The Rs 318-crore public issue of Chemcon Speciality Chemicals, the specialised chemicals manufacturer, opens for subscription on September 21 with a price band at Rs 338-340 per share.

The public offer consists of a fresh issue of Rs 165 crore and an offer for sale of 45 lakh equity shares (Rs 153 crore at upper price band) by promoters Kamalkumar Rajendra Aggarwal and Naresh Vijaykumar Goyal.

The fresh issue proceeds will be utilised largely for expansion of manufacturing facility and working capital requirements.

All brokerage houses advised subscribing to the issue citing company's consistent financial performance, leading position in pharma chemicals globally, longstanding relationships with customers, healthy balance sheet and improving outlook for the sector.

Chemcon issue is trading at around 65-70 percent premium over IPO price in grey market.

Also read: Chemcon Speciality Chemicals garners Rs 95 crore from 13 anchor investors ahead of IPO

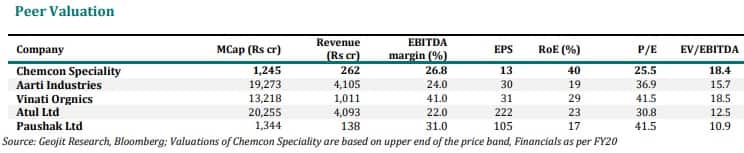

"At the upper price band of Rs 340, Chemcon is available at P/E of 25.5x on FY20, which is attractive when compared to peers. Considering healthy business performance, regular capacity expansions, strong customer base, expanding margin profile and improving outlook for the sector, we have a subscribe rating on this IPO," Geojit Financial Services said.

Its peers Aarti Industries, Vinati Organics, Atul and Paushak are available at P/E of 36.9x, 41.5x, 30.8x and 41.5x respectively, the brokerage added.

Incorporated in 1988, Vadodara-based Chemcon Speciality Chemicals (CSCL) is a leading manufacturer of specialised chemicals such as HMDS (Hexamethyldisilane) & CMIC (Chloromethyl isopropyl carbonate) which are predominantly used in pharmaceutical industry (pharmaceuticals chemicals) and inorganic bromides, predominantly used as completion fluids in the oilfields industry (Oilwell completion chemicals).

CSCL is the only manufacturer of HMDS in India and 3rd largest manufacturer of HMDS worldwide (as per Frost & Sullivan report) in terms of CY19 production with an opportunity to grow at CAGR of 15-20 percent over FY19-FY23. It is also the only manufacturer of zinc bromide and the largest manufacturer of calcium bromide in India in terms of production in CY19.

Also read: Chemcon Speciality Chemicals IPO to open on Sept 21; 10 key things to know

Frost & Sullivan estimates that the company is well positioned to substitute the imports from China and has an opportunity to grow total revenue at a CAGR of more than 25 percent between FY19-FY23.

Geojit said strong customer base & long standing relationship with customers has supported CSCL in retaining market share, increasing product base and reaching out to new customers.

"Company has shown consistent financial performance with a strong financial position. Also, the specialty chemicals industry in which company operate has high entry barriers Therefore, looking after all, we recommend subscribe the issue both for short & long term horizon," said Hem Securities.

The specialty chemicals industry in India has high entry barriers due to the involvement of complex chemistry in the manufacture of products, which is difficult to commercialize on a large scale and a long gestation period to be enlisted as a supplier with the customers. Moreover, some of the raw materials that company use such as bromine, MCF and TMCS are highly corrosive and toxic chemicals. Therefore, handling these chemicals requires a high degree of technical skill and expertise, and operations.

Chemcon's revenue grew at a CAGR of 29 percent during FY18-FY20, EBITDA nearly 25 percent and profit 36 percent. It has healthy balance sheet with stable cash flows, net debt is Rs 44 crore with D/E ratio of 0.3 in FY20.

In FY20, pharmaceutical chemicals segment collectively contributed Rs 167.05 crore, amounting to 63.75 percent of total revenue, and oilwell completion chemicals segment contributed Rs 87.72 crore, amounting to 33.47 percent of revenue.

Exports accounted for 39.78 percent to revenue in FY20, which have grown at a CAGR of 17.57 percent during FY18-FY20. In FY20, company supplied the oilwell completion chemicals largely to customers in India, the Middle East, Serbia and Russia. Now, aiming to expand oilwell sales in existing and new geographies including Nigeria, Malaysia, China and Ghana.

"The company's expansion plans to set up two new plants and one laboratory with a total volumetric reactor capacity of 251.00KL, at existing manufacturing facility Manjusar, Vadodara, would significantly increase the capacity by 60 percent, total volumetric reactor at 625.85 KL. Also, it would enable to benefit from economies of scale in next few years. Fundamentally too, company looks sound with impressive ROCE & ROE at 37.92 percent & 34.23 percent for FY20, favourable debt-equity ratio and stable PAT & EBITDA margins," said Rudra Shares while recommending to subscribe the IPO for listing as well as long term gains.

Choice Broking also advised investors to subscribe the issue given the attractive valuations and positive fundamentals, but the promoter & promoter group's corporate governance issue is making the brokerage cautious.

"The management has indicated that the company will not be impacted by any means, if outcome of the appeal is not favourable. Also the specialty chemical sector got re-rated in the last 5-6 months. Before re-rating, the above peers were available at lower valuations. Thus considering the above observations, we assign an subscribe with caution rating for the issue," it explained.

While subscribing the issue, investors have to consider some risk factors like outbreak of coronavirus; fluctuations in foreign currency exchange rates; political, social, legal and economic changes; increase in raw material prices; geopolitical tension in the Asia region; delay in demand revival of oilwell completion chemicals as around 30-35 percent of revenue comes from oilwell chemicals; and around 59 percent of revenue (FY20) was derived from top 5 customers.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!