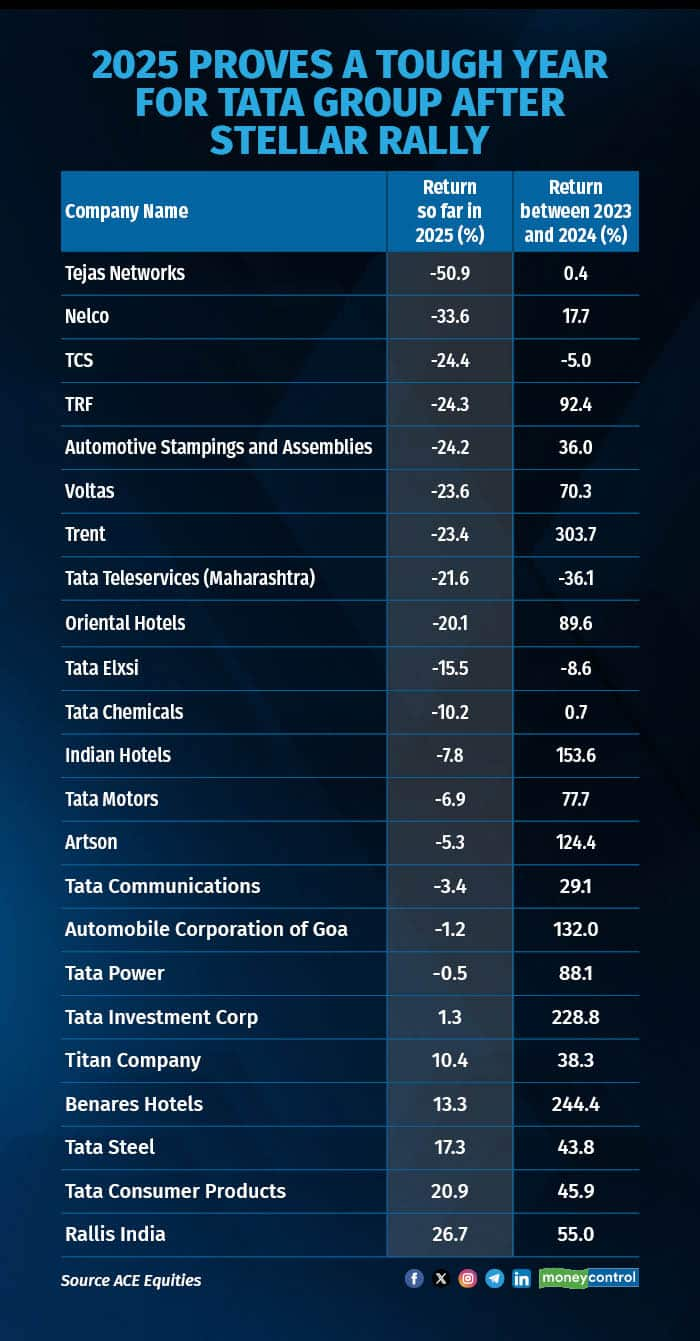

After delivering multibagger returns in 2023 and 2024, Tata Group stocks appear to have lost favour among investors in 2025, with most counters turning laggards this year.

The conglomerate’s total market capitalisation has eroded by more than fifteen percent so far in 2025, slipping to Rs 26.56 lakh crore from Rs 31.10 lakh crore at the close of 2024. This marks a sharp reversal from the nearly 12 percent rise in 2024 and 33 percent surge witnessed in 2023.

Among the biggest drags this year, Tata Consultancy Services alone shed market value of over Rs 3.91 lakh crore, while Trent lost more than Rs 57,000 crore. Tata Motors, Indian Hotels and Voltas each saw their mcap decline by over Rs 14,000 crore. Tejas Networks, whose stock has plunged more than 50 percent in 2025, wiped out over Rs 10,000 crore in value.

Tata Technologies and Tata Elxsi also came under pressure, losing mcap nearly Rs 8,400 crore and Rs 6,600 crore respectively. In contrast, Titan Company and Tata Steel emerged as the group’s biggest gainers, each adding close to Rs 27,000 crore in market value, followed by Tata Consumer Products which rose by over Rs 17,000 crore.

Saurabh Jain, Head of Fundamental Research, SMC Global Securities said broader market headwinds—such as foreign fund outflows, global uncertainty, and stretched valuations—have further weighed on investor confidence. Even high-performing sectors like retail and auto have seen Tata stocks underperform significantly this year.

The fall in stocks was due to a mix of external and internal factors. TCS, once a market leader, and Tejas Networks have seen a sharp decline this year amid layoffs, reduced client spending, global recession fears, and weak earnings. Tata Motors has been hit hard due to US tariffs on foreign vehicles and a global luxury auto demand slump. Weak passenger vehicle growth, particularly in sub-Rs.10 lakh segments, EV margin pressures, and trade barriers in key markets like China, alongside supply chain disruptions and pre-demerger uncertainties related to its passenger vehicle business split, have further strained performance.

Consumer-facing companies such as Trent, Tata Elxsi and Voltas have reported a slowdown in growth, while concerns over valuations are mounting for Indian Hotels. Analysts indicate that several Tata Group firms are encountering subdued demand, weighed down by persistent inflation and elevated interest rates. At the same time, cyclical businesses like Tata Chemicals are contending with margin pressures arising from volatile commodity prices.

Interestingly, as many as 12 Tata Group companies delivered stellar gains of 50-300 percent between 2023 and 2024. Leading the rally, Trent surged more than 300 percent, while Tata Investment Corporation and Benares Hotels soared over 240 percent each. Indian Hotels advanced 150 percent, while Automobile Corporation of Goa jumped 130 percent. Artson and TRF gained 132 percent and 92 percent respectively, whereas Oriental Hotels and Tata Power posted gains of more than 90 percent each.

Tata Motors and Voltas climbed around 80 percent apiece, while Voltas and Rallis India also registered strong growth of nearly 70 percent and 55 percent respectively. Among the group’s heavyweights, Tata Consultancy Services, Tata Steel and Titan Company delivered solid returns of about 45 percent each.

Divyam Mour, Research Analyst, SAMCO Securities said many Tata Group stocks had reached record valuations in 2023–24, and the current phase reflects a period of consolidation rather than structural weakness. Despite near-term softness, the Group’s long-term growth drivers — including EVs, renewables, semiconductors, and digital platforms — remain intact.

All eyes are now on the highly anticipated initial public offering of Tata Capital, which is expected to hit the market before the end of September. However, analysts caution against assuming a uniform rub-off effect across Tata Group stocks. Sunny Agrawal of SBI Securities noted, “I don’t think so, as the Street will assess each and every company on its own merit.”

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.