India had an ambitious pipeline for asset monetisation in 2022, including public sector undertakings (PSUs), under its National Monetisation Pipeline (NMP) with a target of Rs 6 lakh crore for FY22-25.

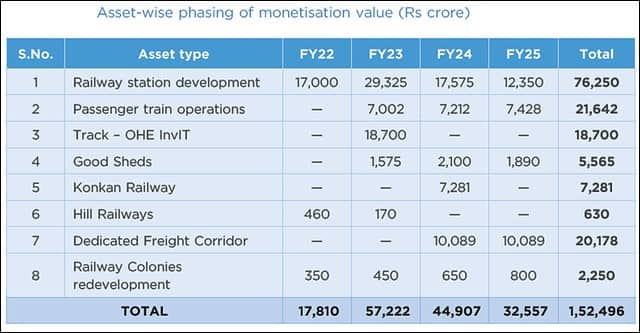

Of this, the Railways had a target of Rs 1.52 lakh crore. According to sources in the Railway Ministry and NITI Aayog, the Railways has managed to raise Rs 28,717 crore so far. The slow progress has been attributed to the Railway Ministry’s reluctance, complex regulations and the absence of a regulator in the sector that have discouraged private sector interest.

The Ministry of Finance had informed the Lok Sabha on August 5, 2024 that the Indian Railways had raised Rs 20,417 crore from asset monetisation between 2021-22 and 2023-24. Multiple government officials across the finance and railway ministries confirmed that the national carrier raised Rs 8,300 crore in 2024-25, bringing the total to Rs 28,717 crore over the four years.

NITI Aayog, the government’s policy think tank, has been working with the Railway Ministry to push forward the asset monetisation pipeline. However, movement from the Railway Ministry has been tepid, according to government officials.

The target included the monetisation of stations, passenger trains, and freight terminals. The Core Group of Secretaries on Asset Monetisation has raised concerns about the slow progress.

In 2022, the government had set up a multi-layer institutional mechanism for the overall implementation and monitoring of the Asset Monetisation Programme, constituting an empowered Core Group of Secretaries on Asset Monetisation (CGAM) under the chairmanship of the Cabinet Secretary. The CGAM includes the Secretaries of Economic Affairs, Revenue, Expenditure, Investment and Public Asset Management (DIPAM), Public Enterprises (DPE), Corporate Affairs, Legal Affairs, and Housing & Urban Affairs.

"Railways have a lot of assets that they can monetise. When will they monetise assets? The case is there to do asset monetisation. NITI Aayog is telling them to do it, but they don’t. They are not agreeing in principle. They are not agreeing on the monetisation of major assets," a senior government official told Moneycontrol.

"Station redevelopment and privatisation formed the major chunk of Indian Railways’ monetisation plans between 2021-25, but these plans were made without the in-depth consultation and recommendation of the railways and have failed to attract private investors," a senior Railway Ministry official told Moneycontrol.

Railway Asset Monetisation Target under National Monetisation Pipeline.Challenges in station redevelopment

Railway Asset Monetisation Target under National Monetisation Pipeline.Challenges in station redevelopmentPrivate entities interested in redeveloping and operating stations have demanded higher returns on their investments and greater control over ticket pricing and train traffic, which the railways has been unwilling to concede.

"NITI Aayog had recommended carrying out station redevelopment projects under a public-private partnership (PPP) model, but this approach failed to attract enough private participation. That is why projects are now being awarded under the engineering, procurement, and construction (EPC) model," another railway ministry official said.

A key factor deterring private players from investing in station redevelopment is the absence of a regulator in the railway sector, raising concerns over timely pay-outs and conflict resolution. The Indian Railway Stations Development Corporation (IRSDC), which was responsible for station redevelopment, was also liquidated in 2022.

"There are fundamental issues in the model. With Indian Railways being a monopsony, the risk perception is enhanced," Davinder Sandhu, Co-founder and Chairman of consultancy firm Primus Partners, said. "For the Indian Railways’ asset monetisation to take off, the railways need to rethink its strategy and model for monetising assets."

Railway Asset Monetisation Target under National Monetisation Pipeline.Private train operations fail to attract bidders

Railway Asset Monetisation Target under National Monetisation Pipeline.Private train operations fail to attract biddersThe Railways had also planned to raise Rs 21,600 crore by allowing private companies to operate passenger trains, but the scheme has failed to generate any funds.

After the Railways received a lukewarm response to its first set of tenders for private trains in 2021, it revised the terms in 2022, but the industry remained unconvinced. Only two bidders — IRCTC and Megha Engineering & Infrastructures — participated at the financial bidding stage in 2021.

"Indian Railways cannot be both a competitor and a regulator. There is, no doubt, a need for a technical regulator. Even though the Railways kept emphasising fair regulation, there has to be a contractual commitment for a project to be financed," a senior executive from a potential bidder told Moneycontrol.

Market experts have argued that in order to make private train operations more attractive, the government should follow the route taken in the aviation sector and deregulate the market.

"The government, instead of bidding out train operations on particular routes, can even look to bid out slots and timings to private players. This will certainly increase participation from the industry," said a market expert from Goldman Sachs.

Industry participants also expect IR to ease the terms of the revenue-sharing agreement in the bidding norms, in order to avoid monopolisation of passenger traffic and routes.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.