The market lost track again on May 5 after a day of gain as benchmark indices slipped in the morning trade as selling started at key resistance level. As of 10.50am, the Nifty was down 48 points or 0.26 percent to 18,207. The Bank Nifty also fell 0.43 percent to 43,499.25.

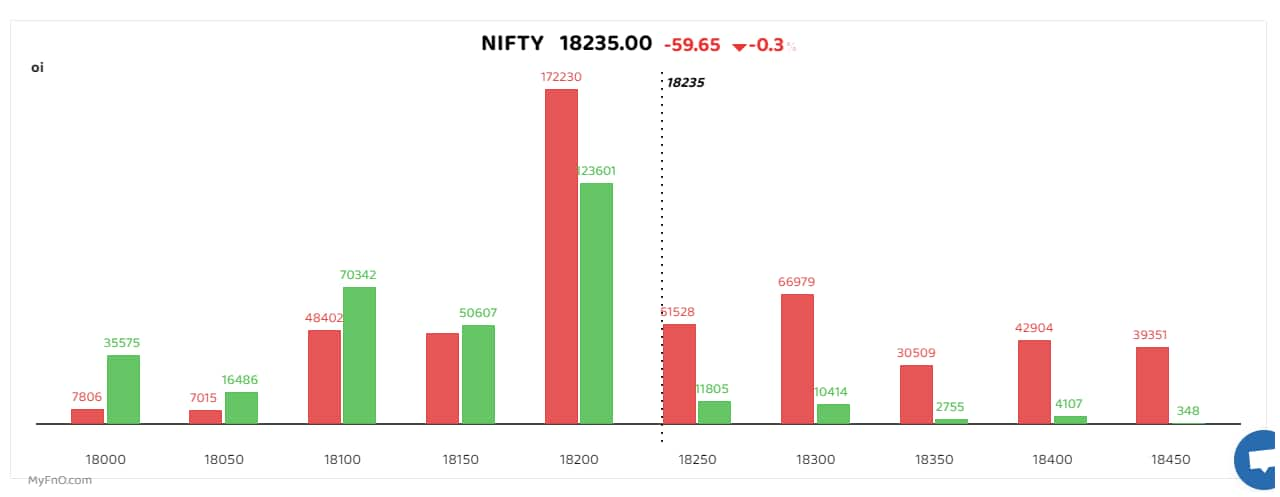

Options data suggests the 18,200 level is crucial now as most Call and Put writings have happened at this level. This is also indicative of the fact that traders have taken Straddle trade at this level in expectations that the market will be sideways from hereon. 18150 and 18100 also saw both call and put writings in equal measure.

Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.

Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.

“I have taken neutral positions today,” said Rajesh Sriwastava, a Bengaluru-based derivatives trader. “However, I expect Bank Nifty to see more selling in the second half as both ICICI Bank and Axis Bank have seen some put unwinding.”

Despite intraday weakness, analysts say the undertone remains strongly bullish and the way some of the heavyweight counters from BFSI space performed in yesterday’s rally, bodes well for the bulls.

"Traders should continue with a buy on decline strategy and keep focusing on stock centric moves," said Sameet Chavan, Head Research, Technical and Derivatives, Angel One.

The HDFC twins saw traders taking bearish bets as MSCI put a spanner in the works by declaring that it will be using a different adjustment factor than earlier expected in case of merger. This will eventually lead to outflow of funds from the stocks.

BHEL, Rain Industries and SAIL also saw short buildup, a sign that traders are bearish on a stock.

TVS Motor, Cholamandalam Finance and MRF, on the other hand, saw long buildup, a bullish sign.

Among sectors, barring realty and auto that saw green tinges, all others saw with long unwinding or short buildup, data showed.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.