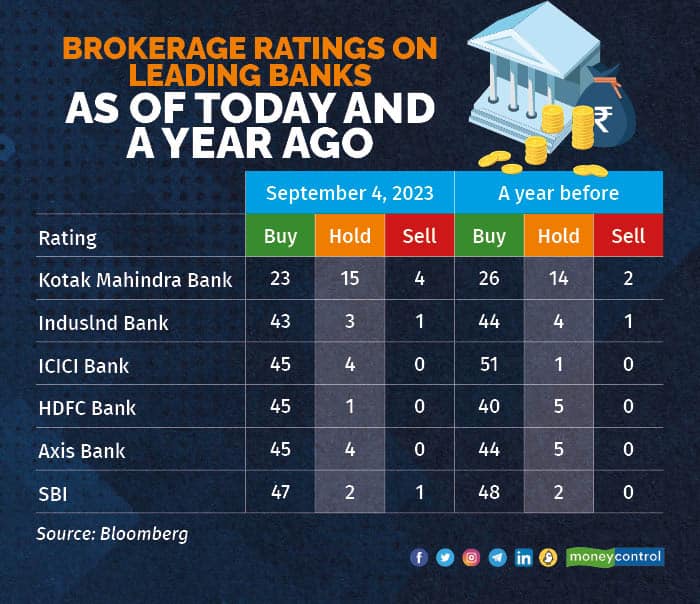

Kotak Mahindra Bank stock had 23 "buy" calls from brokerages as of September 4 morning, down from 26 "buy" recommendations a year ago, and 15 "hold", and four "sell" calls compared to 14 "hold" and two "sell" calls during the same period.

Kotak Mahindra’s valuation has fallen over the last year but it is still more expensive than bigger rivals HDFC Bank and ICICI Bank.

Over the past year, there have been concerns surrounding potential changes in leadership in the wake of Uday Kotak's imminent departure as Managing Director and CEO.

He resigned effect from September 1, three months earlier than the scheduled transition date. After being a part of the bank for over 38 years, Kotak cited significant personal and other family commitments, besides a sequenced leadership transition at the bank as the key reasons behind his resignation.

Also read: Uday Kotak ends one brilliant chapter at the bank despite run-ins with the regulator

Kotak Mahindra stock vs HDFC Bank over the last yearKotak Mahindra Bank stock has lost 8 percent in the last year. The stock has been trading at a premium as compared to its peers in the industry.

Now the stock trades lower than its historical average but is still expensive compared to other banks. The price to book ration for Kotak Mahindra Bank is 2.7x. While for HDFC Bank and ICICI Bank it is 2.3x and 2.4x.

HDFC Bank had 45 “buy” calls, one “hold” call, and zero “sell” calls on September 4. A year before, the bank had 40 “buy” calls, 5 “hold” calls, and zero “sell” calls.

Brokerages upgraded the stock in the last year after HDFC Bank merged with HDFC, the housing finance arm of the company.

Also read Brokerages retain ratings, target prices for Kotak Mahindra Bank despite Uday Kotak's exit

“Uday Kotak’s contribution was pivotal in guiding the bank through its transition from being an NBFC to obtaining a banking licence in 2003 and evolving as one of the most successful and reputed financial organisations in the country,” said Motilal Oswal in a report dated September 4.

Under Kotak’s leadership, the bank became the fourth-largest private lender and established its presence across the financial services spectrum, including asset management, broking, investment banking, and life insurance, it said.

Also read Who will emerge as the new MD & CEO at Kotak Mahindra Bank? Here are the frontrunners

Kotak will continue as a non-executive director for which he has already received shareholder approval. KVS Manian and Shanti Ekambaram, whole-time directors of Kotak Mahindra Bank, are the top candidates to succeed Uday Kotak, reports said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.