Warren Buffett once said – “Be Fearful When Others Are Greedy and Greedy When Others Are Fearful”. Well, it looks like mutual funds took that advice and used the recent sell-off to add stocks to their portfolio.

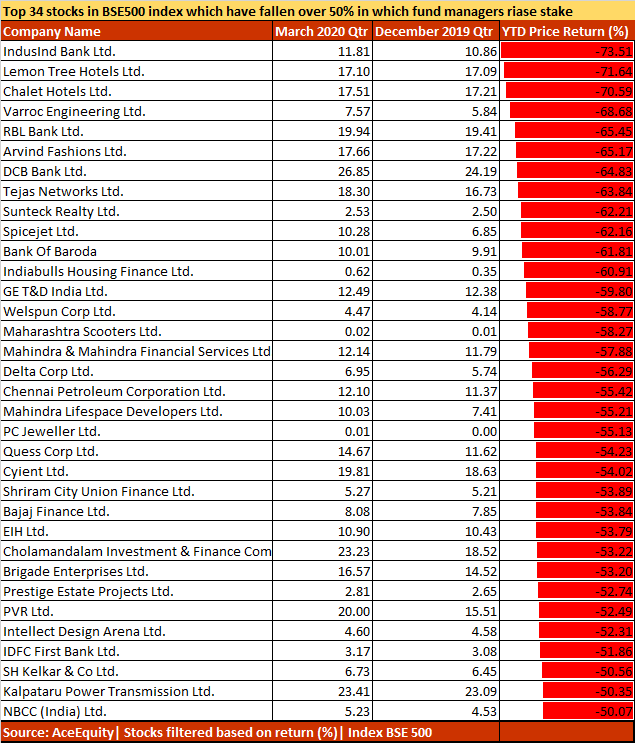

Fund managers raised stake in as many as 290 companies among the S&P BSE500 index even as 240 of them (or nearly 50%) gave negative returns in 2020 YTD.

Indian market fell by about 30 percent in the March quarter and about 18 percent in 2020 YTD, as of data collated on June 2.

Of the 240 stocks that have given negative returns, as many as 34 have fallen more than 50 percent, including SBI, Ashok Leyland, L&T Finance Holdings, PNB Housing, Canara Bank, and Future Retail, and Gayatri Projects etc. among others.

“There are several stocks where mutual fund managers have raised stakes. Fund managers have definitely used the opportunity to raise stake as most of the stocks were available attractive valuations backed by strong fundamentals,” Gaurav Garg, Head of Research at CapitalVia Global Research Limited – Investment Advisor told Moneycontrol.

“Investors should look for stocks where there has been a consistent rise in stakes as they may indicate healthy earnings growth and sustainable performance of the company,” he said.

Over 160 companies in which MFs reduced stake:

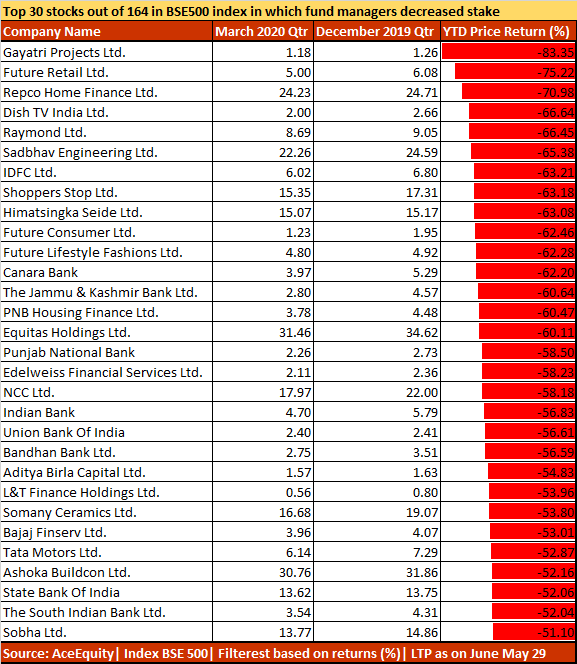

There are almost 164 companies in the S&P BSE 500 index in which fund managers decreased their stake in the March quarter.

As many as 133 out of 164 companies have given negative returns up to 80 percent that includes names like Repco Home, Dish TV, Shoppers Stop, Canara Bank, PNB, data from AceEquity showed.

The list includes mostly financials, retail, NBFCs, construction, and auto stocks which saw a cut in the holding from fund managers. Experts are of the view that fund managers have reduced their stake in the above-mentioned sectors due to major concerns about NPA’s, suggest experts.

“Fund managers have used this downturn to focus on companies and sectors which were assumed to be the biggest beneficiary in this pandemic,” Rahul Sharma, Head of Research, Equity99 Advisors told Moneycontrol.

"Also, fund managers are shifting their bets more index-heavy stocks to align their fund returns with the market. NBFC, constructions, auto, and retail were few of the sectors which have been impacted by the recent slowdown and furthermore due to pandemic,” he said.

Will redemption pressure increase?Mutual Funds net inflows in equity funds halved to a 4-month low in April 2020, data showed despite an increase in overall flows into mutual funds.

MF industry’s AUM increased 7.5 percent MoM (Rs 1.6t) to Rs 23.9 tn in Apr’20, primarily led by equity funds (Rs 859 bn), liquid funds (Rs 698 bn) and other ETFs (Rs 176 bn), Motilal Oswal said in a report.

Net inflows in equity schemes (incl. ELSS) decreased to Rs 67b in Apr’20 from Rs 136 bn in Mar’20, led by a decrease in gross inflows (-52.3% MoM at Rs 155 bn) and decline in redemptions (-53.8% MoM at Rs 88 bn).

Experts fear the worst and the trend of redemptions may well continue for the next 3-6 months as India battles slowdown in the economy which could trigger job losses, contraction in demand, disruption in the supply chain, and risk-off sentiment.

“The investors are switching from high or moderate risk assets to safe assets like bonds etc. The jobholders used to save by continuously investing MF mostly through SIPs but in the present circumstance it's not about accumulating the wealth, rather it's about sustaining,” Garg of CapitalVia Global Research Ltd said.

“The factors like job losses and slow down or temporarily shut down of the business had left out the investors with no other choice than opting redemption. With the current macroeconomic conditions in India, it may likely to continue for three to six months down the ground,” he said.

Sharma of Equity99 Advisors is of the view that investors will continue to redeem their mutual fund holdings. Also, going economic crises will impact many investors which may force them to cut their new investment plans.

Disclaimer: The above stocks are for reference and not buy or sell ideas. The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.