Oswal Financial Services expects the market to remain firm with a positive bias, aided by a potential consumption boost as the GST rate cuts become effective from September 22nd along with Navratri festivities beginning from the same day which should further push demand.

Outlook for export-oriented sectors is also likely to improve, supported by the US Fed’s recent rate cut and encouraging progress in the India–US trade talks, he said.

According to Vinod Nair, Head of Research at Geojit Investments, the upcoming manufacturing PMI will serve as a timely barometer of industrial sentiments, offering early signs of a much-awaited demand revival.

With resilient domestic fundamentals and a weakening US dollar, conditions appear favourable for renewed FII inflows, which could further boost Indian equities in the week ahead, he said.

Here are 10 key factors to watch for next week:

Fed Officials Speeches

After digesting the Fed's policy statement and updated economic projections, globally participants across asset classes will focus on the upcoming speeches by several FOMC officials. Most notably, the speech by new governor Stephen Miran, who was the only member to vote for a deeper 50-basis point cut in the September policy meeting, will be closely watch on September 22 for further policy clues.

Further, the Federal Reserve Chair Jerome Powell's speech on the following day i.e. September 23 will also be watched as in the September policy meeting's conference he emphasized that the rate cut move (first in 2025) was a “risk management” decision rather than the start of a broader easing cycle. This less-dovish tone tempered expectations of aggressive rate cuts ahead, helping the US dollar index recover (from the lowest level since February 2022) and close the week at 97.65 (up 0.03 percent), but sustained well below all key moving averages. Meanwhile, the US 10-year Treasury yield climbed 1.6 percent to 4.133 percent.

US GDP

Apart from Fed officials’ speeches, all eyes will also be on the final US GDP, core PCE prices and real consumer spending numbers for the June quarter, along with flash PMI figures and weekly jobless claims.

"If the Core PCE, the Fed’s preferred inflation gauge, comes in as expected, it could strengthen the case for rate cuts in October and December, whereas a significantly higher reading could prompt a reassessment of easing prospects for the remainder of 2025," Kaynat Chainwala of Kotak Securities said.

As per the last advance estimates, the US economic reported a 3.3 percent growth in Q2-2025, against 0.5 percent contraction in Q1-2025.

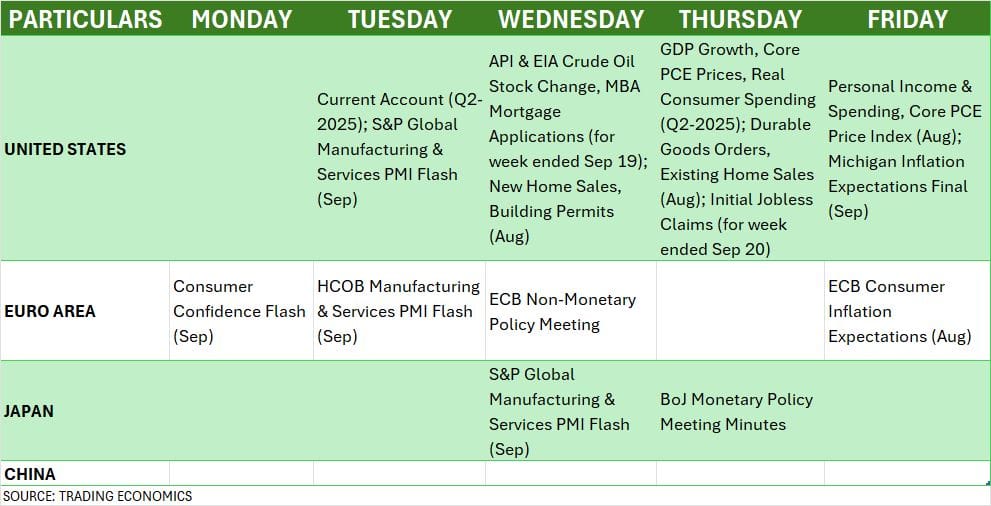

Global Economic Data

Besides, the focus will also be on the manufacturing and services PMI flash numbers for September by major economies, loan prime rates by China, and Bank of Japan Monetary Policy meeting minutes.

"China is expected to keep its loan prime rates unchanged even as recent data continues to point to sluggish domestic demand and deepening signs of an economic slowdown," Kaynat said.

Domestic Economic Data

Back home, the HSBC Manufacturing and Services PMI flash numbers for September scheduled on September 23 will be watched by the street. In August, the Manufacturing PMI climbed to 59.3 against 59.1 in July, while the Services PMI rose to 62.5, from 60.5 in the same period.

Further, bank loan & deposit growth for fortnight ended September 12, and foreign exchange reserves for week ended September 19 will be released next week on September 26.

The market participants will focus on the FIIs mood. After looking at the FII flow of the recent week, it looks like that the sentiment somewhat seems to be improving at the foreign institutional investors (FIIs) desk, partly may be after the first rate cut delivered by the US Federal in 2025 and hope for improving in earnings and economic growth due to several measures taken by the government and RBI from second half of FY26 onward. Also, the resumption of talk between US and Indian officials for trade deal also seems to be one more reason for slowing down the FIIs selling.

FIIs net sold Rs 1,327.4 crore worth shares in the recent week (much lower than selling in previous several weeks), taking the total outflow to Rs 10,572 crore, while they maintained their inflow to primary market.

On other side, domestic institutional investors (DIIs) offset the entire FII outflow and retained their consistent strong inflow, net buying to the tune of Rs 11,177.4 crore for the week and Rs 38,324.7 crore for the current month.

"FII selling in India and buying in other markets like Hong Kong, Taiwan, South Korea etc. has been profitable for FIIs, so far, this year. This scenario may change, going forward," VK Vijayakumar of Geojit Investments said.

Meanwhile, the rupee saw some turnaround against the US dollar, appreciating by 0.2 percent in the recent week to 88.08 after three-week losing streak, but still sustaining below the 87.97.

As the secondary market gained strength and September quarter ending, investors will see the tsunami of 28 IPOs (initial public offerings) worth around Rs 7,500 crore next week including Rs 902 crore worth 17 public issues from the SME segment alone.

Total 11 companies - Atlanta Electricals, Ganesh Consumer Products, Seshaasai Technologies, Jaro Education, Solarworld Energy Solutions, Anand Rathi Share & Stock Brokers, Jain Resource Recycling, Epack Prefab Technologies, BMW Ventures, Trualt Bioenergy, and Jinkushal Industries - will launch their IPOs in the mainboard segment, while the public issues launched by iValue Infosolutions, Saatvik Green Energy, and GK Energy will close next week.

In the SME segment, investors will see total 17 companies - Prime Cable Industries, Solvex Edibles, True Colors, NSB BPO Solutions, Ecoline Exim, BharatRohan Airborne Innovations, Matrix Geo Solutions, Aptus Pharma, Systematic Industries, Justo Realfintech, Gurunanak Agriculture India, Riddhi Display Equipments, Praruh Technologies, Bhavik Enterprises, Chatterbox Technologies, Telge Projects, and DSM Fresh Foods launching their public issues, while JD Cables, and Siddhi Cotspin, which opened their offers last week, are scheduled for closing next week.

On the listing front, the trading in total nine new companies including five - Euro Pratik Sales, VMS TMT, iValue Infosolutions, Saatvik Green Energy, and GK Energy from the mainboard segment will commence on the bourses in the coming week, while the SME platforms will see four new companies - TechD Cybersecurity, Sampat Aluminium, JD Cables, and Siddhi Cotspin - available for trading.

Technical View

Technically, the Nifty 50 is looking strong especially after the recent week's rally by negating lower high-lower low structure of last several weeks and started trading well above all key moving averages as well as the midline of Bollinger bands with bullish momentum indicators, though there was small profit booking on Friday which was on expected lines after a significant rally from 24,400 to 25,450 in current month. As long as the index stays above 25,150, the level where the breakout has seen, the trend is expected to remain favourable for bulls next week to drive toward 25,500-25,700, but falling decisively below it can make the bears active, experts said.

F&O Cues

The weekly options data indicated that the Nifty 50 is likely to face resistance at 25,400-25,500 next week as above it 25,800-26,000 are the levels to watch, with immediate support at 25,300-25,200 zone, followed by 25,000 being crucial support.

The maximum Call open interest was placed at the 26,000 strike, followed by the 25,400 and 25,500 strikes, with the maximum Call writing at the 25,400, 25,350 and 26,000 strikes, while the 25,300 strike holds the maximum Put open interest, followed by the 25,000 and 25,200 strikes, with the maximum Put writing at the 25,300, 25,250 and 25,350 strikes.

India VIX

Meanwhile, the India VIX, which is known as the fear gauge, dropped to all-time closing low in the passing week, giving strong comfort for bulls and signalling less uncertain and volatile environment in the short term. It ended below 10 mark at 9.97, down 1.53 percent, extending downtrend for third consecutive week.

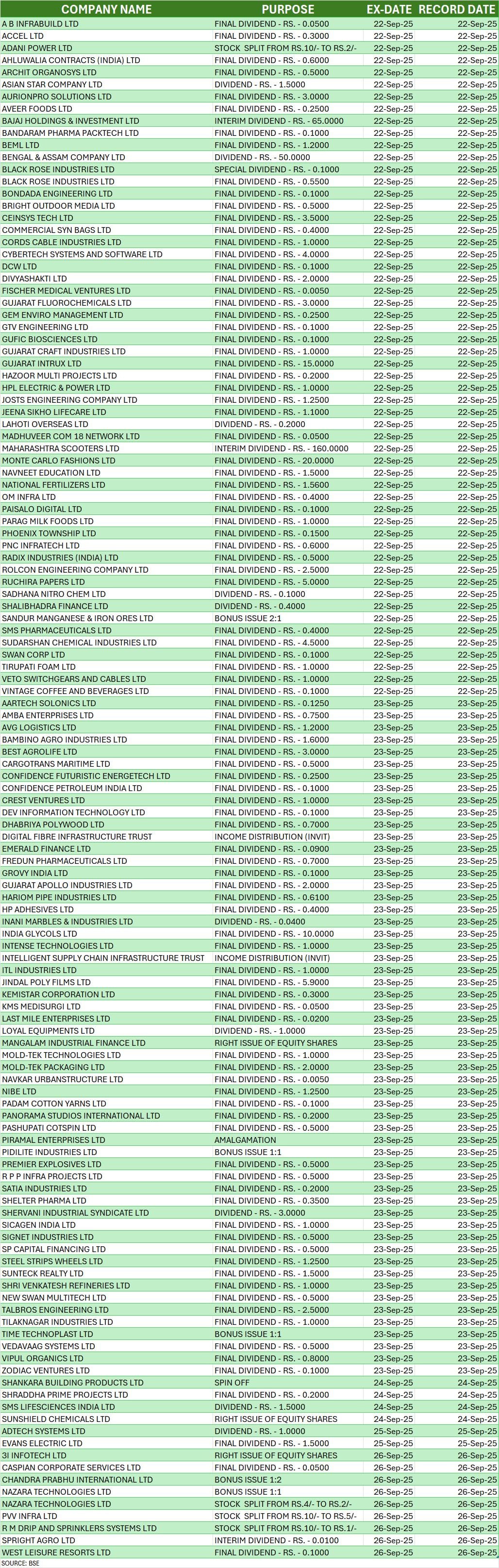

Corporate Action

Here are key corporate actions taking place next week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.