October 11, 2018 / 15:35 IST

Market at Close

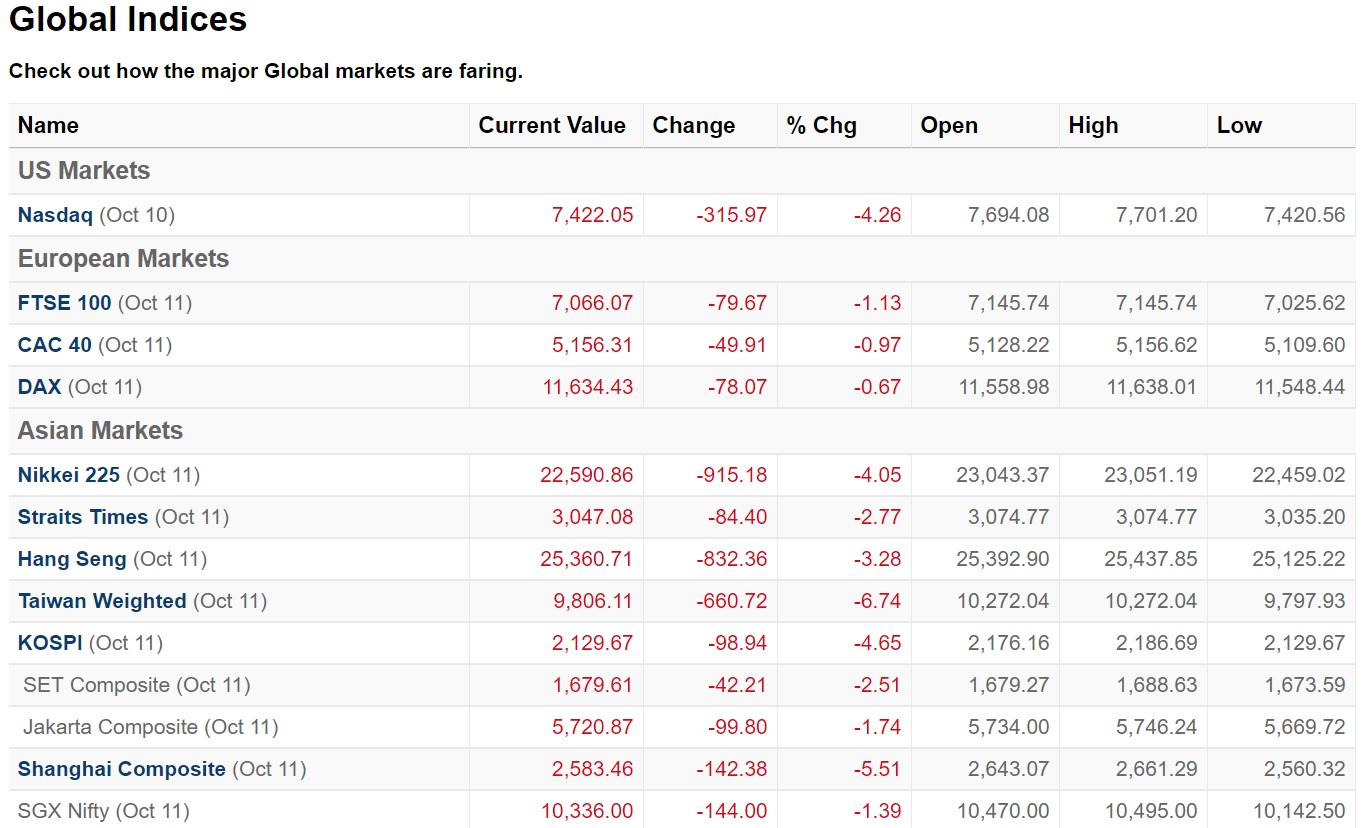

A sell-off in global markets had its impact on the local market, as the Sensex closed over 700 points lower, while the Nifty ended just around 10,250-mark.

Weakness was visible among banking names, particularly in PSU banks along with metals, automobiles, pharmaceuticals, and IT names. A recovery in rupee from record lows failed to make any impact.

At the close of market hours, the Sensex closed down 759.74 points or 2.19% at 34001.15, while the Nifty ended lower by 225.40 points or 2.15% at 10234.70. The market breadth is negative as 824 shares advanced, against a decline of 1,736 shares, while 866 shares were unchanged.

Yes Bank, ONGC, HPCL and IOC were the top gainers, while State Bank of India, Tata Steel, Indiabulls Housing Finance and Bajaj Finserv lost the most.

October 11, 2018 / 15:21 IST

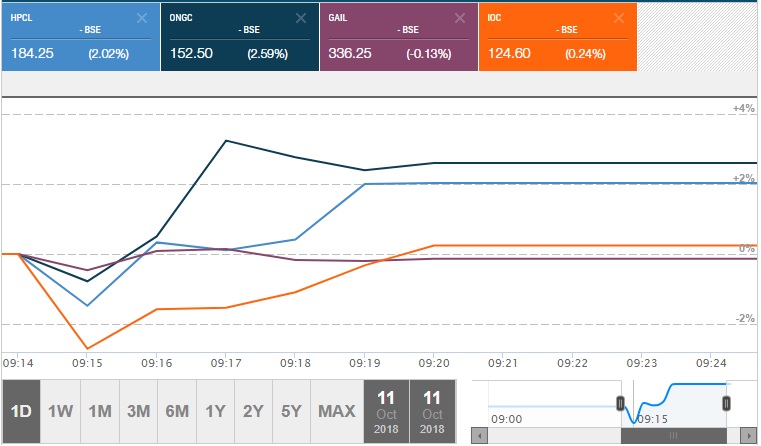

OMCs trade higher

: Fuel retailers Indian Oil Corporation, Bharat Petroleum Corporation and Hindustan Petroleum Corporation shares were among biggest gainers on the Nifty50 after sharp decline in crude oil prices on Thursday.

HPCL rallied 19 percent on top of 5.6 percent upside in previous session, BPCL gained 7.4 percent (3 percent in previous session and IOC was up 8 percent (1.55 percent).

Oil prices traded around $86 a barrel few days back on supply concerns ahead of US' sanctions on Iranian oil effective from November, which fell to around $81 a barrel now.

October 11, 2018 / 15:18 IST

Hourly Losers

October 11, 2018 / 15:12 IST

Market Check

: Benchmark indices are trading under pressure in the final hour of trade with Nifty trading below 10,250 level.

The Sensex is down 767.88 points at 33993.01, while Nifty is down 228.80 points at 10231.30. About 730 shares have advanced, 1728 shares declined, and 962 shares are unchanged.

All the sectoral indices are trading in red.Nifty PSU bank index down 5 percent, followed by pharma, metal and IT index down 3 percent, while auto is trading lower with 2.5 percent cut.

October 11, 2018 / 15:04 IST

Volume Shockers:

October 11, 2018 / 14:53 IST

GMR signs MoU with APGDC

: Shares of GMR Infrastructure shed 4 percent Thursday. The company's subsidiary has signed MoU with APGDC for supply of piped natural gas.

Kakinada SEZ, a subsidiary of GMR Infrastructure, signed a MoU (Memorandum of Understanding) with the Andhra Pradesh Gas Development Corporation (APGDC) to get access to piped domestic natural gas for its upcoming 10,500-acre zone.

October 11, 2018 / 14:49 IST

ASIAN PAINTS FALLS |

Shares of Asian Paints slipped 2.6 percent intraday Thursday. Foreign research house BofAML has maintained buy with a potential upside of 35 percent.

The research house keep a target of Rs 1,650 per share.

According to firm, Pan-India check indicates swelling optimism about future growth and it expect a healthy H2FY19 led by solid festive season.

Read the full report here.

October 11, 2018 / 14:26 IST

Oil marketing companies are rising in trade today on the back of a fall in global crude prices. Take a look at the intraday chart of HPCL, BPCLand IOC.

October 11, 2018 / 13:25 IST

MARKET OUTLOOK

“Institutional Investors will be watching closely on quarterly financial results and taking calls on the future direction. It is expected, since equity market has corrected at good percentage, selective sectors would recover soon. We are anticipating the rural theme will continue do well. Anticipating the currency depreciation, we expect export oriented sectors like pharmaceuticals, information technology, agro chemicals, would do well going forward. Selective auto OEMs & auto ancillaries, FMCG would do well,” Saravana Kumar, Chief Investment Officer at LIC Mutual Fund said in a statement.

October 11, 2018 / 13:04 IST

October 11, 2018 / 13:01 IST

Market Update

There has been a smart recovery in the market from its low points, with the Sensex trading over 450 points lower. The Nifty is back above 10,300-mark.

State Bank of India, Tata Steel, and Indiabulls Housing were the top losers, while Yes Bank, ONGC and HPCL have gained the most.

The Sensex is down 476.24 points or 1.37% at 34284.65, while the Nifty is lower by 141.30 points or 1.35% at 10318.80. The market breadth is negative as 765 shares advanced, against a decline of 1,535 shares, while 1109 shares were unchanged.

October 11, 2018 / 12:46 IST

RUPEE OUTLOOK

“The rupee continues to make a new record low as the global and domestic equities experienced steep sell-off. Continued FII outflows from debt and equity market is keeping sentiments bearish. Though the crude oil prices have eased overnight, it is a temporary. As US sanctions on Iran begin from November, crude oil prices might continue to rise in the international market. This may pressurize the rupee in coming sessions. Focus would now shift to India’s macroeconomic data which will give further direction to the rupee,” Rushabh Maru, Research Analyst at Anand Rathi Shares and Stock Brokers said in a statement.