The northern winter flight schedule will start on Sunday, October 29.

The Directorate General of Civil Aviation has approved 23,732 weekly departures, which are 3.6 more than in the ongoing summer schedule and 8.1 higher than last year’s winter schedule.

IndiGo continues to lead with 55 percent of all the flights – or 11,465 weekly domestic departures – approved this winter. Air India and SpiceJet follow with 2,367 and 2,132 weekly domestic departures, respectively.

The winter schedule more than makes up for the absence of Go First, which halted services in May and sought voluntary insolvency. Go First had approvals for 1,538 weekly flights when the summer schedule started in March.

However, IndiGo alone will increase weekly departures by 1,654 flights in the upcoming winter schedule and will help tide over the vacuum created in the market because of the fall of Go First.

Air India Express (483 additional weekly domestic departures), Air India (189 additional weekly domestic departures), Vistara (46 additional weekly domestic departures) and Akasa Air (39 additional weekly domestic departures) will help take the market towards growth.

Sequential or seasonal?

The growth in the number of flights in a schedule can be assessed in two ways – sequentially – winter versus the preceding summer – or by season, i.e., winter 2023 versus winter 2022.

Compared with the on-going summer season, SpiceJet and flybig will be shrinking in terms of flights operated, while IndiGo grows remarkably – by both percentage (14 percent) as well as absolute numbers (1,654 weekly departures).

When compared against the previous winter, Akasa Air is growing at 64 percent, Star Air at 61 percent, and IndiGo at 30 percent. Among the Tata Group of airlines, Air India is growing at 19 percent, Vistara shrinks a little, and Air Asia India remains as is, with growth coming from Air India Express with which AirAsia India will merge soon.

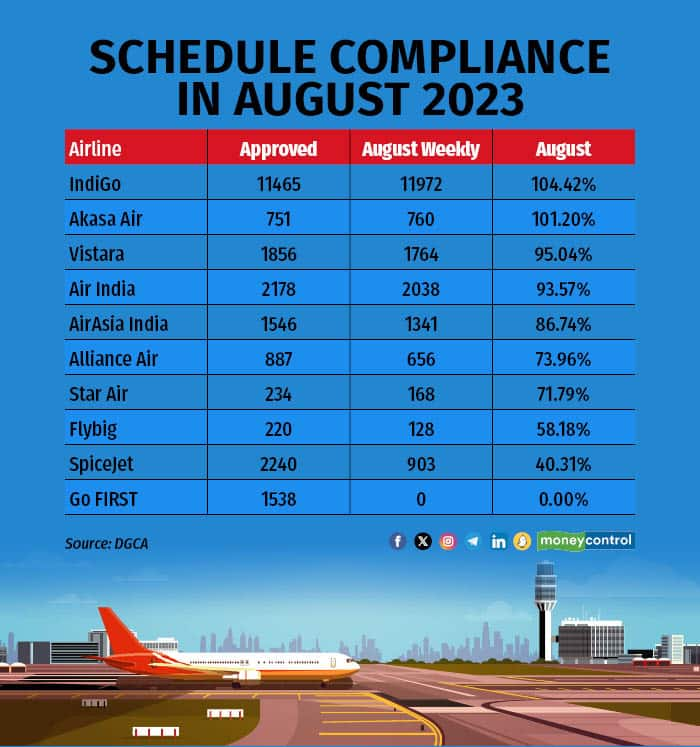

However, approval of the schedule is only part of the story. Most airlines fail to scale up and operate the actual number of flights allowed. In the current summer schedule, barring IndiGo and Akasa Air, no airline has operated flights as approved by the regulator.

Compliance was poor in August, the latest month for which data is available. Vistara and Air India had compliance rates of 95 percent and 93.5 percent, respectively, while AirAsia India had compliance of 86.7 percent.

SpiceJet’s compliance has been sub-par, with the airline operating less than 50 percent of its approved weekly departures in August.

Long way to recovery?

Before the pandemic struck, airlines had approval to operate 24,372 weekly departures for the summer of 2020. As COVID hit, India went into a lockdown, including the suspension of flights, and the season never really started. When air services resumed, they were capped, along with fares.

A lot has changed in Indian skies since then. Go First is not flying, while Akasa Air is the new entrant. Air India has been privatised, Air India Express has started domestic operations, and two mergers are on the horizon.

The approved winter schedule this year still falls 3 percent short of the summer 2020 schedule, even though IndiGo has grown 20 percent, Vistara 17.7 percent and Air India 12.29 percent. SpiceJet has shrunk by half and that is just with the allocation of slots, with actual operations even smaller.

The goal of crossing half a million daily domestic passengers may have to wait for now as airlines struggle to get more seats in the air. And when they eventually do, the hope is that they will not struggle to get passengers on those seats.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.