The Reserve Bank of India (RBI) on May 19 announced that the Rs 2,000 currency note was being withdrawn from circulation, giving the public time till September 30 to exchange or deposit the high-denomination note.

The Rs 2,000 note was introduced in November 2016 to meet the currency requirement after Rs 500 and Rs 1,000 notes were demonetised. As the objective was met and smaller denomination notes were available in adequate quantities, the printing of the Rs 2,000 note stopped in 2018-19 and now the central bank has decided to pull it out of circulation.

"In view of the above, and in pursuance of the 'Clean Note Policy' of the Reserve Bank of India, it has been decided to withdraw the Rs 2,000 denomination banknotes from circulation," the central bank said in a late evening announcement.

Some were quick to label the move as Demonetisation 2.0, which it isn’t.

Demonetisation makes the currency notes invalid from the day the decision comes into force, while withdrawal means that the market would not get a new supply of the currency note and the existing notes will remain legal tender but exhausted gradually.

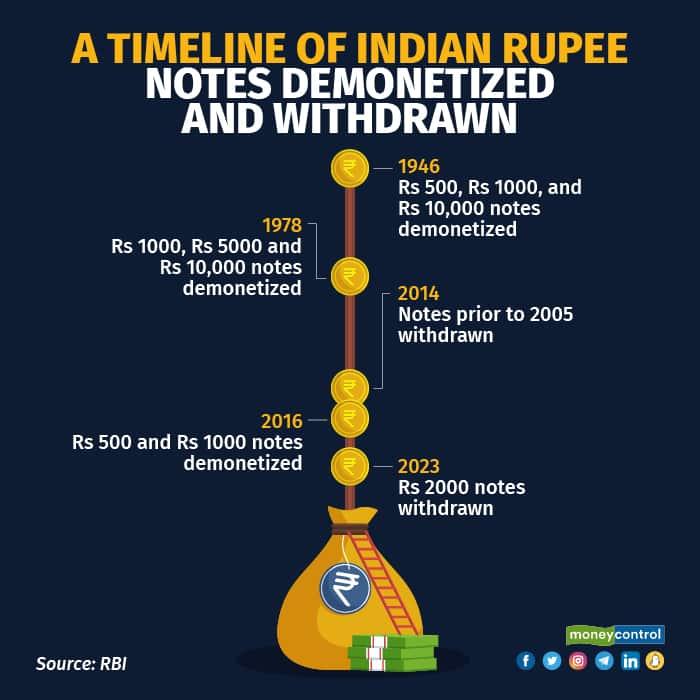

From 1946 to 2023, a timeline of demonetisation and rupee note withdrawals in India

From 1946 to 2023, a timeline of demonetisation and rupee note withdrawals in India

The RBI’s decision to withdraw the Rs 2,000 note is not the first such decision for India. In the last 76 years, the central bank has on several occasions demonetised or withdrawn currency notes. Here is a timeline:

1946: Rs 500, Rs 1000, and Rs 10,000 notes demonetised

The British government in consultation with RBI governor Chintaman Dwarakanath Deshmukh decided to demonetise notes of Rs 500 and above denominations, citing World War II and rising black market operations as the reason for the move.

“Following similar action in several foreign countries, including France, Belgium and the U.K., the government of India decided on demonetisation of high denomination notes, in January 1946,” RBI documents show.

On January 12, 1946, two ordinances were issued, demonetising Rs 500, Rs 1000, and Rs 10,000 currency notes.

The Bank Notes (Declaration of Holdings) Ordinance, 1946, required all banks and government treasuries in British India to furnish to the RBI by 3 pm on the same day, a statement of their holdings of banknotes of Rs 100, Rs 500, Rs 1,000 and Rs 10,000 as at the close of business on the previous day.

The second ordinance, the High Denomination Bank Notes (Demonetisation) Ordinance, 1946, demonetised banknotes of the denominations of Rs 500 and above with effect from the expiry of January 12, 1946.

In 1954, all three notes were reintroduced.

1978: Rs 1,000, Rs 5,000 and Rs 10,000 notes are demonetised

In the early 1970s, the Wanchoo Committee, a direct tax inquiry panel set up by the government and led by former Chief Justice of India Kailash Wanchoo, suggested demonetisation of some notes as a measure to unearth and counter the spread of black money.

Years later, the Janata Party government, led by Prime Minister Morarji Desai, demonetised Rs 1,000, Rs 5,000 and Rs 10,000 notes on January 16, 1978 under the High Denomination Bank Notes (Demonetization) Ordinance, 1978.

In his budget speech on February 28, 1978, finance minister HM Patel said the decision was part of a series of measures the government had taken to control illegal transactions and against anti-social elements.

2014: Notes issued before 2005 withdrawn

On January 22, 2014, the RBI said that after March 31, 2014, it would withdraw all banknotes issued before 2005 from circulation.

Also read: RBI recalls all Rs 2,000 currency notes from circulation

“From April 1, 2014, the public will be required to approach banks for exchanging these notes. Banks will provide an exchange facility for these notes until further communication,” the central bank said.

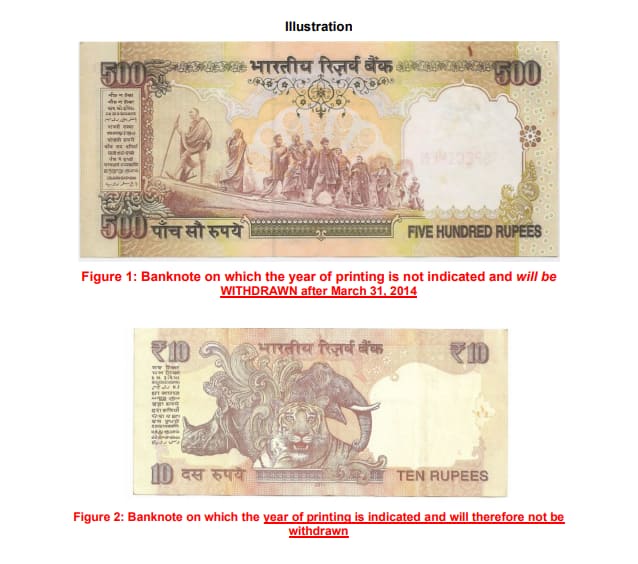

These notes were pulled out of circulation because before 2005 these had fewer security features when compared to the currency printed after 2005. Image source: RBI

These notes were pulled out of circulation because before 2005 these had fewer security features when compared to the currency printed after 2005. Image source: RBI

These notes were withdrawn because the currency printed before 2005 had fewer security features when compared with the banknotes printed after 2005.

To help people identify the currency issued before 2005, the RBI said these notes didn't have the year of printing on the reverse side.

2016: Rs 500, Rs 1000 notes demonetised

On November 8, 2016, Prime Minister Narendra Modi in a televised address to the nation announced the demonetisation of Rs 500 and Rs 1,000 notes, which ceased to be legal tenders.

Also read: Rs 2,000 note withdrawal: Digital payments may get a push, says former RBI Deputy Governor

Simultaneously, the government and the RBI announced the issuance of new Rs 500 and Rs 2,000 banknotes.

While announcing this demonetisation decision, PM Modi said the move would reduce the use of illicit and counterfeit cash in fund illegal activities and terrorism. It would also help in curbing black money, the Prime Minister said.

May 19, 2023: The RBI says it is withdrawing Rs 2,000 notes from circulation as part of the clean note policy. Members of the public can deposit or exchange Rs 2,000 notes, which will remain legal tender, at bank branches or designated RBI offices till September 30, 2023.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!