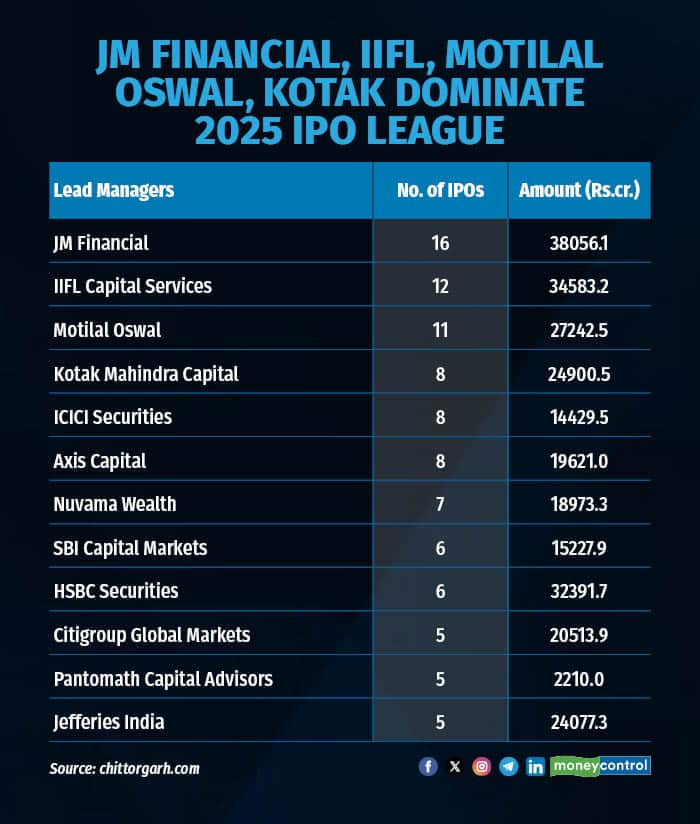

The domestic IPO market has seen a strong momentum this year, with investment bankers jostling for mandates to manage public issues, given the robust pipeline of upcoming fresh papers. So far this year, JM Financial has pulled ahead, steering 17 IPOs worth Rs 38,056 crore, including HDB Financial, Ather Energy and JSW Cement.

IIFL Capital Services followed by 12 IPOs, which raised a combined Rs 34,583 crore, with notable offerings like HDB Financial, Hexaware Technologies, Knowledge Realty Trust, Schloss Bangalore, and Aegis Vopak Terminal.

Motilal Oswal Investment Advisors followed with 11 deals aggregating Rs 27,243 crore, bringing companies such as HDB Financial, NSDL, Schloss Bangalore, and Dr Agarwal’s Health Care to the market.

Kotak Mahindra Capital, Axis Capital and ICICI Securities each managed eight offerings, while HSBC Securities made a mark with mandate for six big-ticket IPOs. Jefferies India and Citigroup Global Markets India handled five issues each, with HSBC drawing attention for its aggressive push into large mandates.

Among other notable performers, Nuvama Wealth Management executed seven IPOs, and SBI Capital Markets managed six offerings. At the end of the table, Pantomath Capital Advisors successfully took five companies public.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.