EPACK Durable, India’s second-largest room air-conditioner original design manufacturer is coming out with a Rs 640 crore initial public offering that opens on January 19.

The company is focused on expanding its portfolio of products such as hair dryers, kitchen chimneys, domestic air coolers, and tower fans. It is among the first to make special copper tubing and design air-conditioners with a new refrigerant.

Improved demand, mainly after the pandemic, led to a strong financial performance by the company in the previous financial year. But the sustainability of these margins over the coming years remains to be seen.

Let’s assess the story of the company in five charts.

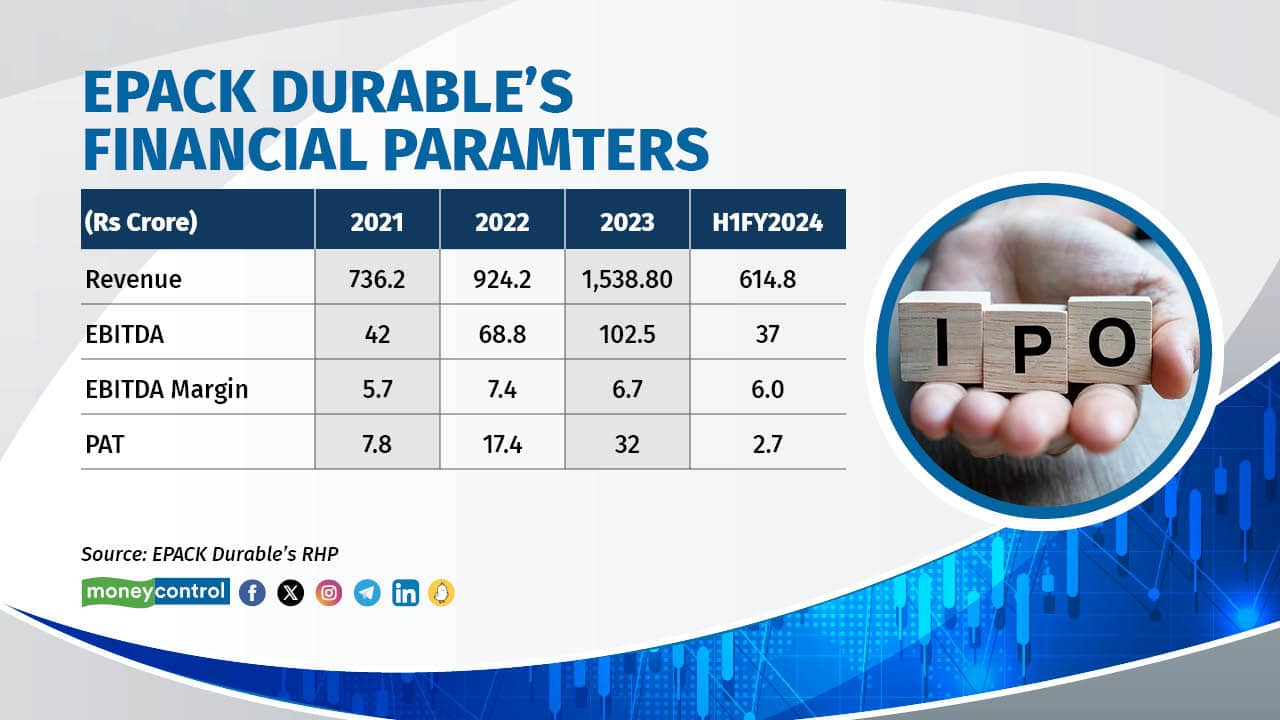

Chart 1: EPACK Durable’s Financial Performance

The company has maintained its margin profile at 5-6 percent consistently over the past few years. It recorded revenue growth of 66 percent in FY23.

The strong performance came mainly on the back of expanded capacities and improved demand after Covid-19, resulting from extended heat waves across the country and easy availability of financing options.

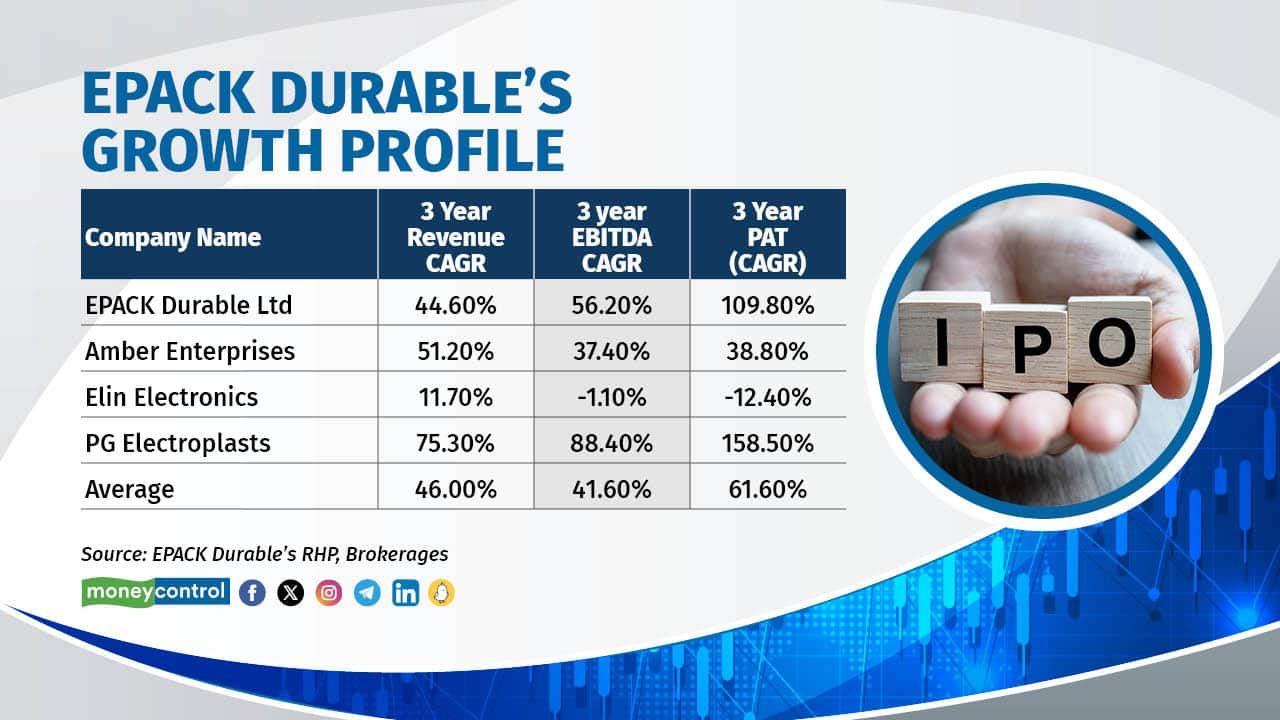

Chart 2: EPACK’s Growth Profile

EPACK Durable’s revenue growth on a compounded basis over the past three years was more or less in line with industry standards, but the company outperformed in terms of operational performance and bottom line growth.

From FY21 to FY23, the company reported a 44.6 percent CAGR in operating revenue to Rs 1,538.8 crore. Room air-conditioners contributed about 80 percent of total revenue and increased by a compounded 41.6 percent, while small domestic appliances contributed 14 percent to the top line, registering a CAGR of 61.8 percent.

With easing commodity prices, the net cost of revenue increased by 42.8 percent CAGR, resulting in a 212 basis points (bps) expansion in the gross profit margin. However, relatively higher other expenses led to a 95 bps expansion in the EBITDA margin, which stood at 6.7 percent in FY23.

With expanded capacities, depreciation charges increased by 70.3 percent CAGR, while higher financial liabilities led to a 10.9 percent CAGR in finance costs.

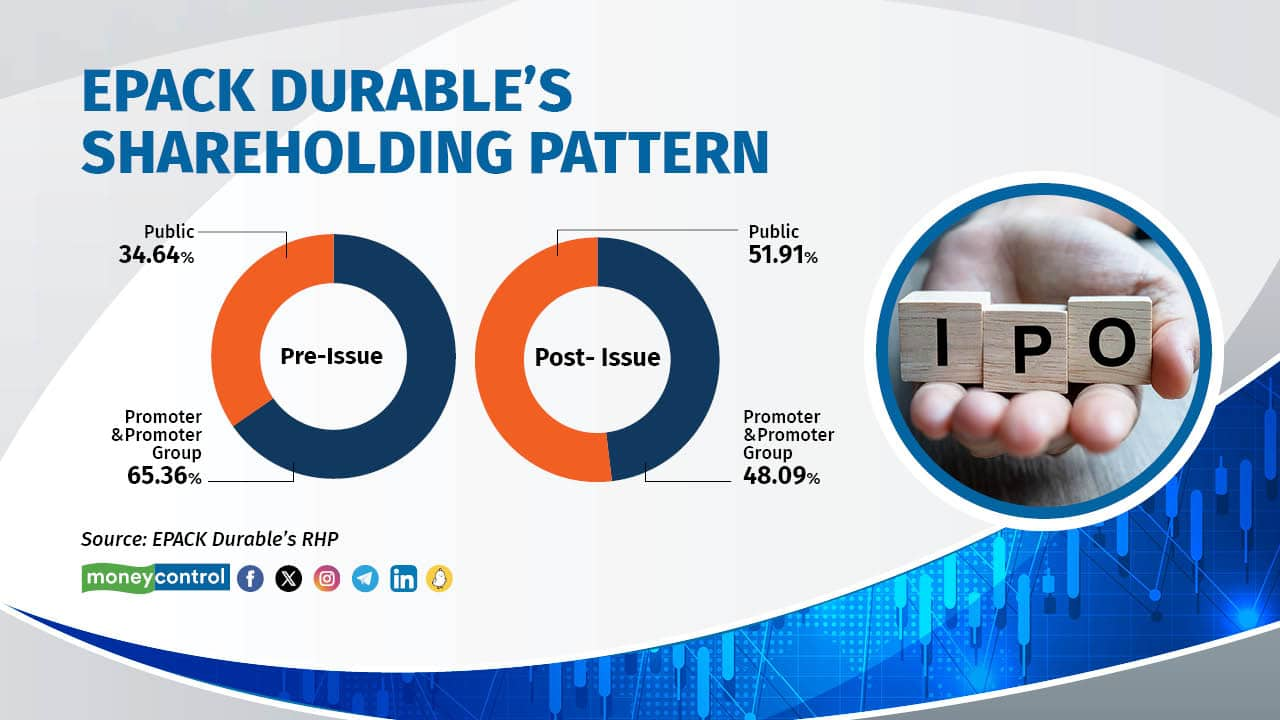

Chart 3: EPACK’s Shareholding Pattern

Some promoter and promoter group (P&PG) entities are selling shares in the IPO through an offer for sale. Following the IPO, their stake is expected to decline to 48.09 percent from 65.36 percent.

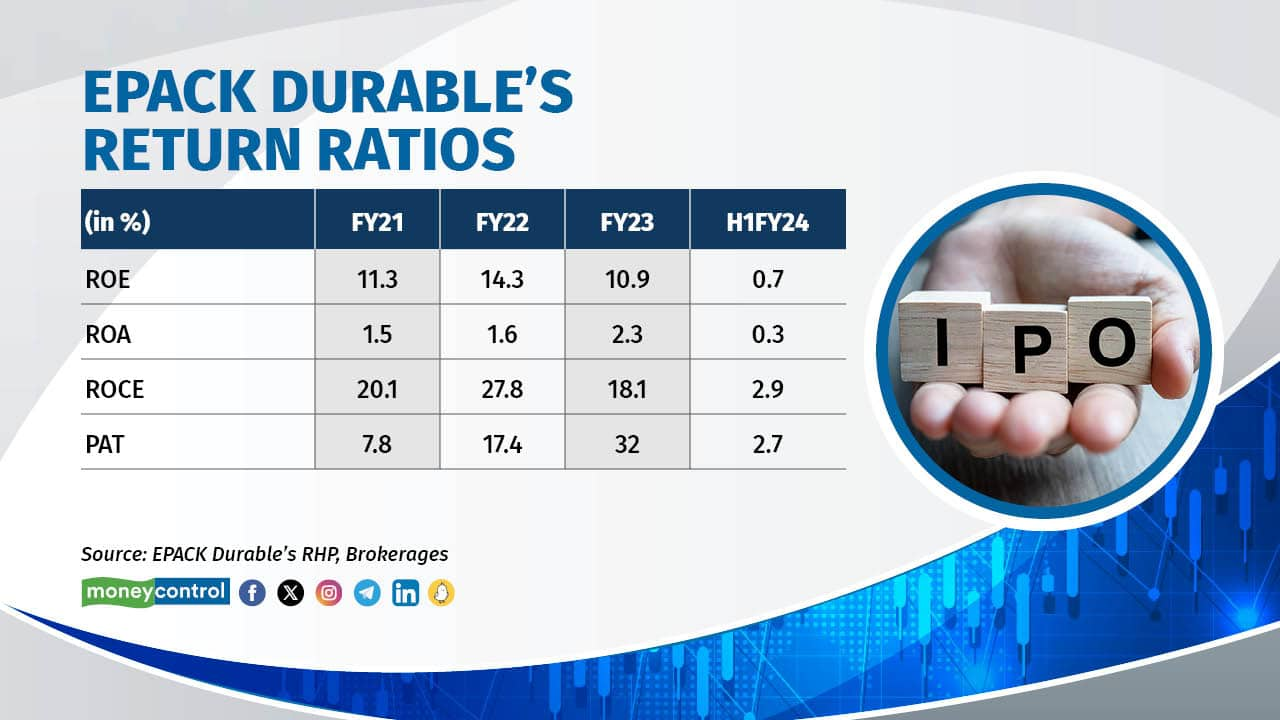

Chart 4: EPACK Durable’s Return Ratios

EPACK Durable’s return ratios have improved over the past three years.

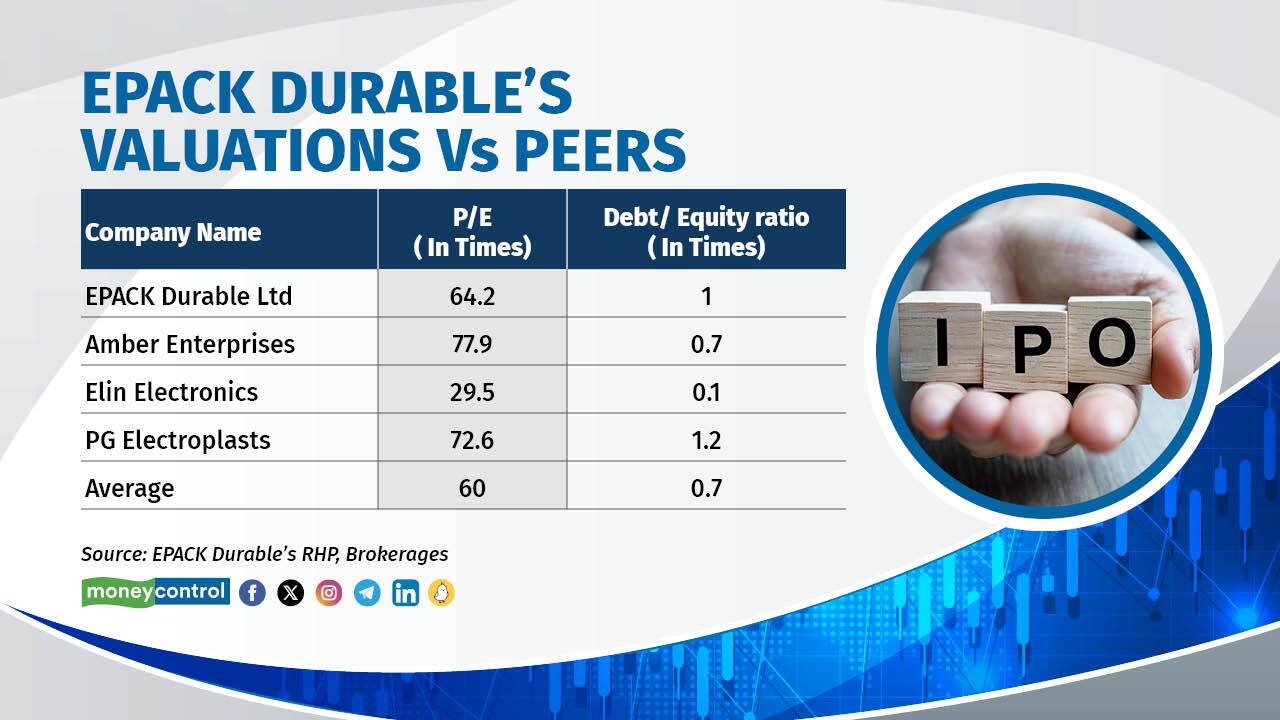

The price band for the IPO is Rs 218 to Rs 230 per share. At the higher end of the price band, EPACK is seeking a P/E multiple of 64.2x its FY23 EPS of Rs 3.6, which is at premium to the peer average of 60x. Its debt to equity ratio is a bit on the higher side of industry standards.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.