The initial public offering of Dodla Dairy is going open for subscription on Wednesday. This would be the third company to launch an IPO this week, after Sona Comstar and Shyam Metalics.

The equity shares issued by the company will be listed on both BSE and the National Stock Exchange. ICICI Securities and Axis Capital are the book running lead managers to the offer.

Here are 10 key things to know before subscribing the public issue:

1) Public Issue

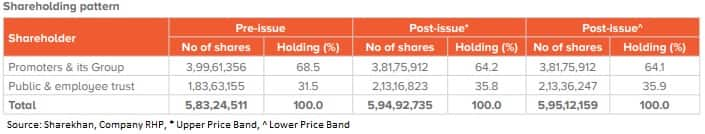

The IPO comprises a fresh issue of Rs 50 crore and an offer for sale of up to 1,09,85,444 equity shares by the existing selling shareholders.

The offer for sale consists of up to 92 lakh equity shares by investor TPG Dodla Dairy Holdings Pte Ltd. The offer for sale also comprises selling of up to 4,16,604 equity shares by Dodla Sunil Reddy, 10,41,509 equity shares by Dodla Family Trust, and 3,27,331 equity shares by Dodla Deepa Reddy, which all are part of promoter and promoter group.

2) IPO Dates

The public issue will open on June 16 and the closing date is June 18. The anchor book, if any, will open for a day on June 15, a day before the issue opens for retail, non-institutional investors, and qualified institutional buyers.

3) Price Band

The company in consultation with merchant bankers has fixed a price band for the offer at Rs 421-428 per equity share.

4) Fund Raising and Objects of Issue

The company plans to raise Rs 520.17 crore at a higher end of the price band.

The net proceeds of a fresh issue (i.e. after reducing the offer expenses) will be utilised for repaying of certain borrowings (Rs 32.26 crore) availed by the company from ICICI Bank, Hongkong and Shanghai Banking Corporation, and HDFC Bank; funding capital expenditure requirements (Rs 7.15 crore); and general corporate purposes.

5) Lot Size and Reserved Portion Categorywise

Investors can bid for a minimum of 35 equity shares and in multiples of 35 equity shares thereafter. So retail investors can apply for shares worth a minimum of Rs 14,980 and a maximum of Rs 1,94,740.

The company has reserved up to 50 percent of offer size for qualified institutional buyers, 15 percent for non-institutional investors, and the balance 35 percent for retail investors.

6) Company Profile

Dodla Dair is an integrated dairy company based in south India. Its primary source of revenue is the sale of milk and dairy-based value-added products (VAPs) in the branded consumer market.

Amongst private dairy players with a significant presence in the southern region of India, it is the third-highest in terms of milk procurement per day and second highest in terms of market presence across India among private dairy players, CRISIL said.

Its operations in India are across the five Indian states - Andhra Pradesh, Telangana, Karnataka, Tamil Nadu and Maharashtra, while overseas operations are based in Uganda and Kenya.

It processes and sells retail milk (full cream, standardised, toned and double toned) and produces dairy-based value-added products such as curd, Ultra-High Temperature processed milk, ghee, butter, flavoured milk and ice cream among others. It also manufactures and sells cattle feed to farmers through procurement network.

As of March 2021, its procurement operations consisted of 6,771 village-level collection centres (VLCCs), 232 village dairy farms and third party suppliers and 94 chilling centres.

7) Competitive Strengths and Strategies

a) It is a consumer-focused dairy company with a diverse range of products under the 'Dodla Dairy' and 'Dodla' brands.

b) It has an integrated business model with well-defined procurement, processing and distribution capabilities, in a cost-efficient manner.

c) It believes farmer-friendly policies and continuous engagement with them with welfare programs have strengthened its relationships with farmers which in turn has strengthened its raw milk procurement process.

d) It follows stringent quality control procedures.

e) The company has delivered consistent growth over the last three financial years both in terms of financial and operational metrics.

f) The company has an experienced board and senior management team.

Strategies

a) The company intends to enhance its brand visibility and expand the reach of products.

b) The company intends to further strengthen its procurement and processing operations.

c) It intends to continue to grow domestically and internationally by way of organic and inorganic growth in order to increase presence and revenue.

d) It intends to increase revenues from dairy-based value-added products.

e) It is committed to the wimplementation of scientific techniques in dairy farming and allied activities.

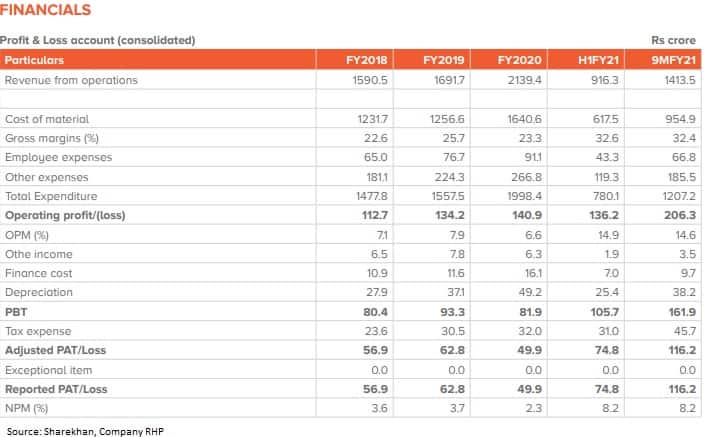

8) Financials & Peer Comparison

Dodla Dairy has delivered consistent growth over the last three financial years both in terms of financial and operational metrics. Its revenue from operations increased at a CAGR of 15.98 percent during FY18 and FY20, and EBITDA (earnings before interest, tax, depreciation and amortisation) increased at a CAGR of 11.81 percent in the same period.

Its revenue from operations, EBITDA and profit after tax for nine months period ended December 2020 were Rs 1,413.5 crore, Rs 206.5 crore and Rs 116.38 crore respectively.

Its debt to equity ratio (calculated as total borrowings/total equity of the company) was 0.17 as of December 2020, 0.35 in FY20, 0.39 in FY19, and 0.37 in FY18.

Revenue from the sale of milk and dairy-based VAPs constituted 72.81 percent and 27.18 percent respectively in FY20, and 75.32 percent and 24.68 percent respectively in nine months period ended December 2020.

9) Promoters and Management

Dodla Sunil Reddy, Dodla Sesha Reddy and the Dodla Family Trust are promoters of the company, holding an aggregate of 2,49,70,631 equity shares (42.81 percent of the pre-offer paid-up equity).

TPG Dodla Dairy Holdings (TDDHPL) held 25.77 percent stake and International Finance Corporation has 4.55 percent shareholding in the company.

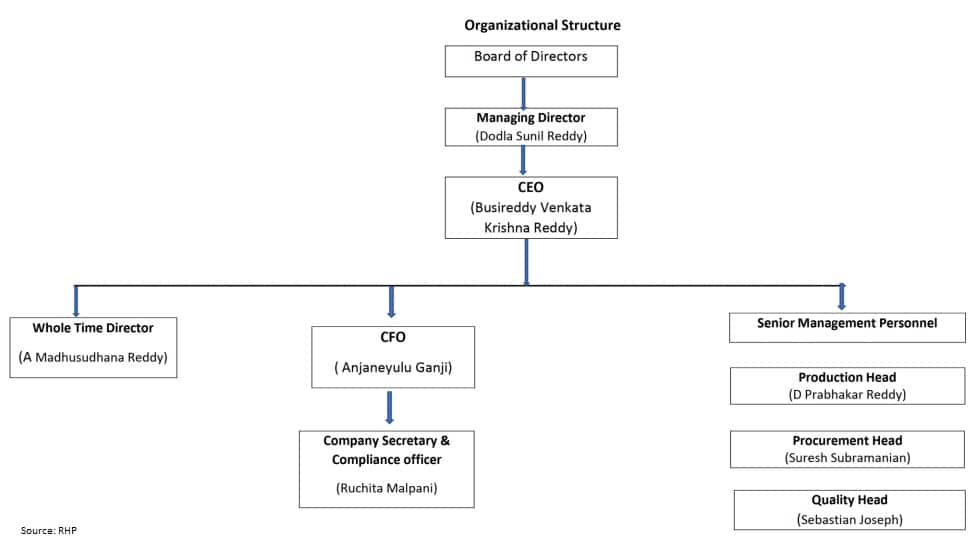

Dodla Sesha Reddy is the Chairman and non-executive Director on the board of the company. He has dairy industry experience of more than 22 years. He is currently a director on the board of Nelcast and Dodla Enterprises.

Dodla Sunil Reddy is the Managing Director of the company. He has more than 25 years of experience in the dairy industry. He is responsible for setting up business strategy with a focus on accountability, competitive performance and value creation.

Madhusudhana Reddy Ambavaram is a Whole-time Director, while Akshay Tanna is a Non-Executive Nominee Director on the board.

Raja Rathinam, Ponnavolu Divya, Rampraveen Swaminathan, and Raman Tallam Puranam are Independent Directors on the board.

Anjaneyulu Ganji is the Chief Financial Officer of the company. He has various years of experience in accounting roles in various industries. Prior to joining the company, he was associated with Tata Cummins and Maersk.

Venkat Krishna Reddy Busireddy is the Chief Executive Officer of the company. He has over 35 years of experience in the dairy sector. He has been with the company for more than 23 years. Prior to joining the company, he was associated with Premier Extractions.

10) Allotment, refunds and listing dates

After closing the public issue on June 18, the finalisation of the basis of allotment with the designated stock exchange will take place around June 23, and the funds will be refunded around June 24.

Equity shares allotted will be credited to eligible investors' demat accounts around June 25, and the trading in equity shares will commence around June 28.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!