Indian markets underperformed US markets on a year-to-date basis as well as one-year basis and that could the reason why Indian investors are looking to diversify overseas.

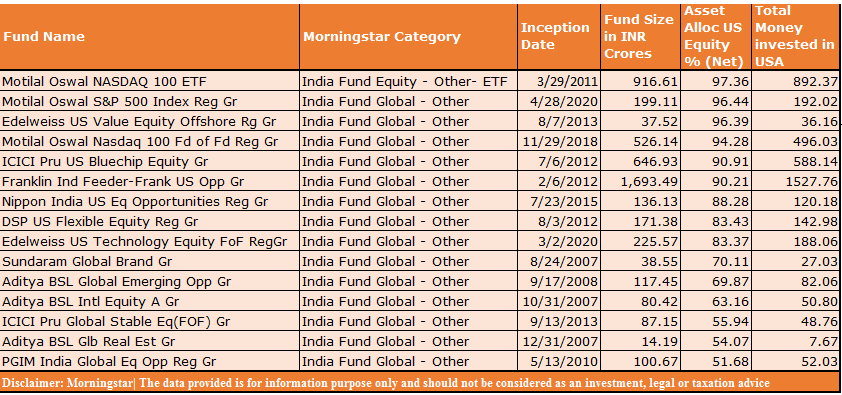

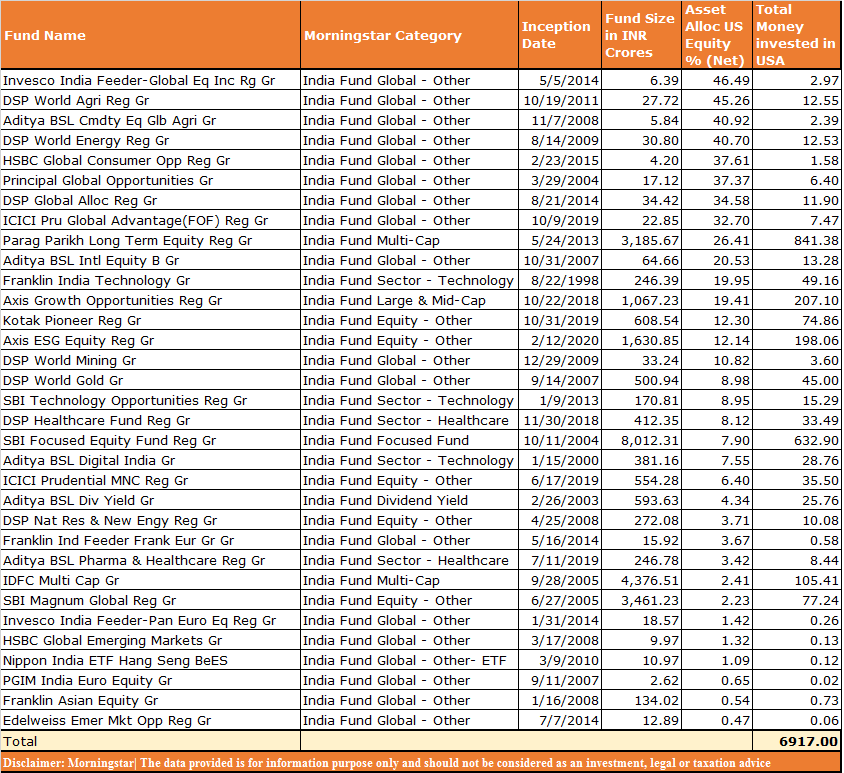

Data collated from Morningstar India suggests that more than Rs 6,000 crore of Indian money is riding on US markets and the trend is likely to grow stronger. As the momentum picks up the amount of money invested will grow multifold.

“The Indian money invested in the US market is approximately Rs 6,917 crores. From a portfolio construction perspective, global funds add another level of diversification in an investors’ portfolio,” Himanshu Srivastava, Associate Director–Manager Research, Morningstar India told Moneycontrol.

“Over the last few years, the returns from some of the global markets, particularly the developed ones, have been much better than emerging markets like India. Additionally, global funds tend to do better when the rupee depreciates (against the currency being invested in), which has been the case for some time now,” he said.

Data suggests that over a one, three, and five-year time frame, the performance of many global funds, especially those which invest in developed economies such as the US, has been better than most of the domestic funds.

“International diversification, as a concept, has exploded over the past few months. It’s partly due to poor returns in India and international funds having the highest returns in the past few years,” Pratik Oswal, Head of Passive fund Business, Motilal Oswal Asset Management Company, told Moneycontrol.

“A lot of investors today are talking about maintaining an allocation of 15-20 percent into international equities. As diversification takes off - the 6,000 crores amount will increase manifold over the next three-five years,” he said.

Investors have two options to invest in US markets. One is the mutual fund route, which is more straightforward and is the same as buying any other mutual fund. The other way is by remitting money abroad via the LRS (Liberalised Remittance Scheme).

“Mutual Fund schemes are preferable for investing in the US markets. It is not feasible for retail investors to track and understand US markets and it is better to leave it to professional asset manager to do so,” Gaurav Dua, SVP, Head-Capital Market Strategy & Investments, Sharekhan by BNP Paribas, told Moneycontrol.

What will drive diversification?

Experts are of the view that the amount of money invested in US markets will only pick momentum from here as more players enter the market and spread awareness but don’t pin hopes on massive returns, experts say.

“The amount is definitely going to increase in the future. I believe that we currently are at Day 1 of international investing in India. A testament to that is our AUM grew about 10 times in the last nine months and more and more people are entering the US markets,” Viram Shah, CEO, and Co-Founder, Vested Finance, told Moneycontrol.

Shah said people now have an easy way powered by technology to directly invest in US markets. A lot of people want to feel they are shareholders of companies such as Apple, Amazon, Facebook, they want to directly invest in those companies because they like the brands and so this direct option allows individuals to be able to do that.

Secondly, there is an increase in awareness. “The benefits of having some part of their wealth allocated internationally, this number will definitely grow. As more players enter the market and spread the awareness it generally bodes well for the industry,” he said.

How to open an account?

Under LRS, the Reserve Bank of India allows an Indian resident to invest up to USD $250,000 per year in overseas markets.

The LRS is a set of policies that governs the maximum amount and purposes of remittance. The LRS has made it easier for Indian residents to study abroad, travel, and make investments in other countries.

“A lot more Indians are spending a lot more money in the US (globally) for travel, education, etc. We see these Indians building portfolios towards achieving these goals,” Ankit Agarwal, Managing Director at Alankit Ltd told Moneycontrol.

“Customer needs to fill in a simple KYC form and upload ID and address proof to open an account on World Investing. Once the account is open, customers remit money from Indian account to US investment account (can be as low as $100) and they are all set to invest,” he said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.