Bears had a strong control over Dalal Street in the week ended October 29 with the benchmark indices witnessing the biggest weekly fall (down 2.5 percent each) in last eight months as global brokerage houses - Morgan Stanley and Nomura - downgraded Indian equities to equal-weight and neutral, respectively, from overweight due to expensive valuations. Dull global cues, profit booking by FIIs & DIIs, and mixed September quarter earnings with reflecting inflationary pressure in margin due to higher input prices also weighed on the sentiment.

The BSE Sensex fell below psychological 60,000 mark, declining 1,514.69 points to 59,306.93, and the Nifty50 broke 18,000 levels, down 443.25 points to 17,671.65, continuing downtrend for the second consecutive week. The selling pressure was seen across sectors with private bank, IT, metal and realty indices being the biggest losers. The correction in the broader market was slightly less than the benchmarks as the Nifty Midcap 100 and Smallcap 100 indices shed nearly 2 percent each.

The coming truncated Diwali week is going to see a lot of events including earnings, US Federal Reserve meeting, monthly auto sales and PMI numbers. The nervousness seen on Dalal Street led by profit booking and consolidation in the previous week is expected to continue in the coming days as well, experts feel.

"We are seeing profit taking for the last two weeks and indications are pointing towards a further slide. Keeping in mind the prevailing trend and excessive volatility, it’s prudent to maintain extra caution in the selection of stocks and prefer hedged positions," said Ajit Mishra, VP Research at Religare Broking.

After three days of normal trading, the market will open for an hour in the evening for Lakshmi Poojan on November 4 on the occasion of Diwali and it will remain shut on Friday for Diwali Balipratipada.

Here are 10 key factors that will keep traders busy next week:

More than 350 companies will release their September quarter earnings in the coming holiday-shortened week including important ones - HDFC, Tata Motors, Bharti Airtel, State Bank of India, Sun Pharma, Eicher Motors, HPCL, Divis Laboratories, and IRCTC.

Among others, Aditya Birla Capital, Devyani International, Indian Railway Finance Corporation, SPARC, Lux Industries, Bank of India, Godrej Properties, Union Bank of India, Bajaj Healthcare, Bombay Dyeing, Dabur India, Easy Trip Planners, eClerx Services, Jindal Steel & Power, Laxmi Organic Industries, Minda Corporation, MTAR Technologies, PNB Housing Finance, Radico Khaitan, Trent, Aditya Birla Fashion and Retail, Bata India, Pfizer, Muthoot Finance, Dhanlaxmi Bank, and Sun TV Network will also announce earnings next week.

US FOMC Meet

The US Federal Reserve Policy meeting, which is scheduled to be held on November 2-3, is important to watch out for given the possibility of beginning of bond tapering in mid-November. Experts feel globally investors will closely watch the commentary related to tapering schedule and indication of interest rate hikes give the threat of inflation.

"The news flow and market sentiment may be largely dominated by the upcoming FOMC meeting. While investors appear to have priced in the possibility of tapering by mid-November, the focus will now shift to the timing of interest rate hikes in light of the looming threat of inflation," said Yesha Shah, Head of Equity Research at Samco Securities.

The movement of US dollar index and bond yields will be closely watched in the next week, given the Federal Reserve policy meeting. Experts feel any announcement related to bond tapering or clarification over interest rate hikes could impact the dollar index and risk sentiment.

The US dollar index, which measures the value of US dollar against world's leading six currencies, inched up to 94.11 from 93.62 on week-on-week basis, while US bond yields corrected to 1.56 percent from 1.64 percent in the same period.

The Indian rupee remained rangebound before closing at 74.93 against the US dollar, against 74.99 a dollar in previous week.

"Rupee traded in a range near 74.90 as dollar index and Crude prices started glued, eyeing next week's FED's statement on tapering updates which would give further direction to Dollar prices and related currencies. Going ahead, the rupee can be seen in a range of 74.75-75.25," said Jateen Trivedi, Senior Research Analyst at LKP Securities.

FII & DII Flow

The FII flow was one of the major reasons for correction in the week gone by as they have started taking profits off the table given the high valuations and downgrade of Indian equities by global brokerages. The FII outflow was very high, though DIIs came to rescue.

Hence experts feel if the market sees more selling pressure by any chance in coming days, then FIIs could be one of reasons for nervousness at Dalal Street.

Foreign institutional investors have dumped Rs 15,700 crore worth of Indian equities in the week ended October 29, taking the total outflow to Rs 25,572 crore in October month. On the other side, domestic institutional investors have net bought Rs 9,427 crore worth of shares during the week and their net buying in a month stood at Rs 4,471 crore.

The primary activity will remain strong in the coming week too, as three IPOs - Policybazaar, Sigachi Industries, and SJS Enterprises - will open for subscription on Monday and will close on Wednesday. Nykaa operator FSN E-Commerce Ventures and fintech company Fino Payments Bank will remain opened on Monday and Tuesday, respectively, in the coming week.

PB Fintech-led Policybazaar is planning to raise Rs 5,625 crore through its public issue, while SJS Enterprises will garner Rs 800 crore and Sigachi Industries aims to mop up Rs 125.43 crore, at upper price band.

Auto Sales

Indian auto companies will start releasing their October sales data from November 1. The shortage of semiconductors, and rising commodity prices are expected to impact sales, though there is a support from festive season. As a result, the sector is major underperformer for last several months.

"The week will start with auto sales numbers for October month where expectations are low while the market will also gauge the consumers' sentiments on Dhanteras and Diwali," said Santosh Meena, Head of Research at Swastika Investmart.

Bajaj Auto, Tata Motors, Maruti Suzuki, TVS Motor, Hero MotoCorp, Mahindra & Mahindra, Escorts, Ashok Leyland, Eicher Motors etc will be in focus.

Coronavirus and Vaccination

The fear of coronavirus gradually seems to be easing further, considering the data seen in the month of October. The daily addition of cases fell below 20,000 since October 8 and now since October 21, infections on daily basis largely fell below 16,000 count.

On the other side, more than 105 crore of Covid vaccine doses were administered across the country so far, of which nearly 31 percent of people vaccinated with both Covid vaccine doses, which experts feel is a great achievement with having the recovery rate above 98 percent, and positivity rate remained below 1.5 percent for more than a week now.

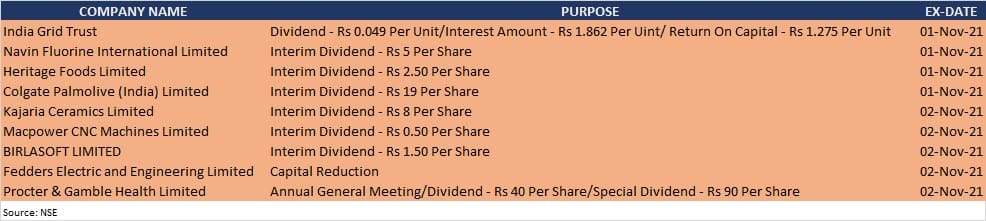

Corporate Action and Economic Data

Here are key corporate activities taking place in the coming week:

Markit Manufacturing PMI data for October will be released on Monday, and Markit Services PMI and Composite PMI numbers on Wednesday.

Foreign exchange reserves for the week ended October 29, and deposit and bank loan growth for fortnight ended October 22 will be released on Friday.

Technical View

The Nifty50 saw bearish candlestick pattern formation for daily as well as weekly charts, indicating bears have upper hand at the street, which experts feel can drag the index below 17,500 levels in coming days and for the upside, 18,000 is expected to be crucial level to watch out for.

"A reasonable negative candle was formed on the daily chart, which indicate a sharp follow-through weakness in the market. The last two sessions decline seems to have changed the positive sentiment of the market. The recent all-time high of 18,604 of October 19 could now be considered as an important top reversal for the market and that is not going to be challenged in a hurry," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He further said having reached near the immediate support of 20-week exponential moving average (EMA) around 17,560-17,600 levels, there is a possibility of minor upside bounce from the lower levels by next week, which could be a sell on rise opportunity. "The expected downside target for the Nifty could be around 17,000 levels, which could be reached in the next few weeks."

The Bank Nifty seems to be topped out near 41,500 levels as it also corrected 3 percent for the week gone by.

"The index manages to close above 20-DMA which is currently placed at 39,000 level. On the downside, 38,500-38,000 is a critical support zone; below this, it is vulnerable for the more downside. On the upside, 40,000 will act as an immediate and strong hurdle while 40,500-41,000 will be the next hurdles," said Santosh Meena of Swastika.

F&O Cues

The November series started off on a week note as the index fell way below 18,000 mark and corrected 5 percent from its record high levels. And the rollover data was relatively low in comparison with last couple of months.

Option data indicated that the Nifty could be in a wider and bigger trading range of 17,200 to 18,300 levels in coming days. Maximum Call open interest was seen at 18000 then 19000 and 18500 strikes, while Put open interest was seen at 17000 then 17500 strike.

"From a rollover perspective, Nifty November series has started with little over 10 million shares, which is relatively low compared to the last couple of months. We have not seen major movement with low open interest. Moreover, as the Nifty has breached its major Put base of 18000 during settlement, these levels should act as immediate hurdle on the higher side. On downsides, we expect major Put base of 17500 to act as support for the Nifty," said ICICI Direct.

"Volatility index has tested it monthly highs near 18.5 percent before closing the week around 17.5 levels on the back of closure among Put writers. Looking at elevated IV (implied volatility), market participant should remain cautious at higher levels," the brokerage added.

India VIX went up to 19.6 levels during the week, before closing down by 0.68 percent week-on-week basis at 17.43 levels.

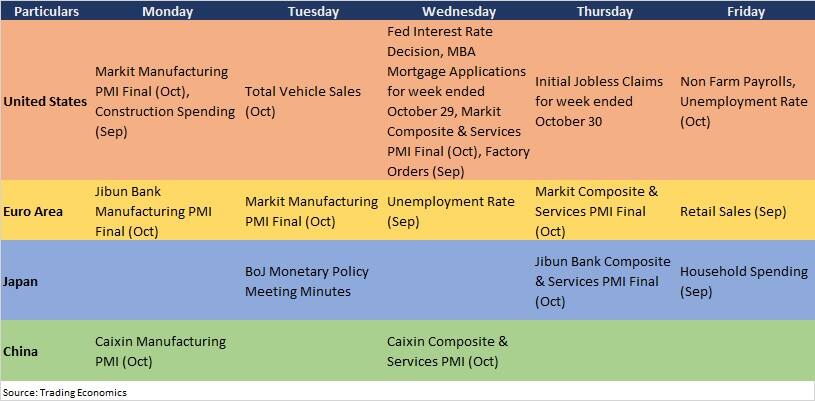

Global Cues

Here are key global data points to watch out for next week:

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.