At Rs 10,035 crore, the Goods and Services Tax (GST) collection of Haryana is four times that of Punjab's Rs 2,316 crore for April 2023, despite the big brother being home to a larger population of 3.06 crore and sprawled over an area of 50,362 sq km, compared to a population of 2.99 crore and an area of 44,212 sq km for the smaller cousin.

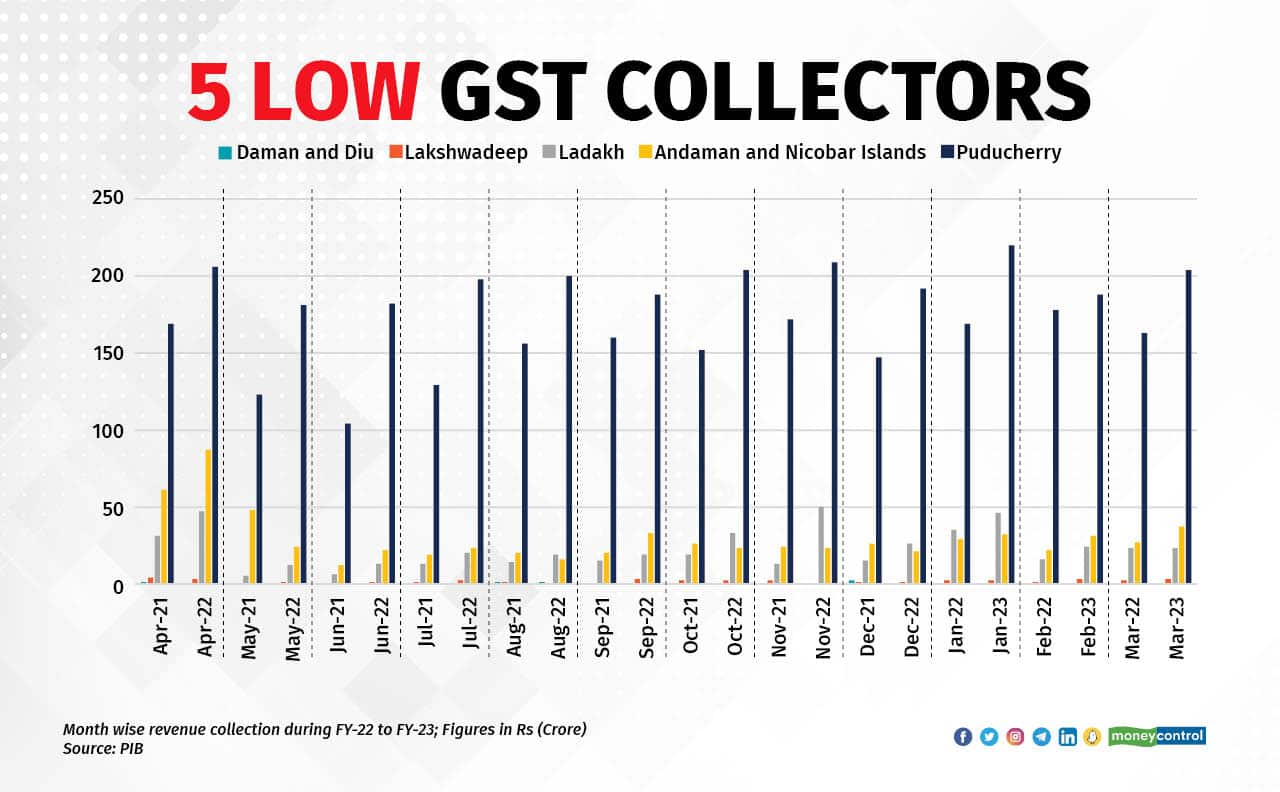

The states with the maximum GST collection include Maharashtra, Karnataka, Gujarat, Tamil Nadu, and Uttar Pradesh, while the north-eastern states and union territories rack up the lowest revenue.

“Gurugram contributes around 40 percent of Haryana’s GST collections. The concentration of large corporations in Gurugram drives up Haryana’s GST collections. Punjab's economy is still based a lot on agriculture, which is GST exempt. Punjab is India’s third-largest foodgrain producer, behind Uttar Pradesh and West Bengal. In 2018, 25 percent of Punjab’s GDP came from agriculture, while for Haryana it was 14 percent,” Anita Rastogi, Principal, Price Waterhouse & Co LLP, told Moneycontrol.

Haryana is developing much faster in terms of infrastructure and is a preferred destination for multinational companies as well as individuals, thereby leading to significant GST collections, Anchal N. Arora, Partner, Felix Advisory, said.

Haryana has a higher consumption of goods and services, which could be the result of higher disposable incomes and a larger middle class. This also leads to higher GST collections as the tax is applied on the consumption of goods and services.

“Automation, data analytics, and digital audits in the state of Haryana is helping deter errant taxpayers. Haryana is located in the National Capital Region (NCR) and is surrounded by Delhi, Uttar Pradesh, and Rajasthan, which are all high revenue-generating states. This could lead to a higher flow (and consumption) of goods and services, and therefore higher GST collections,” Rajat Mohan, Senior Partner, AMRG & Associates, an accounting firm, told Moneycontrol.

Haryana has about 1.5 times more entities registered with GST authorities than Punjab, but the GST collection is about four times.

States with better infrastructure have been able to attract corporates and reap its benefits.

“Haryana has so many big corporates because of its advanced infrastructure and better industrial policies. Punjab and Rajasthan have not been able to develop that kind of infrastructure or support system to attract major investments, resulting in lower GST numbers. If we look at neighbouring states, only UP is on par in terms of growth and revenue collections,” Ankur Gupta, Practice Leader at tax advisory firm SW India, told Moneycontrol.

GST is a consumption-based tax that is levied at the point of consumption. The GST collections of a state depend on various factors, such as the size of the economy, the level of industrialisation, consumer spending patterns, and the tax administration. Larger states like Maharashtra, Karnataka, Gujarat, and Uttar Pradesh, which have a large population and more economic activity, consume more goods and services, resulting in higher GST collection.

“In states like Tamil Nadu, high employment and literacy means higher purchasing power, which leads to greater consumption, and consequently, higher GST collections. Bengaluru in Karnataka is a hub of the service sector, which again leads to high consumption,” Rastogi said.

GST collections are the highest in Maharashtra, since it is the financial capital of the country and attracts significant investment.

“Maharashtra is quite proactive when it comes to audit investigation, which helps improve GST collections. Unfortunately, that’s not the case with others. Maharashtra invests substantial amounts in training officers for this,” Pune-based chartered accountant Pritam Mahure told Moneycontrol.

As a result, due to the massive base of industries and corporates, the larger states collect a major chunk of the GST revenues, while smaller states with a focus on growth and development are expanding their tax base.

Additionally, big states tend to have more industrial, commercial, and institutional infrastructure investments that add to the overall tax collection. Moreover, big states have much better infrastructure when it comes to tax administration, which leads to more efficient tax collection and compliance.

“States like Maharashtra, Karnataka, Gujarat, and Tamil Nadu have highly advanced technology backing the local tax offices, ensuring better compliance. The tax officers of the bigger states are regularly updated in jurisprudence, ensuring a thorough assessment process. All this plays a crucial role in improving tax recovery and making the process more efficient and effective,” Mohan said.

On the other hand, the north-eastern states are tiny in terms of population, and their purchasing power is low. A predominantly informal economy, limited industrialisation, limited financial inclusion, and geographical challenges add to the woes of tax administration, leading to low collection in these states.

“A large portion of the population in the north-east states is engaged in agriculture, which is exempt from GST. This reduces the number of taxpayers in these states. In states like Tripura and Manipur, the service sector is in a nascent stage,” he said.

However, GST collection has grown in the past year in states like Jammu and Kashmir, Ladakh, Sikkim, and Mizoram.

“While the growth of J&K and Ladakh can be attributed to increased investment, the growth in Sikkim and Mizoram can be attributed to improving infrastructure,” Gupta said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.