The public issue for National Securities Depository Ltd (NSDL) is set to open on the bourses tomorrow. However, on many financial and performance parameters, CDSL leads the pack.

On the sheer number of demat accounts itself, CDSL has over 15 crore accounts, almost four times more than NSDL. Even on financial parameters, despite lagging NSDL pre-pandemic, CDSL has taken over on profitability and margins front.

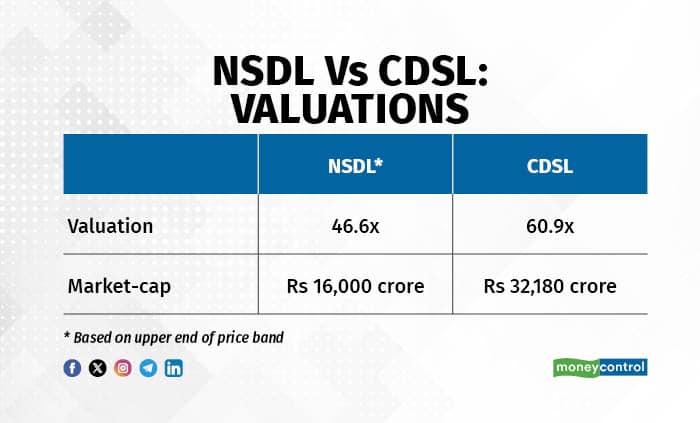

Valuations:

At its upper price band of Rs 800 per share, analysts are of the opinion that the issue is fully priced. However, at a P/E of 46.6x, the IPO is priced more than half the value of its competitor Central Depository Services (India) Ltd, more commonly known as CDSL.

As of July 29, CDSL commands a valuation of 60.91x, with a market capitalization of . The depository's shares have been on a steady downward path as the NSDL issue inched closer, cracking over 14 percent over the past month.

Clientele:

Even though NSDL and CDSL offer the same services, facilitating the electronic holding and transfer of securities, the two depositories have a varied client base.

NSDL has a more sticky, concentrated client base of mutual funds, foreign institutional investors, pension funds, and insurance players. As of FY25, NSDL serviced almost all of the value of equity, debt and other securities held by foreign portfolio investors in dematerialized form in India.

On the flip side, CDSL's core clientele are individual investors who invest in the equity markets via discount brokers. Since the pandemic, the firm has scaled up rapidly as retail investors flocked to the equity markets.

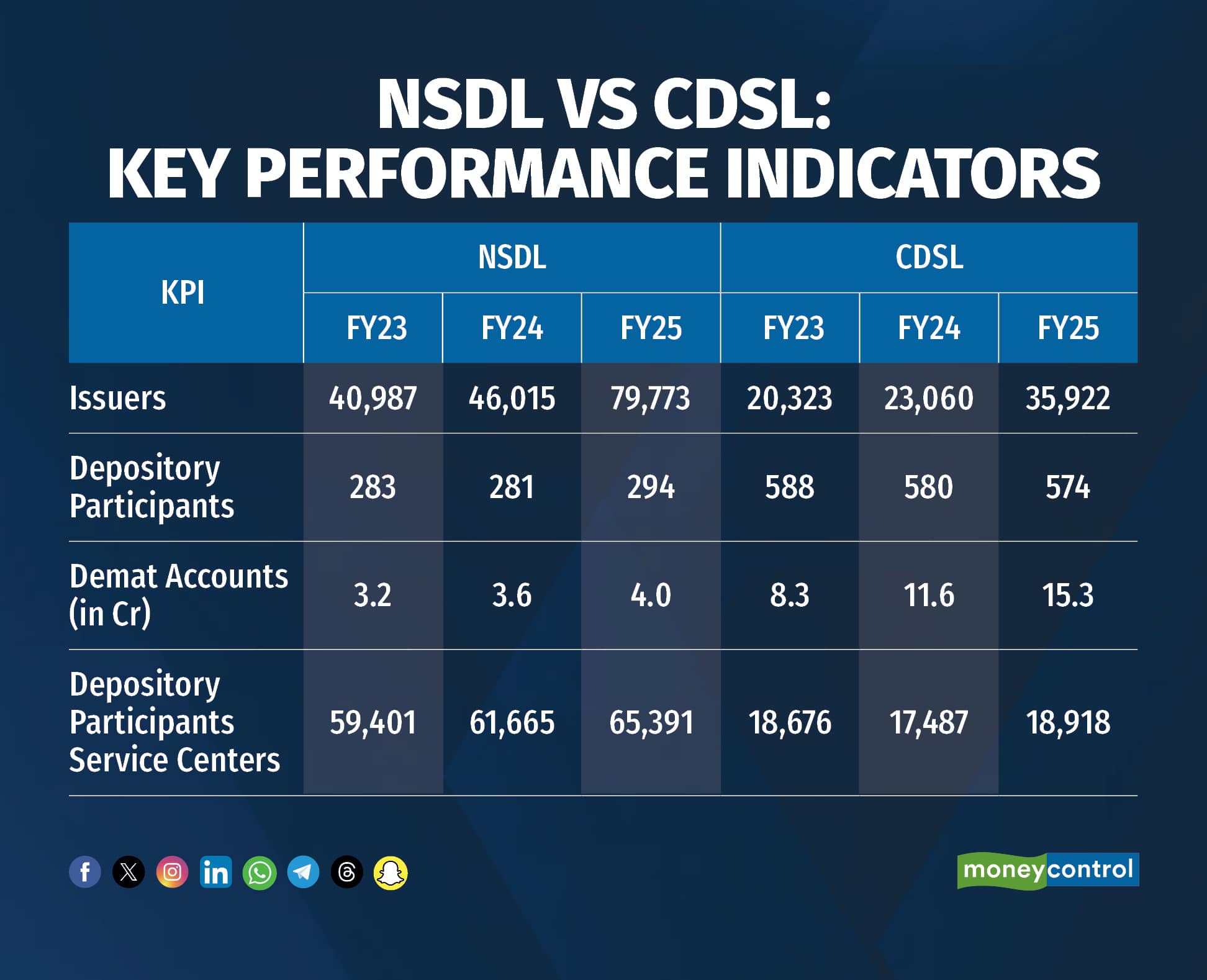

Key performance indicators:

NSDL boasts of more issuers (companies that are registered with the depositaries for various services such as annual custody), with the number steadily rising. However, NSDL has fewer depository participants (financial services firms, like brokers) and the accounts are far more concentrated in value. The firm has a standalone operational revenue per investor account of Rs 56.80, which is higher than CDSL’s as a result of its strong institutional focus.

Despite having fewer issuers, CDSL has higher retail reach, with a larger number of demat accounts and over 580 depository participants, which indicates that it has stronger traction among retail investors via discount brokers and other smaller brokers.

In its red herring prospectus, NSDL acknowledged the loss of market share in the depository business as a result of the rapid emergence of new age fin-tech brokers. These brokerages saw their market share skyrocket from five percent in FY16 to 70 percent as of FY25.

“The non-adaptation of NSDL system and its services by these new age fin-tech brokers could result in a significant loss of potential business and market share to our primary competitor, CDSL, and any failure to do so could lead to a further erosion of our market share, which may impact our revenue growth with respect to the increase in our expenses, ultimately impacting our revenue, profitability and profit margins,” noted the depository.

However, NSDL has higher assets under custody. In FY25, the firm’s demat custody value, which is the total value of securities held in accounts with the company, clocked in at a whopping Rs 464 lakh crore, as against CDSL’s demat custody value of Rs 71 lakh crore.

NSDL held approximately 85.06 percent and 86.81 percent of total securities in terms of numbers and values, respectively.

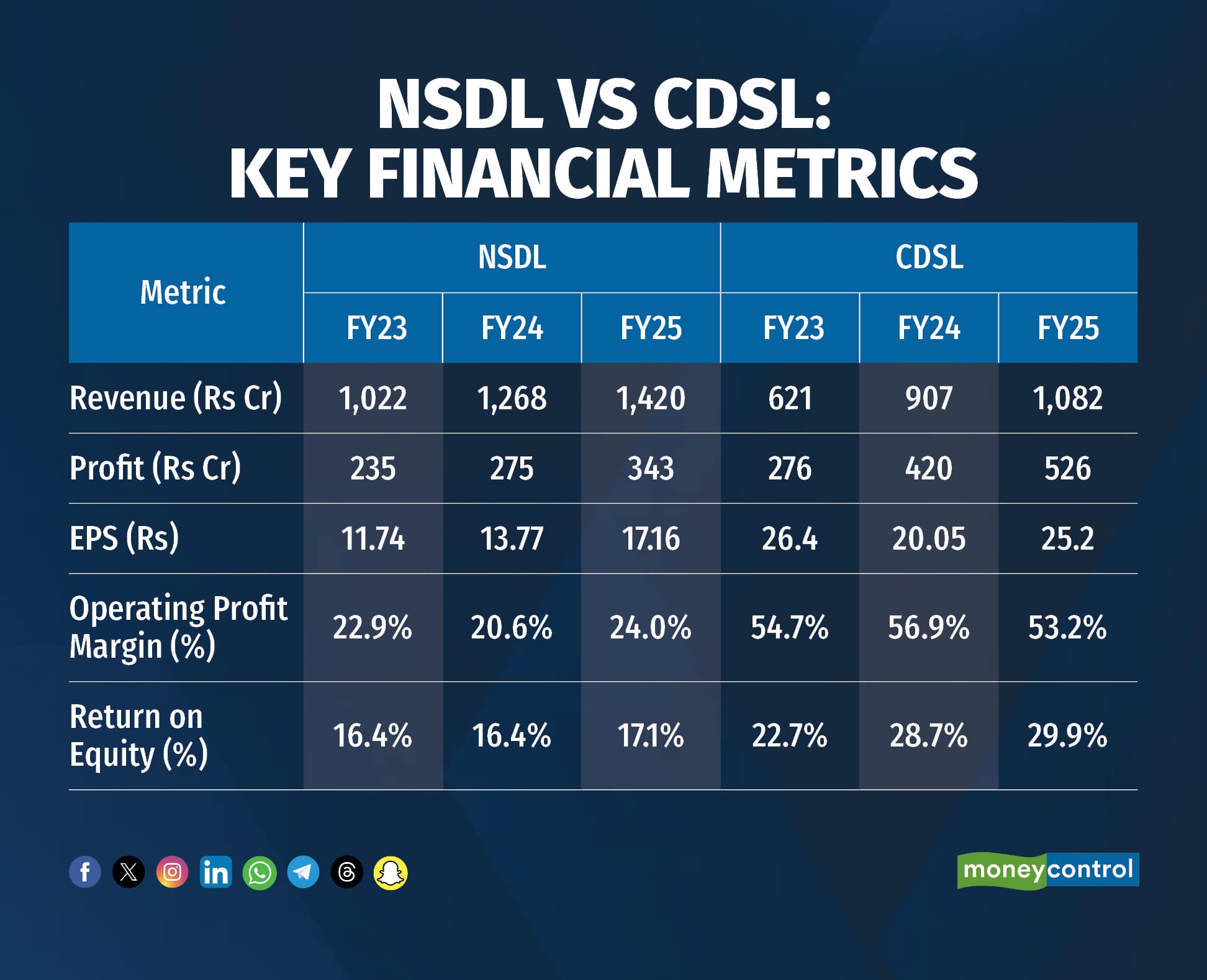

Key financial metrics:

Over the past three years, NSDL has seen its revenue record a steady rise to Rs 1,420 crore in FY25. However, the CAGR from FY23 to FY25 was 17.9 percent. While CDSL posted a lower revenue of Rs 1,082, the growth rate was 32 per annum.

CDSL outperformed on the profitability front, reporting a profit of Rs 526 crore in FY25, significantly higher than NSDL’s Rs 343 crore. Even though NSDL has a larger revenue base, CDSL boasted of higher profit margins and profit, which mean that the firm has superior cost efficiency and operational leverage.

According to experts, NSDL’s slower profit growth and margins of 20-24 percent indicated that the depository has a more cost-intensive model, likely due to its deeper institutional focus.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.