Highlights

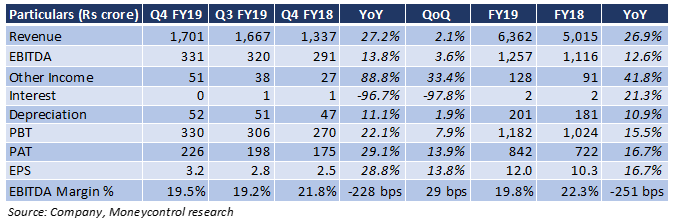

Indraprastha Gas Ltd (IGL) reported another quarter of better than expected performance for January-March, with strong growth in revenue and profit driven by a healthy volume uptick, especially in the CNG segment. Post the healthy Q4 results, the stock has seen a sharp jump.

Key positives

- The company saw revenue growing a strong 27 percent year-on-year (YoY) and EBITDA 14 percent on the back of a solid volume expansion.

- Overall volume grew 17 percent YoY to 6.3 mmscmd, with CNG volumes up 15 percent and PNG 20 percent.

- While domestic and third-party PNG volumes rose 13 percent each, industrial and commercial volumes went up 30 percent.

- CNG volume growth is attributable to 7.2 percent uptick in consumption per vehicle and a 5.8 percent growth in number of vehicles. With steady CNG vehicle conversions, CNG volumes are expected to remain healthy.

Key negatives

- High gas price coupled with a sharp rise in employee cost impacted the per unit EBITDA (earnings before interest, tax, depreciation and amortisation) margin. Employee cost included pending revision in salaries for FY19 and minor one-time payments.

Other comments

- The Supreme Court has ruled in favour of IGL to take over operations of Haryana City Gas Distribution services in Gurugram. Close proximity to IGL’s existing geographies will reduce the need for huge investment and give the company access to a network of 20 CNG stations and 160 km pipeline, a positive for future growth.

- IGL has started the CNG sales at four OMC outlets in Rewari during FY19. It has plans to add 6 more CNG outlets in FY20, along with fast-paced development for household PNG connections.

- Gas volumes are picking up in industrial areas of Bawal and Dharuhera.

- IGL plans to spend around Rs 1,000 crore in FY20 and add another 70-75 CNG stations.

Outlook

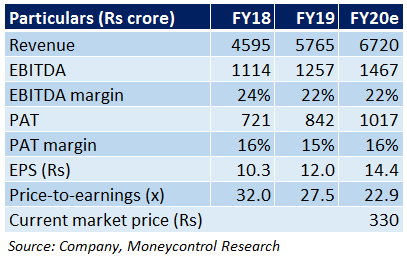

IGL has displayed a strong performance in the past few quarters. Post the results, the stock has seen a further uptick and is trading close to its 52-week high at a 2020e PE of 23x.

We expect the good performance to continue with rising demand and deeper penetration in the existing geographies. The company is witnessing a strong uptick in volumes and we expect the volume growth to remain healthy. Expansion in new GAs (geographical areas) would be an additional growth driver for future.

With the fundamental growth story intact and a sector outlook positive, we stay bullish on the long-term growth journey of this company. However, with the recent sharp uptick in the stock price, we would want to wait for better prices before entering.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.