Darshan Bathija, co-founder and CEO of the exchange, confirmed the development to Moneycontrol in an e-mailed query. The roles that were impacted include those related to marketing, talent acquisition and others, he said.

"Two months of their salaries paid as a severance payment and retain their signing and/or joining bonus, 12 months health insurance for them and their family, and our talent team working closely with them to find a great place to work," said Bathija.

Additionally, the company will be looking at reducing marketing expense, slowing hiring, reducing executive compensation by 50 percent and pausing most vendor engagements.

Founded in 2018 by Bhatija and Sanju Soni Kurian, Vauld is headquartered in Singapore with most of its workforce based in India. The exchange is backed by Valar Ventures- a firm co-founded by PayPal founder Peter Thiel, Pantera Capital, Coinbase Ventures, CMT Digital, Gumi Cryptos, Robert Leshner and Cadenza Capital. This comes at a time when international exchanges including Coinbase and others have laid off workforce, after feeling the pinch with volumes dropping amid falling prices of tokens, led by Bitcoin and Ethereum.In India, after a year of aggressive marketing, and high cash burn, exchanges are now back to the basics of focusing on products and diversifying offerings while growing revenue streams, as they grapple with declining trading volumes, which is set to fall further as the 1 percent tax deducted at source (TDS) regime kicks in next month.

Moneycontrol earlier reported that over the past year, the acquisition spend per customer for many exchanges was in the range of Rs 500 to over Rs 1,000. While overall advertising has slowed down owing to the crash, per customer costs have not come down drastically yet.

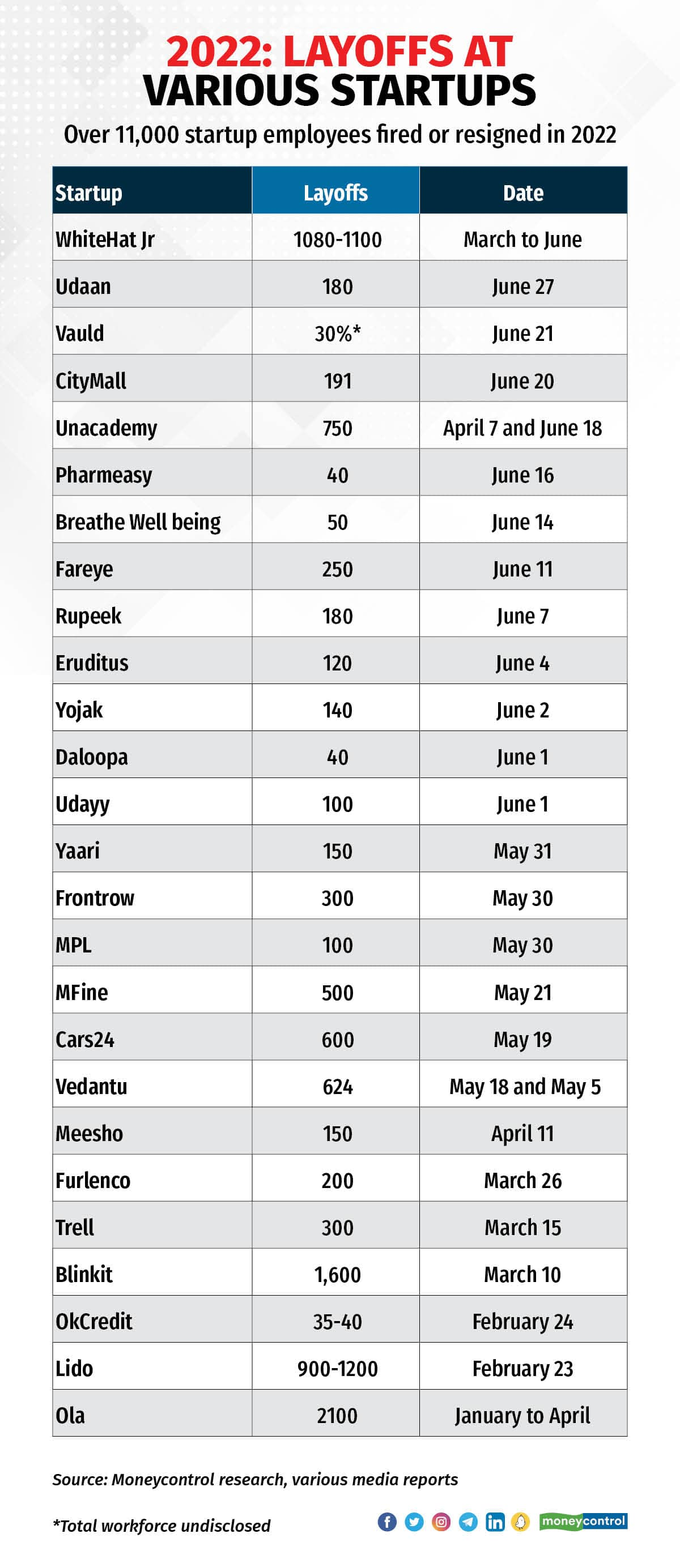

The overall startup market has taken a hit with layoffs across Indian startups have crossed the 10,000 mark as companies struggle to raise funds and are finding ways to reduce their cash burn to survive the funding winter. More than 11,000 Indian employees working at startups were let go in 2022, according to data based on Moneycontrol Research and other media reports.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.