The rally on Friday helped benchmark indices closed flat with a positive bias for the week ended April 26, but the broader markets underperformed with Nifty Midcap index falling 1.9 percent amid mixed earnings.

It indicated that traders remained cautious in the run up to general elections and as US-China are yet to solve their trade issues. Oil prices fell sharply on April 26 after US told OPEC to lower fuel prices, but are still at elevated levels with Brent crude futures at around $72 a barrel.

"Markets during the week traded largely sideways with an upward bias although Nifty went up during the week; but the small and mid-cap indices were still languishing indicating that the markets are in no hurry to set a decisive path for themselves yet," Jimeet Modi, Founder and CEO, SAMCO Securities & StockNote told Moneycontrol.

He said such divergent behavior of the Indian bourses will generate no meaningful direction for the markets.

Even though broader markets lost ground, more action was seen in smallcaps than midcaps during the week.

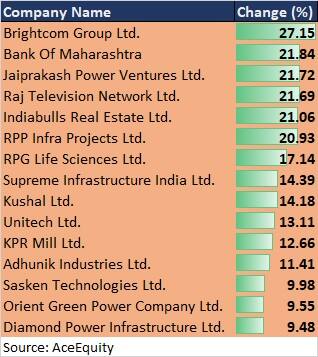

Around 200 out of 740 smallcap stocks closed in the green and of which top 15 stocks rallied between 10 percent and 27 percent.

These 15 stocks outperformed others among BSE Smallcap index are Bank Of Maharashtra, Indiabulls Real Estate, RPP Infra Projects, RPG Life Sciences, Supreme Infrastructure, KPR Mill, Sasken Technologies, Orient Green Power Company, Diamond Power Infrastructure, etc.

Among midcaps, only 20 percent of the stocks closed in the green, of which eight stocks gained between 2-9 percent - Gruh Finance, Reliance Nippon Life Asset Management, AU Small Finance Bank, Larsen & Toubro Infotech, ABB India, Supreme Industries, Tata Global Beverages and Rajesh Exports.

Overall, market is expected to remain in a consolidation mode in the coming week and the focus would be on March quarter earnings and general elections, experts said, adding that crude oil prices will also be closely watched.

"Open interest is consistently reducing in the futures market given the already elevated levels and the uncertainty on election outcome. Status quo is expected to be maintained going forward. Therefore, markets are expected to move either 2/3 percent up or down from the current levels," Jimeet Modi said.

He aked investors not to rush into the markets in the current indecisive phase. He advised against going shopping till atleast May 23 when the election results come out.

Jayant Manglik, President - Retail Distribution, Religare Broking, who also reiterated cautious view on markets, suggests focusing on trade management and traders should align their trades accordingly.

Among the sectoral indices, pharma and IT pack look strong while metal and media counters may continue to underperform, he said.

FIIs remained net buyers during the week to the tune of more than Rs 4,500 crore, taking total inflow over Rs 69,000 crore in February-March and April. However, during the same period, DIIs were net sellers as they continued to prefer profit booking.

Technically, on the weekly chart the Nifty has formed a bullish candle with a long lower shadow indicating buying at lower levels.

Nifty is trading above 20, 50 and 100 day SMAs which is important short term moving average, indicating positive bias in the short term, experts said.

"The index is moving in a higher top and higher bottom formation on the weekly chart indicating positive bias. The chart pattern suggests that if Nifty crosses and sustains above 11,800 levels it would witness buying which would lead the index towards 11,850-11,900 levels," Rajesh Palviya, Head- Technical and Derivatives Research, Axis Securities told Moneycontrol.

However if the index breaks below 11,700 level, it would witness selling which would take the index towards 11,650-11,600 levels, he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.