The market recorded the biggest weekly loss since June 2022, falling 4.77 percent for the week ended December 20, tracking weakness in the global counterparts especially after the US Federal Reserve sees only two rate cuts in 2025 (instead of an earlier forecast of four) as officials expect a higher inflation outlook. Higher bond yields, a stronger US dollar, the rupee breaching the 85 mark, and FII outflow also caused selling pressure in the benchmark markets.

After the severe correction, the market is expected to consolidate with a negative bias and keep an eye on the trend in global peers and FII flow in the coming holiday-shortened week. Experts said the trading volume is likely to be low, given the year-end and Christmas holiday season in major parts of the world.

The BSE Sensex plunged 4,092 points (5 percent) to close at 78,042, and the Nifty 50 tanked 1,181 points (4.8 percent) to 23,588. The Nifty Midcap 100 and Smallcap 100 indices were down by 3.53 percent and 3.57 percent, respectively, during the week. Selling pressure was also seen across sectors, barring pharma.

Looking ahead, Siddhartha Khemka, Head—Research, Wealth Management at Motilal Oswal Financial Services, said, "Indian markets are expected to remain subdued and will closely follow global cues amidst a volatile environment."

With the festive season approaching and global markets closed for 2-3 days, including a domestic holiday on December 25, market activity is expected to be low this week, according to him.

The market will remain shut on December 25 for the Christmas holiday.

Here are 10 key factors to watch this week:

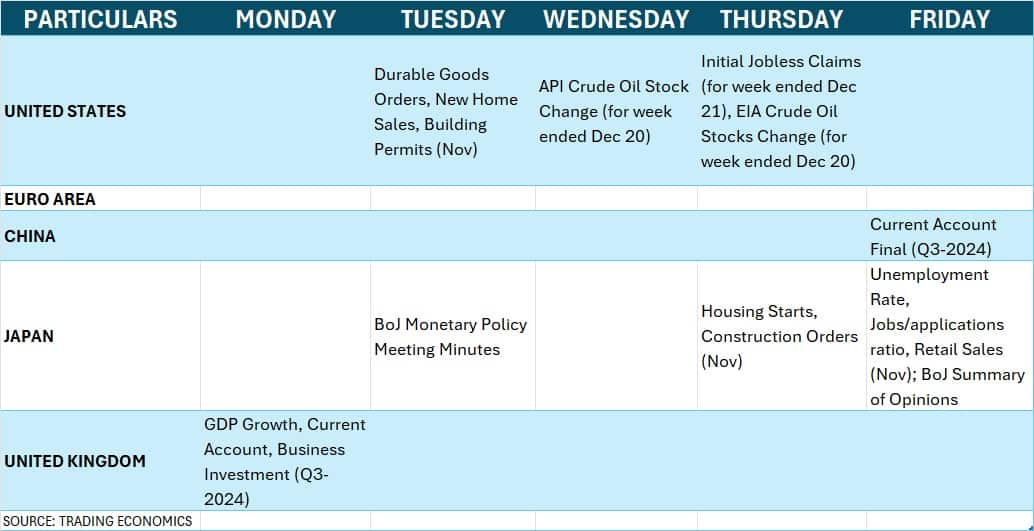

Global Economic Data

Globally investors will keep an eye on monthly durable goods orders, new home sales, and weekly jobs data from the US, while the United Kingdom will disclose its GDP and current account numbers for the September quarter.

Furthermore, minutes of the recent monetary policy by Bank of Japan, unemployment rate, retail sales, and construction orders from Japan will also be monitored.

Domestic Economic Data

On the domestic front, there won't be any major trigger in terms of data barring foreign exchange reserves for the week ended December 20 which will be released on December 27. Forex reserves have been declining since the last week of September, down by nearly $2 billion to $652.87 billion (the lowest level of nearly six months) in the week ended December 13, while it was down by $52 billion from its record high of $704.89 billion on September 27.

The market participants will also focus on the activity at the FIIs' and DIIs' desks, though there will be a bit of a decline in volume due to year-end and the Christmas holiday season for a couple of weeks globally. Last week, there was been change in the strategy by foreign institutional investors from buying to selling due to rising US dollar and bond yields (post Federal Reserve's interest rate outlook) which weighed on the market sentiment.

FIIs net sold Rs 15,828 crore worth of shares last week, which resulted in turning net sellers for the month as well (-Rs 4,121 crore) in the cash segment, but domestic institutional investors managed to offset some FIIs outflow, buying Rs 11,874 crore during the week, taking the total net purchases to Rs 16,547 crore for the current month.

Meanwhile, the US 10-year treasury yield spiked to 4.53 percent following the recent Federal Reserve commentary, up by 3.02 percent from 4.397 percent the previous week, extending the uptrend for another week. The rally was also seen in the US Dollar index (DXY), rising 0.81 percent during the week to 107.815, the highest closing level since November 2022, continuing upward trend for the third consecutive session.

Indian Rupee

The focus will also be on the Indian rupee. Given the increasing demand for the US dollar supported by the Federal Reserve's outlook and geopolitical tensions, the rupee remained bearish for the seventh consecutive week, breaching 85 a dollar for the first time in history. The currency weakened by 0.2 percent to 84.927 against the US dollar. Experts expect the overall trend to remain bearish amid likely volatility.

"We expect a rupee to remain volatile this week amid volatility in the dollar index and volatility in the domestic equity markets and a pair could trade in the range of 84.50-85.60," Manoj Kumar Jain of Prithvifinmart Commodity Research said.

Oil Prices

Oil is another factor to watch this week. The subdued oil prices remained supportive for India, the net oil importer. Brent crude futures, the international oil benchmark, were down by 2.08 percent during the week to $72.94 a barrel. The prices remained below all key moving averages, which is a bearish signal. Experts see the weak outlook for 2025 as well and according to them, the spike in prices is possible only if the geopolitical tensions escalate significantly.

The primary market will remain active in the coming week as well, with one mainboard and two SME IPOs hitting Dalal Street, while there will be several listings lined up. From the mainboard segment, Unimech Aerospace and Manufacturing will open for subscription on December 23, while Solar91 Cleantech and Anya Polytech & Fertilizers from the SME segment will be launched on December 24 and December 26, respectively.

In the mainboard segment, Transrail Lighting, DAM Capital Advisors, Mamata Machinery, Sanathan Textiles, and Concord Enviro Systems will close their public issues on December 23 and debut on the bourses effective December 27. Ventive Hospitality, Senores Pharmaceuticals, and Carraro India are set to close on December 24.

In the SME segment. Newmalayalam Steel IPO will be closing on December 23, while investors can start trading in NACDAC Infrastructure, Identical Brains Studios, and Newmalayalam Steel shares effective December 24, 26, and 27, respectively.

Technical View

Technically, the Nifty 50 is definitely looking weak as it traded below 10-and 20-week Exponential Moving Averages (EMAs) as well as in the lower band of Bollinger Bands on the weekly charts. The momentum indicators RSI and MACD also showed negative bias on the daily as well as weekly charts, in fact on the daily scale the RSI reached 34 after failing to hold the 60 mark and the MACD dropped below the zero line, which is a negative sign. Further, the index closed below the 200-day EMA for the first time since November 21. Hence, the next target on the downside is expected to be 23,263, the November low, followed by 23,000, however in case of a rebound, 23,875 is the immediate target, followed by 24,050 on the higher side, experts said.

F&O Cues

As per the monthly options data, the 24,000 strike holds the maximum Call open interest, followed by the 24,500 and 24,200 strikes, with maximum Call writing at the 24,000 strikes, and then the 23,900 and 24,200 strikes. On the Put side, the maximum open interest was seen at the 23,000 strikes, followed by the 23,500 and 24,000 strikes, with maximum writing at the 23,200 strikes, and then the 22,800 and 22,700 strikes.

The above options data indicated that the Nifty 50 is likely to be in the range of 23,000-24,000 in the short term as breaking on either side can give clear direction to the market.

India VIX

The India VIX, the volatility index, jumped 15.48 percent during the week to reach 15.07, which is nearly a month's high, making the trend uncomfortable for bulls. As long as the VIX stays in the higher zone, the bull may be in a weak position.

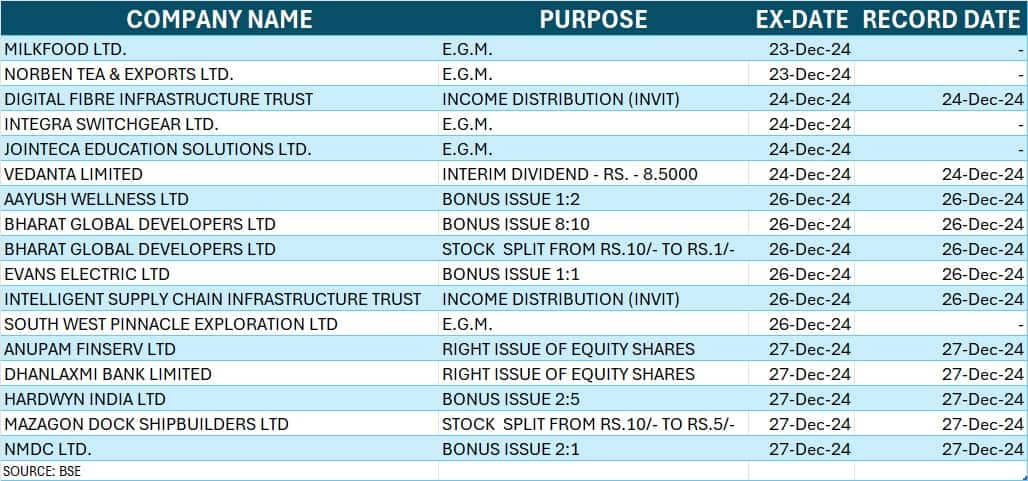

Corporate Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.