The primary market has created a lot of records in 2021, be it in terms of total fund-raising, the size of IPOs (initial public offerings) or subscription or debut premium.

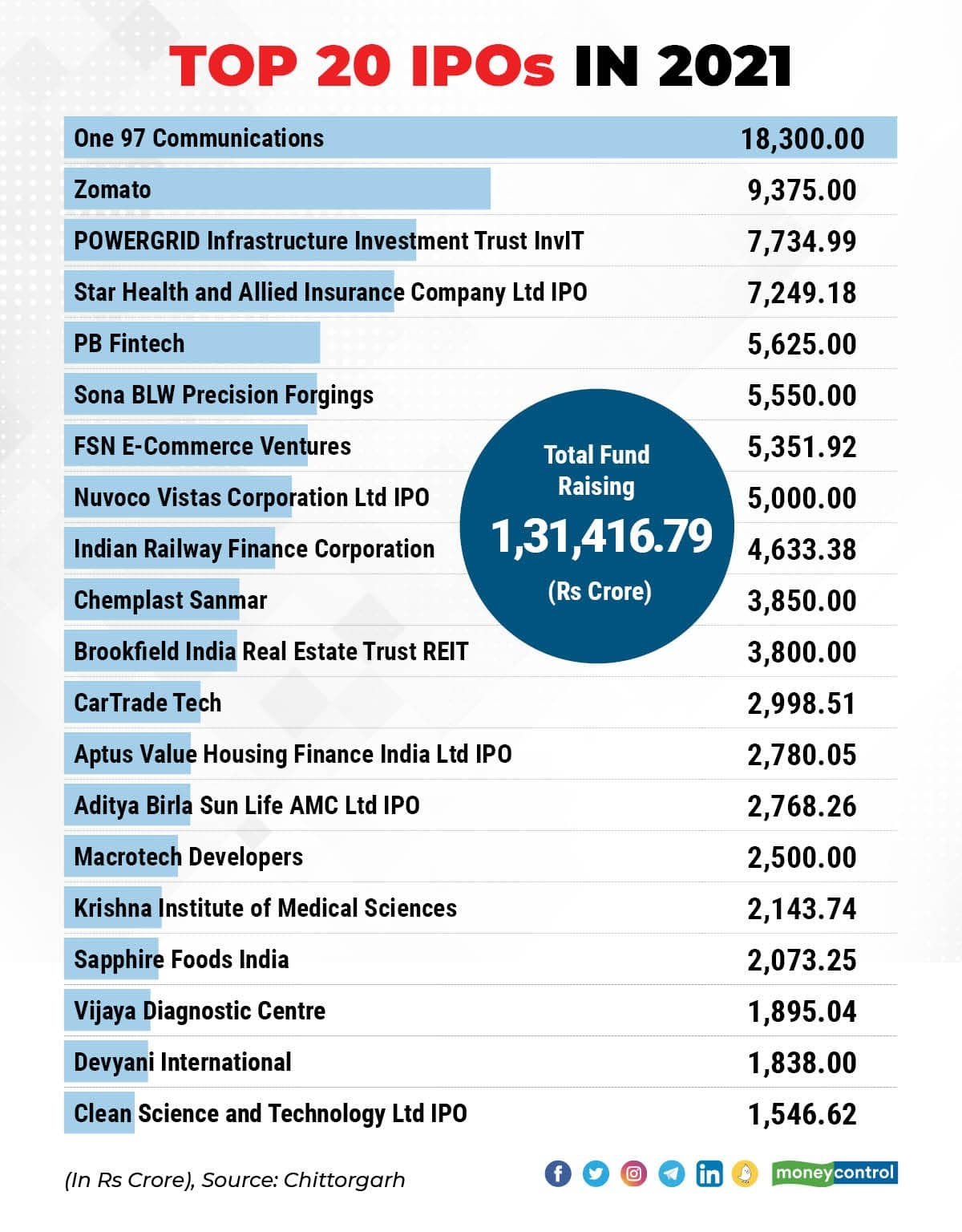

A total of 65 companies launched IPOs and garnered more than Rs 1.31 lakh crore during the year, which is 74.6 percent higher from the previous record year of 2017. In 2017, 38 firms mopped up Rs 75,278 crore through public issues.

Government initiatives on digitisation, Make in India, the low interest-rate environment, and measures to maintain liquidity and to support sectors impacted by COVID-19 are the primary factors.

Apart from new investors, the outstanding performance of the secondary market was one of the biggest reasons for the momentum in the primary market.

“This is for the first time that the funds raised through IPOs in a year has crossed the Rs 1 lakh crore-mark. The major reasons are the strong rally in the secondary markets as Indian indices are among the best-performing ones, globally, the entry of new investors into the markets, falling interest rates of bank deposits, and more and more startups coming to the markets," said Mohit Nigam, Head, PMS, Hem Securities.

Click Here To Read All IPO Related News

Entry of new-age companies

The year 2021 also marked a great beginning for new-age tech and fintech companies, including One97 Communications (Paytm), Zomato, PB Fintech, FSN E-Commerce Ventures (Nykaa), CarTrade Tech, Fino Payments Bank, CE Info Systems (MapmyIndia), and Nazara Technologies.

One97 Communications, operator of digital payments company Paytm, raised the biggest amount of Rs 18,300 crore in the history of Indian capital markets, though the issue saw tepid response from investors.

Food delivery giant Zomato reported the second-biggest IPO in size (Rs 9,375 crore), followed by POWERGRID Infrastructure Investment Trust InvIT (Rs 7,735 crore), Star Health and Allied Insurance Company (Rs 7,249 crore), PB Fintech (Rs 5,625 crore), Sona BLW Precision Forgings (Rs 5,550 crore), FSN E-Commerce Ventures (Rs 5,352 crore), and Nuvoco Vistas Corporation (Rs 5,000 crore).

Momentum to continue in 2022?

Experts believe 2022 is also expected to be a strong year for the primary market as the great beginning of new-age tech companies, like Zomato and Nykaa, has already provided a favourable direction to the upcoming IPOs, including Byju’s, Delhivery, Ola, PhonePe and Flipkart.

If the LIC IPO is launched as per schedule in Q4FY22, the fund-raising could be more than Rs 1-1.1 lakh crore in 2022, they said.

"The IPO market in 2021 was very robust and vibrant. We have seen more than five new issues hitting every month, on average. In 2022, the primary market should continue to remain active and vibrant, with a lot of new issues being lined up, especially in the new-age tech and fintech spaces. A few of the probables are LIC, More Retail, Mobikwik, Ola, Delhivery, Byju's etc," said Narendra Solanki, Head, Equity Research (Fundamental) at Anand Rathi Shares & Stock Brokers.

Nigam of Hem Securities also agreed with Solanki that the high momentum is expected to continue into 2022.

"Several other big names will launch IPOs in 2022, besides the four mentioned above. They include OYO, PhonePe and Flipkart. If liquidity remains high and momentum sustains, the upcoming financial year will see a number of successful IPOs," he added.

Yuvraj Thakker, Managing Director at BP Wealth, too, said the successful IPOs of Zomato and Nykaa have opened up the gates for several startups to get listed.

IPO subscription

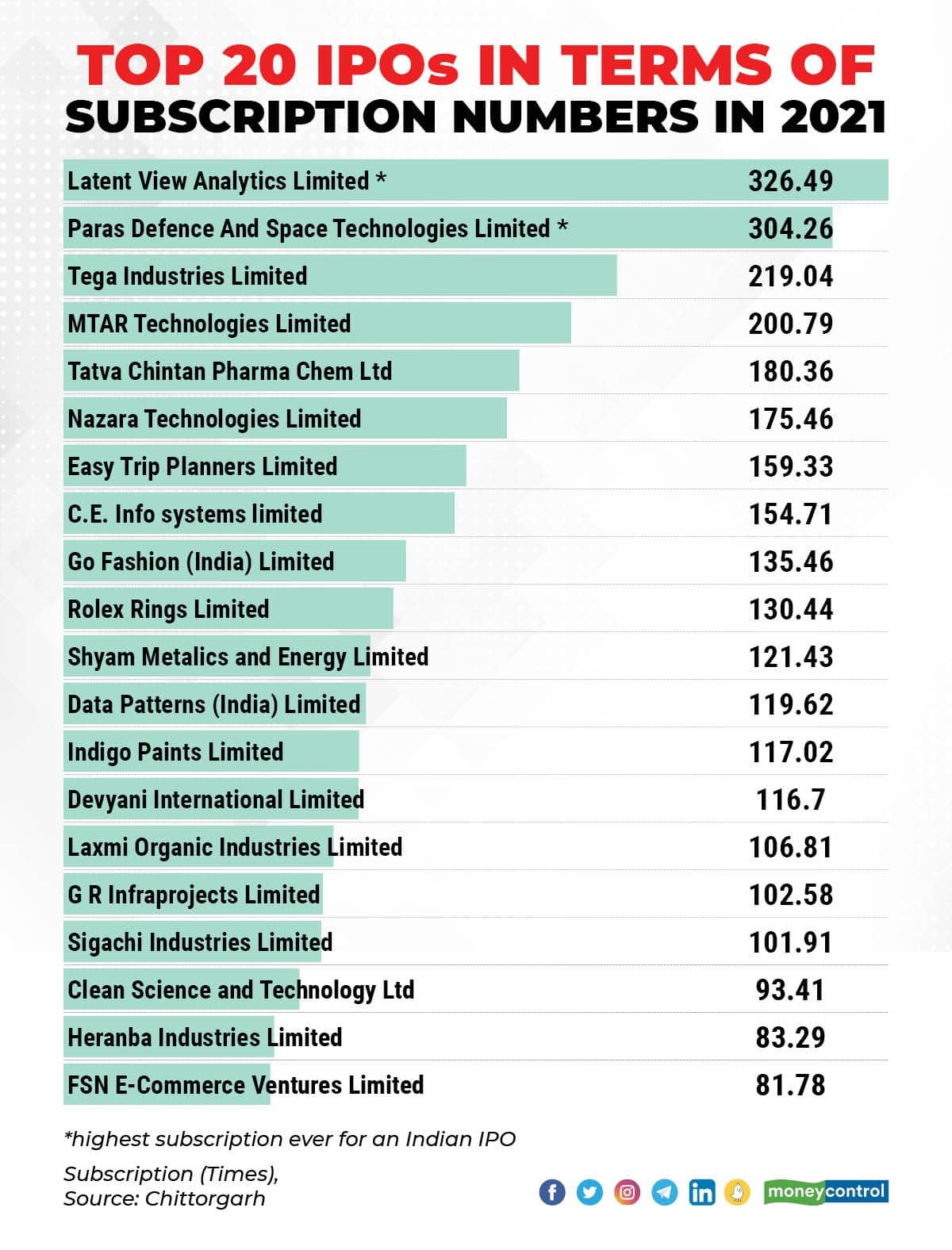

The year 2021 also saw the highest-ever subscription in IPOs. For the first time in the history of Indian capital markets, IPO subscriptions crossed 300 times. Latent View Analytics reported the highest-ever subscription of 326.5 times, followed by Paras Defence and Space Technologies at 304.3 times.

The primary market boom was so strong in the year that 17 IPOs saw more than 100 times subscription. They include Tega Industries, MTAR Technologies, Tatva Chintan Pharma Chem, Nazara Technologies, Easy Trip Planners, CE Info systems, Go Fashion, Data Patterns, Indigo Paints, Devyani International, and Laxmi Organic Industries.

"Year 2021 has been one of the best for IPOs, despite COVID-19. Positive investor sentiment and the absence of economic downturns have led to a successful year for the primary markets. CY 2022 could see a similar or even bigger fund raising," said Yuvraj Thakker, Managing Director, BP Wealth.

But Srinivas Rao Ravuri, Chief Investment Officer, PGIM India MF, said they believe 2022 would be a challenging year for investors and companies planning IPOs.

Disclaimer: The views and investment tips by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.