The Indian rupee has been seeing weakness along with a fall in other emerging market currencies against the US dollar. In fact, it has been hitting new lows almost on a daily basis for the last couple of weeks on continuous dollar demand.

The currency touched a record low of 72.67 a dollar intraday, but it recovered about 22 paise to end lower by 72 paise to around 72.45 as the RBI may have intervened by selling dollars.

The rupee corrected more than 13 percent year-to-date and around 5.5 percent in last one month.

"Adverse risk from trade wars, escalating geopolitical tensions, secular uptrend in crude oil prices, Fed rate hikes despite global uncertainties, and increasing tightness in central bank liquidity have continued to dominate market sentiments leading to a broad-based USD strength," Kotak Securities said.

Additionally, political and economic uncertainties in Turkey, Argentina and Brazil have sparked fears of a contagion risk spreading to the rest of the EMs.

"Against the adverse global backdrop, the domestic macro scenario continues to weaken. Higher crude price amid Iran sanctions and domestic political uncertainty over the next few months will likely further weigh on INR," it said.

With several global risks persisting and domestic fundamentals deteriorating, Kotak shifted its USD-INR range to 69-74 for the rest of FY19. It said USD-INR is likely to stabilise around 70-72 after bouts of overshooting.

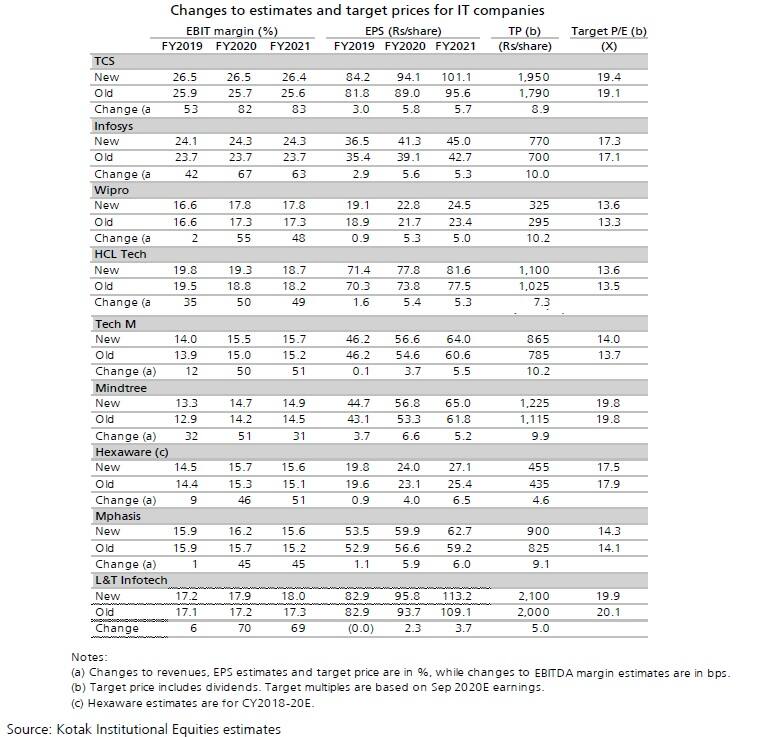

After such a sharp depreciation, Kotak Securities raised its EPS estimates as well as target prices for 9 IT stocks by 0-7 percent and 5-10 percent, respectively.

"We upgrade FY19-21 EPS estimates by 0-7 percent on the back of revision of INR/USD rate to 70-72 from 68.5-70 earlier. Target price increases by 5-10 percent due to the upgrade in EPS estimates and roll over of target price by three months," the report said.

The rupee depreciation seems to have already reflected in technology stocks which have so far been the best performers this year.

The Nifty IT index rose half a percent, taking total year-to-date gains to more than 38 percent as the Indian rupee depreciated 13 percent in 2018 so far.

Mindtree has been biggest gainer among stocks available in the IT index, surging 90 percent followed by KPIT Technologies (up 70 percent), TCS (54 percent), Tech Mahindra (53 percent), Infosys (41 percent), HCL Technologies (21 percent) and Wipro (3 percent).

The report said even as INR has depreciated, the impact of the same on immediate earnings will be a function of hedging. "Infosys, TCS and Mindtree do not have meaningful cash flow hedges and will benefit immediately from INR depreciation. L&T Infotech, Tech Mahindra and Mphasis are aggressively hedged and will not derive meaningful near-term upside."

Infosys has miniscule cash flow hedges of USD 300 million. TCS hedges but through options implying that it will realise the benefit of INR depreciation unless the company has entered into range barrier options with the INR depreciating beyond the range.

Mindtree hedges only the monetary assets and does not have any cash flow hedges. On the other hand, Tech Mahindra and L&T Infotech have hedged 70-90 percent of net cash inflow over the next 12-months resulting in no change in FY2019E EPS. Wipro, HCL Technologies, Mphasis and Hexaware have hedged aggressively.

Kotak said while FY2019 EPS will be influenced by hedges, all companies will receive an earnings boost in the subsequent year.

As a rule of thumb, 1 percent rupee depreciation aids EBIT margin by 20-30 bps and NOPAT by 2-3 percent. However, it assumes modest retention of Rupee depreciation benefit; with bulk of it that will be competed away or reinvested.

Infosys and Tech Mahindra are Kotak's top picks in largecaps and L&T Infotech and Mindtree among midcap names.

"We like Tech Mahindra for potential recovery in the telecom segment, continuing margin expansion and inexpensive valuations. Mindtree's portfolio of business that is aligned to growth areas positions it well. In addition margins will continue to expand. L&T Infotech has scale characteristics led by excellent client base, well diversified revenue mix, strong delivery and much improved digital competencies," it reasoned.

Companies that have higher sensitivity to currency are the ones – (1) with companies with higher offshore leverage, (2) lower margin, and (3) lower India-centric revenues, it said.

The US dollar has appreciated against other currencies viz: British pound, euro and Australian dollar compared to average of June 2018 quarter numbers.

"This results in effective cross-currency headwind of 50-100 bps for various companies. As a result, the effective INR revision baked into our models is 2.5-3 percent as compared to the headline revision/ depreciation of 3.6 percent for FY2020.

Disclaimer: The views and investment tips expressed by brokerage house on Moneycontrol.com are its own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.