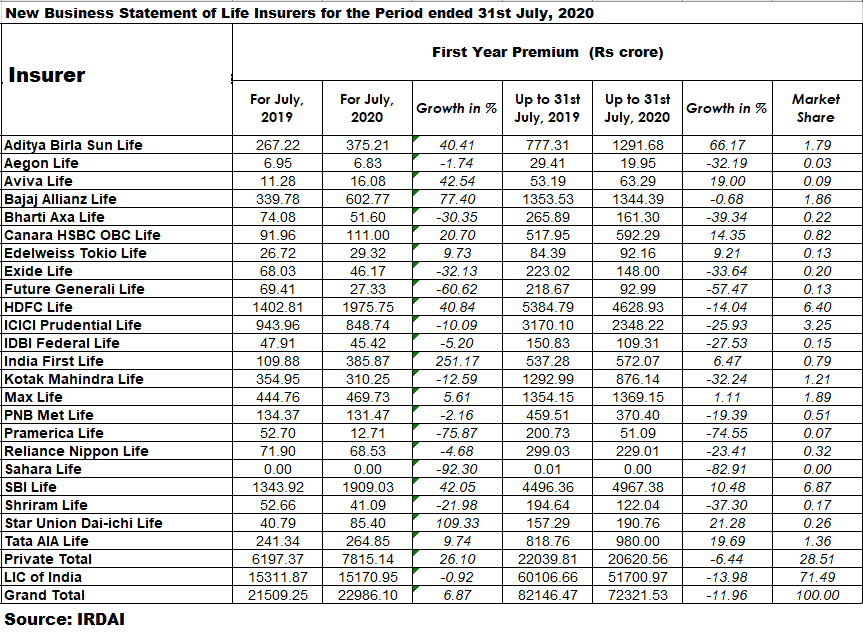

Showing the first signs of growth in FY21, the new business premium of life insurers saw a 6.9 percent year-on-year (YoY) growth to Rs 22,986.10 crore in July.

Ever since the coronavirus outbreak in India and the subsequent lockdown from March 25, this is the first month that life insurers have seen a growth in first year premium collection.

Data from Insurance Regulatory and Development Authority of India (IRDAI) showed that, while for the April 1 to July 31 period the life insurers saw a 12 percent YoY decline in premium to Rs 72,321.53 crore, July was an outlier.

In the industry, private insurers saw a 26 percent YoY growth in first-year premium collection to Rs 7,815.14 crore in July 2020. Life Insurance Corporation of India (LIC) saw a flat premium (decline of 0.9 percent YoY) of Rs 15,170.95 crore.

Among the listed insurers, HDFC Life Insurance posted a 40.8 percent YoY increase in new premium to Rs 1,975.75 crore. ICICI Prudential Life Insurance saw a 10 percent YoY decline in new premiums to Rs 848.74 crore. SBI Life Insurance saw a 42 percent YoY rise in first-year premium to Rs 1,909.03 crore in July 2020.

The first-year premium collection data for July 2020 showed that all bank-led insurers started seeing positive growth. This is amidst an easing of the lockdown across India and more customers walking into bank branches.

Since March, life insurers have been seeing a double-digit decline in new premiums. In March, there was a 32 percent YoY decline in first-year premium.

In April 2020, the decline was at 32.6 percent. Life insurers' new premiums saw a 25.4 percent YoY decline in May 2020 while in June 2020 life insurers saw a 10.5 percent decline in new premiums compared to a year-ago.

Bank-led players see growth in premiums

For July, IndiaFirst Life Insurance that has Bank of Baroda and Andhra Bank (now merged with Union Bank of India) as the bank promoters saw a 251.2 percent YoY growth in new premium to Rs 385.87 crore.

Star Union Dai-ichi Life Insurance that has Bank of India and Union Bank as its Indian promoters saw a 109.3 percent YoY growth in new premium to Rs 85.4 crore in July.

Another life insurer, Canara HSBC OBC Life that has Canara Bank, HSBC and Oriental Bank of Commerce (now merged with Punjab National Bank) also saw a 20.7 percent YoY growth in premium to Rs 111 crore in July.

Industry officials are of the view that once public transport like local trains and metro rail resumes across the country, there will be a further improvement in new premium collection for life insurers.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.