The coronavirus (COVID-19) pandemic and the lockdown to contain the spread has impacted the life insurance premium collection for April 2020. According to data from the Insurance Regulatory and Development Authority of India (IRDAI) first-year premium collections declined 32.6 percent year-on-year (YoY) to Rs 6,727.74 crore in April 2020.

Premium collected by Life Insurance Corporation of India (LIC) declined 32 percent YoY to Rs 3,581.65 crore in April 2020, while for private life insurers it dipped 33.3 percent to Rs 3,146.09 crore.

Among listed insurers, HDFC Life Insurance's new premium collection fell 52.3 percent YoY to Rs 688.89 crore in April while for ICICI Prudential Life Insurance it fell 59.5 percent to Rs 256.19 crore. For SBI Life Insurance, it remained nearly flat at Rs 917.43 crore in April.

Also read: Live updates from Coronavirus pandemic in India

The only life insurers to report growth in new premiums in April 2020 were Aditya Birla Sun Life, Aviva Life, Bajaj Allianz Life, Edelweiss Tokio Life and Tata AIA Life.

In terms of the number of new policies/schemes sold, there was a 67.6 percent YoY decrease in policy sales to 416,200 in April 2020. New policy sales for LIC fell 80.2 percent YoY while for private insurers there was a 33.7 percent YoY decline.

A lockdown had been announced in India to minimise COVID-19 spread from March 25 onwards. This has now been extended till May 17 with some relaxations provided to regions falling in the green and orange zones.

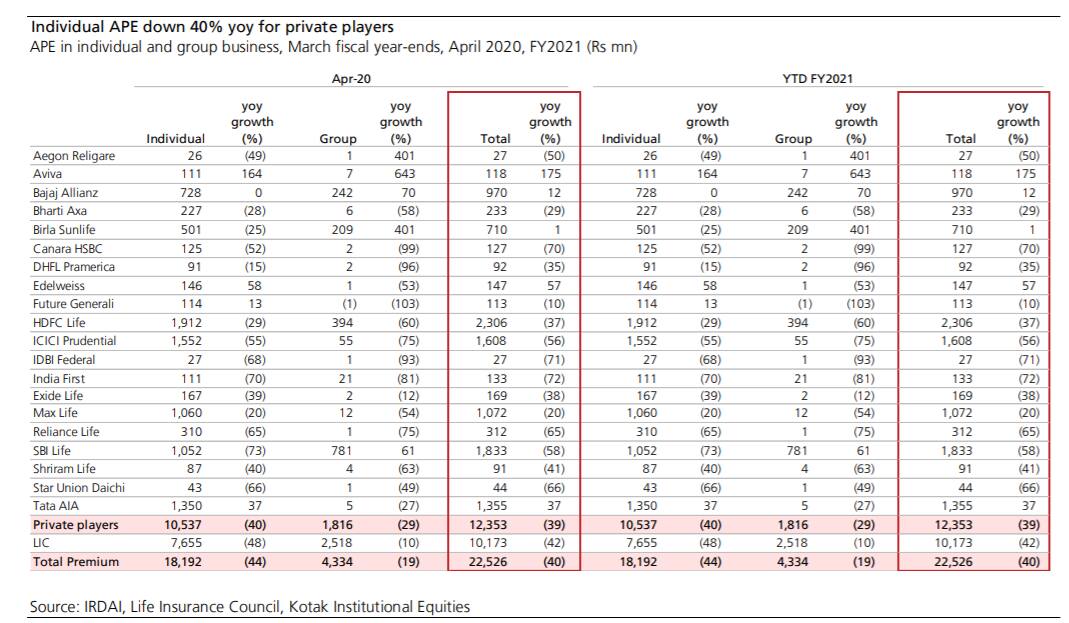

Kotak Institutional Equities said in a report that private life insurance players reported 40 percent YoY decline in individual APE in April 2020 despite the lockdown during the entire month. The report said this is better than the expectations of about 90-95 percent decline.

“Demand for protection policies and spill-over from the year-end pipeline were the likely drivers. Subdued capital markets acted as a dampener, inflows to equity-oriented mutual funds were muted at Rs 44 billion in April 2020 as compared to Rs 96 billion per month in the previous two months,” said the report.

APE refers to annualised premium equivalent which includes 100 percent of regular premiums and 10 percent of single premiums.

Among large private players, Kotak said in the report, ICICI PruLife individual APE was down 55 percent and SBI Life down 73 percent. Individual APE for HDFC and Max Life Insurance declined 28 percent and 20 percent, respectively.

It is likely that renewal premiums of life insurers would be impacted as well. This is because IRDAI has allowed time till May 30, 2020 to pay the renewal premiums falling due in March and April 2020.

Follow our full coverage of the coronavirus pandemic here.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.