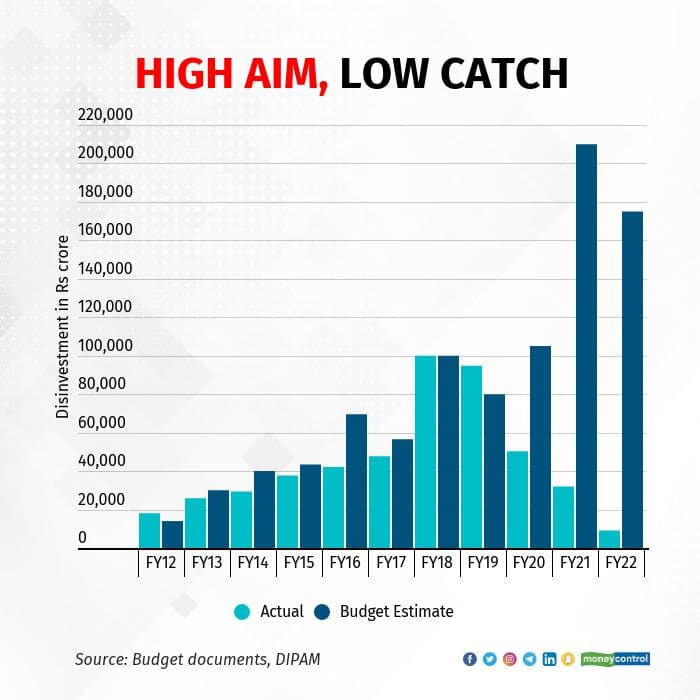

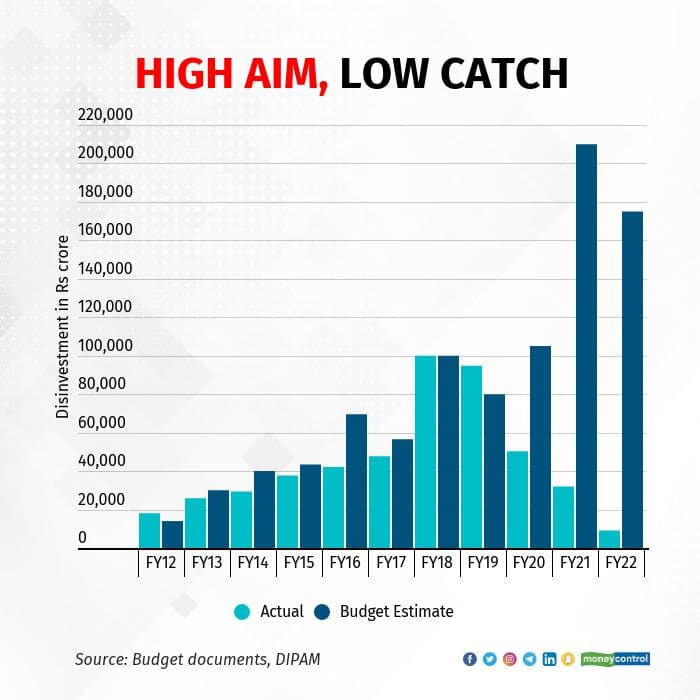

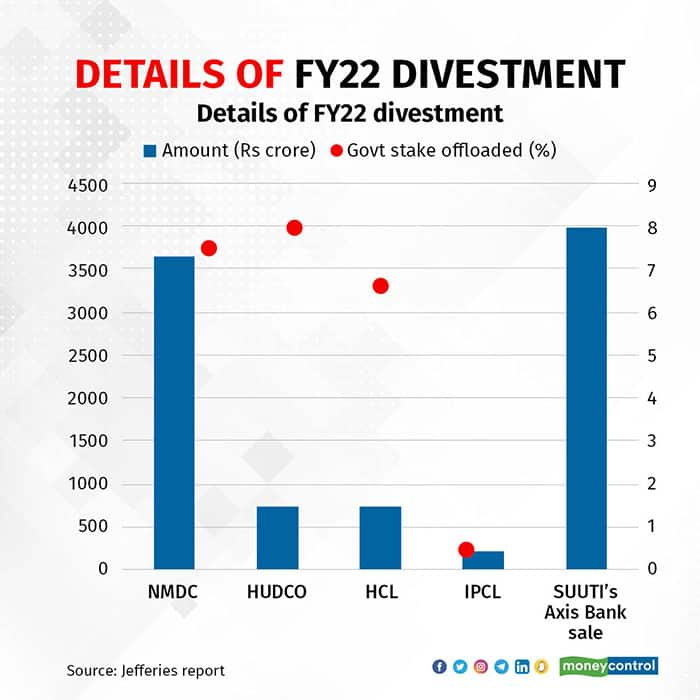

In the corporate world, past achievements tend to benchmark future targets. Not for the Central government, though. Despite a track record of missing divestment targets almost every year, the government has only set higher targets progressively.

Analysts expect the disinvestment aim for FY23 to be no different even though the government may miss the budgeted target for FY22. The FY23 disinvestment target is expected to be Rs 1.5-2 lakh crore, depending on whether the stake sale of a single company is concluded in the current year.

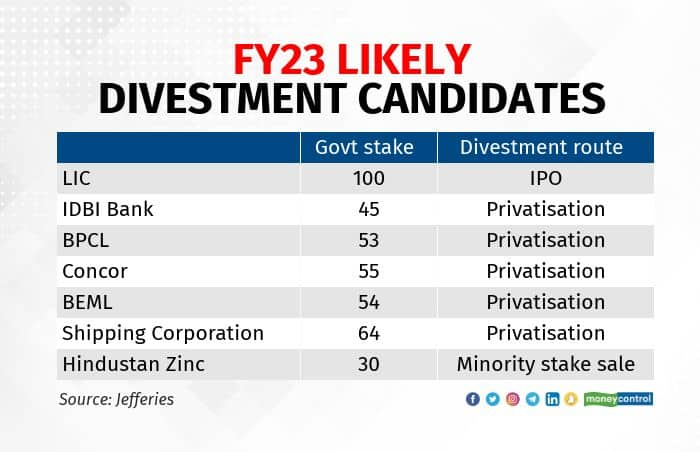

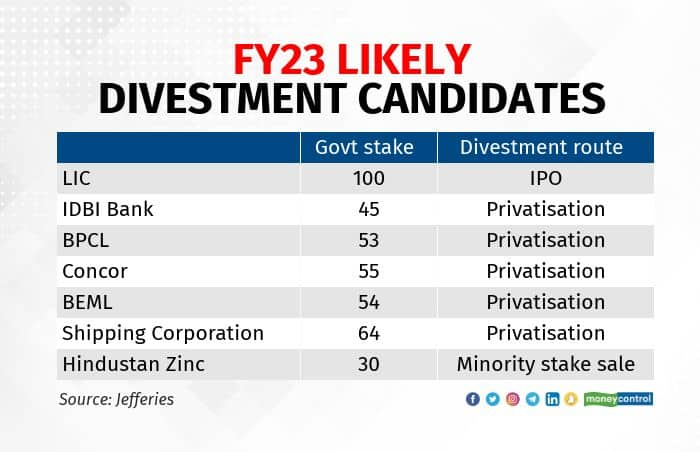

The task of offloading stake in Life Insurance Corporation of India began two years ago and is still far from complete. The government had pencilled in Rs 1 lakh crore as proceeds from this stake sale in its divestment target of Rs 1.75 lakh crore for FY22.

Officials have asserted that LIC’s initial public offer will be launched before March. But with the valuation exercise yet to be complete, this is becoming less probable every passing day. Analysts have already assumed that the government won’t be able to fill its treasury with the money from LIC’s stake sale in FY22.

“For the planned initial public offering of the country’s largest insurer, Life Insurance Corporation (LIC), the government is pushing to complete it within Mar-22; however, given the tight deadline, there is a possibility it gets pushed back. As such, we expect the divestment target to be higher at INR 1.25 trillion (FY23),” analysts at Morgan Stanley wrote in their budget note.

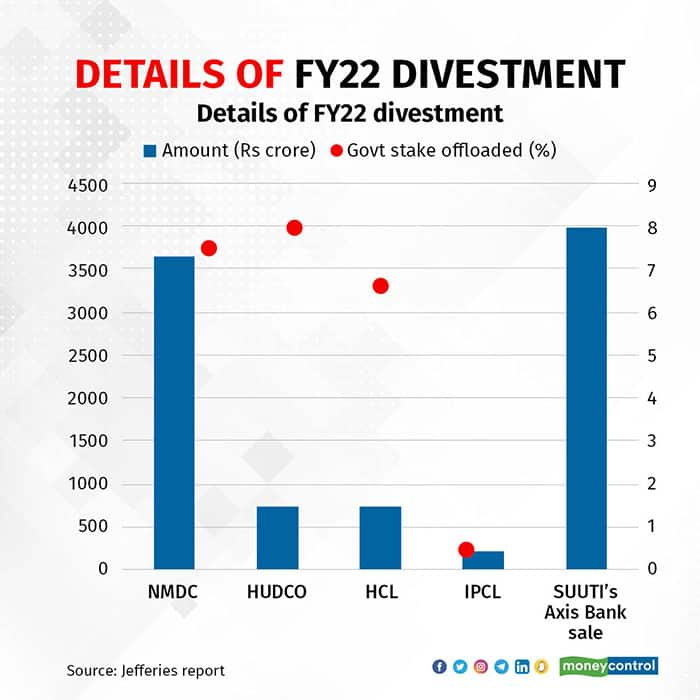

Besides the life insurance behemoth’s IPO, privatisation through strategic stake sales in a bunch of public sector enterprises will ensure that the government gets enough proceeds. In FY22, the government was supposed to privatise Bharat Petroleum Corporation, BEML, Shipping Corporation of India, and two public sector banks. These would be now rolled over to the next year.

While the government may not find it hard to meet the divestment target it will set in the budget, it won’t find it easy either. Assembly elections in key states could keep the government from going full throttle on privatisation of PSEs. That would mean strategic sales in companies could get delayed.

“Political stability/local election results would be key for its execution. Any miss would be a key risk to our fiscal deficit target,” analysts at BofA Securities pointed out in a note.

Analysts at Jefferies India said that after the key assembly elections, the government could fast-track privatisation.

Another factor is adverse market conditions and the possible tightening of liquidity. The US Federal Reserve has indicated quicker rate increases and an end to bond buying there. India’s central bank too is in withdrawal mode.

Equity indices have already dropped sharply in the past month, pulling down valuations for most stocks. As such, the government has hardly been successful in taking advantage of buoyant equity market episodes in the past.

What works for divestment now is that the list of candidates for stake sale in FY23 have healthier balance sheets than those offered in the past. The successful sale of the stressed loss-making Air India indicates that there are takers for other companies that have better profitability to show.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!