Jitendra Kumar GuptaMoneycontrol Research

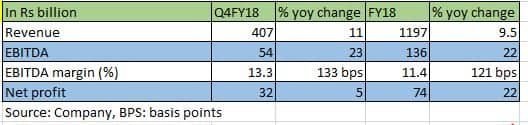

Even in a challenging industry environment, L&T reported a 7 percent growth in order inflows and 9.5 percent growth in sales during fiscal 2018. Operating margins expanded because of cost efficiency and savings, boosting net profit by 22 percent year on year. During the year, the company was able to reduce its working capital to 19 percent of sales, from 23-24 percent previously.

Infrastructure, which accounts for close to 50 percent of its revenues, grew 12 percent to Rs 59,000 crore. Except for power business, where revenues declined 18 percent and margin fell as low as 3.4 percent, most other segments reported good growth. Heavy engineering business did well; revenues grew 22 percent, as did those in the hydrocarbons business. Power business which accounts for 5.2 percent of the sales is facing difficulty because of poor domestic demand. The company is looking for opportunities in the overseas markets to compensate for the loss in the domestic market.

Enough on the plate

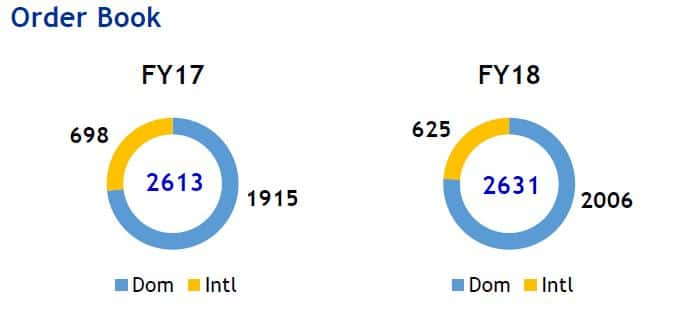

The management believes private capex could remain muted for some more time given the debt problems of many companies and as well as under-utilisation of capacity in the industry. L&T expects to benefit from government spending in infrastructure, oil & gas, metros, defence, water resources, roads and few others. It has a robust order book of close to Rs 263,000 crore or about 2.5 times its consolidated FY18 sales. Subject to timely execution of these orders, the company should be able to report a steady growth in earnings.

L&T is optimistic about achieving relatively better growth in the current fiscal. It has guided about 12-15 percent revenue growth in the current fiscal with order intake guidance of about 10-12 percent, which is quite impressive. And with the margins set to improve further, earnings growth too should be good.

Valuations

L&T is restructuring its portfolio of business by selling non-core assets. It’s planning to come out with InvIT for its road assets etc. In the long term, these initiatives will start to reflect in overall profitability. In fact, the company is aiming for a Return of Equity of about 18 percent against the current RoE of less than 14 percent, which should enhance valuations. This year, the company should be reporting an earning per share of about Rs 58 per share. At the current market price of Rs 1,376, price-to-earnings ratio works out to about 23 times, which is reasonable.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!