Paushak (Market cap: Rs 688 crore) is the largest manufacturer of phosgene-based specialty chemicals in India. Company through its product buffet ranging from chloroformates, isocynates, carbonates and phosgene gas caters to applications for pharmaceuticals, agro-chemicals end markets.

Company is the key beneficiary of improving end market applications for phosgene gas which is reflected in its operating performance. Strong balance sheet provides a leeway to execute multifold expansion plan which in turn positions it to increase its market share.

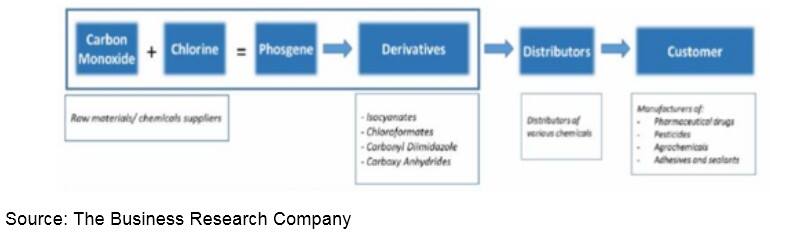

Phosgene derivatives value chain

As per company’s annual report, global phosgene production is estimated to be more than 20 lakh tonne. However only 5 percent of this compromise specialty segment catering pharmaceutical and agrochemicals industries. This segment is expected to grow by 5-6 percent per annum for the medium term.

Key global players involved in the production of phosgene are Covestro, BASF, Yantai Wanhua, and DowDuPont. In India other major companies which participate in this value chain are UPL and Atul.

Backward integration – among few to manufacture phosgene gasThe company is one of the few companies having regulatory permission to manufacture phosgene gas. On account of this it is backwardly integrated which helps it to cushion the impact of raw material prices.

Strong operating performanceCompany’s operating margin has been in the range of 27-30 percent for last six quarters, partly aided of improving scale of operations. Company’s sales quarterly run rate has almost doubled during same period. Operating leverage was visible in terms of employee cost (14.5 percent of sales in Q2 FY19 vs. 16.5 percent in Q2 FY18).

Improving export market potentialCompany has been able to harness export opportunity in recent times wherein its export share has increased to 21 percent of sales in last fiscal from 16 percent in FY17.

Paushak has initiated upon a huge Rs 120 crore capex program (total assets at FY18: Rs 144.42 crore) planned to be executed within next three fiscal year (FY19-FY21). This capex program, among others, aims to increase phosgene capacity by upto three times. It is noteworthy that company’s current capacity for the phosgene production is 4,800 tonne annually.To fund the current capex program mix of internal accruals and debt would be used.

Company has strong R&D focus with R&D investment of the order of 2-3 percent of net sales.

Balance sheet bandwidth sufficient to sustain expansionPaushak is a zero debt company which allows it a bandwidth to go for the current capex program. With respect to debt requirement in the current capex cycle, we find debt metrics to remain comfortable. CRISIL in its recent ratings note bring out that debt to equity ratio and interest coverage ratio are expected to remain about 0.4x and 5-6x during the capex cycle.

Outlook- promoter backdrop and technology prowess are postiveWell first the risk factors which primarily arises from the fact that company is undergoing a huge capex program and because of that there is an execution risk.

Having said that company has strong promoter backdrop which has had a vast experience in handling similar capex program in the group company. Secondly, promoters have a four decade experience of handling the modalities of phosgene gas. Thirdly, they have strong balance sheet which provides enough head room for the same.

Now, company is operating in a promising segment whose applications in pharma and agri-chem end markets are multiplying. There are limited players in the segment and given the capex program company can capitalize the supply demand imbalance.

Finally, stock has corrected by about 30 percent from its all-time high and currently trading at about 25x 12 month trailing earnings and presents by itself an interesting opportunity.

Follow @anubhavsaysFor more research articles, visit our Moneycontrol Research page.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!