In-Depth | Decoding OPEC+ cut: What is Saudi's agenda and how will oil shortfall impact the economy?

In-Depth | Decoding OPEC+ cut: What is Saudi's agenda and how will oil shortfall impact the economy?

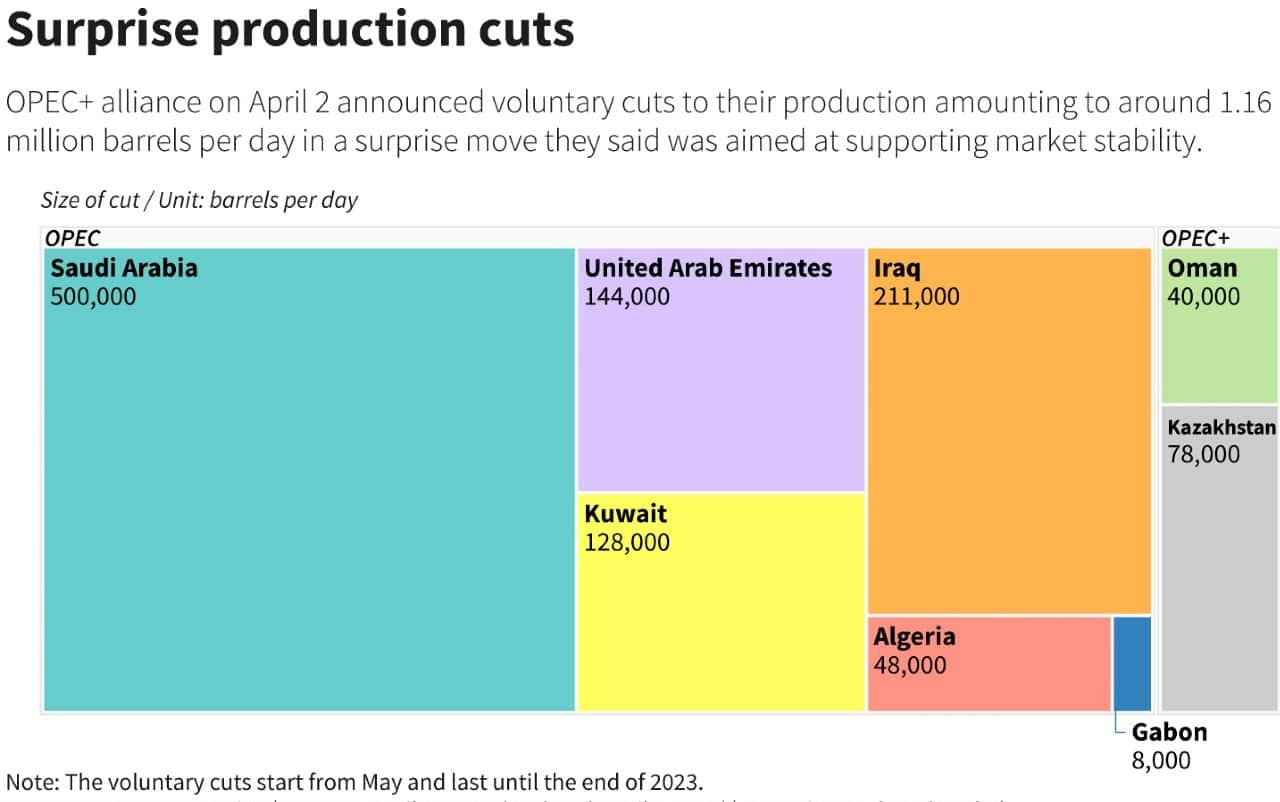

The Organisation of Petroleum Exporting Countries (OPEC) and its allies, called OPEC+, announced oil production cuts of around 1.16 million barrels per day (bpd) in a surprise move earlier this month. The shock cut, led by Saudi Arabia, OPEC’s dominant member, has added a wrinkle to central banks’ efforts to tame inflation, just days after a slowdown in US price data had boosted market optimism and Europe's cost of living was starting to ease.

OPEC+ defends its surprise output reduction as being aimed at oil market ‘stability’. However, oil prices surged over 8 percent to $83.95 a barrel after the announcement, the highest rise in more than a year. The voluntary cuts start from May 2023 and will last until the end of the year.

With the supply cut and demand recovery in China, oil prices may again surge to the levels of $100 per barrel, last seen in July 2022. In March, benchmark Brent crude fell to $72 per barrel, the lowest in 15 months, due to the collapse of major global banks including Silicon Valley Bank (SVB) and Credit Suisse.

By putting the prospect of $100 a barrel oil back in view after it had dropped to $70, the decrease in production has invited potentially ominous signs of global inflation, adding to worries that higher prices and an aggressive monetary tightening by central banks could tip the world economy into recession.

OPEC was formed in 1960 as a cartel, with the aim of fixing the worldwide supply of oil and its price. In 2016, when oil prices were particularly low, OPEC joined forces with 10 other oil producers, including Russia, Azerbaijan and Kazakhstan, among others, to create OPEC+.

OPEC+ is now a group of 23 oil-exporting countries that meets regularly to decide how much crude oil to sell in the world market. At the core of this group are the 13 members of OPEC, which are mainly West Asian and African countries such as Iran, Iraq, Nigeria and Libya, among others.

Today, OPEC nations produce around 30 percent of the world's crude oil. Saudi Arabia is the largest oil producer within the cartel, producing more than 10 million barrels a day. Together, OPEC+ nations produce about 40 percent of all the world's crude oil.

Non-OPEC countries can do little to counter the effort to push the price of oil higher at a global level (Image: Vladimir Simicek/AFP)

Non-OPEC countries can do little to counter the effort to push the price of oil higher at a global level (Image: Vladimir Simicek/AFP)

The most recent cut of over 1 million bpd follows a cut of 2 million bpd that was announced in October 2022, when the grouping had agreed to cut production from November till the end of 2023 despite calls by the US to pump more oil. The two output reductions account for about 3 percent of the world's oil supply.

The recent cut brings the total volume of cuts by OPEC+ to 3.66 million bpd, according to Reuters, equal to 3.7 per cent of global demand. The April 2023 cut is the second jolt from OPEC+ in the space of six months. It immediately led to a 5 percent rise in the price of oil on international exchanges.

“The move has the potential to push the market into a deficit in the second quarter, versus earlier expectations of a surplus,” said Vandana Hari, the Singapore-based founder of oil consulting firm Vanda Insights.

Group leader Saudi Arabia said that the move is ‘precautionary’ to avoid a deeper slide in oil prices. Oil prices fell from highs of over $120 per barrel last summer to $73 last month.

“Oil prices may test $90-$95 a barrel very soon, but if prices breach the $100 mark, then it could put inflationary pressures on the global economy. Last year, oil prices at the same level in the aftermath of the Russia-Ukraine war was the primary reason behind the global inflationary trend,” Anuj Gupta, vice-president of IIFL Securities, told CNBC-TV18 in an interaction on the OPEC+ output cut.

With fears of a US recession exacerbated by the recent bank collapses, lack of economic growth in Europe and China’s rebound from Covid-19 taking longer than expected, oil producers are wary of a sudden collapse in prices as seen during the pandemic and the global financial crisis in 2008-09.

The size of oil output cuts announced by each of the OPEC+ members on April 2, 2023. (Graphic Source: Reuters)

The size of oil output cuts announced by each of the OPEC+ members on April 2, 2023. (Graphic Source: Reuters)

The Saudis are taking the lead by reducing oil supply by 500,000 bpd, with the United Arab Emirates, Kuwait, Iraq, Oman, Algeria and Kazakhstan contributing smaller cuts.

“OPEC has a granular understanding of the demand-supply factors. They seem to have decided that the world economic situation is not hunky-dory and that oil demand may collapse faster than what has been anticipated. To that extent, this is an attempt to bring stability to oil prices,” said Harshavardhan Dole, energy analyst at IIFL Securities.

Dole added that the move may be a combination of fundamental demand-supply factors and geopolitics, where OPEC+ wants to assert its control over the global oil market.

Even though Saudi energy minister Abdulaziz bin Salman claimed that the kingdom's voluntary reduction was a precautionary measure aimed at supporting the stability of the oil market, analysts reckon that this may not be the sole reason.

The latest production cut means that a tighter market and higher oil prices will arrive sooner. If prices spike as many analysts now predict, it could more than compensate for lower sales, boosting OPEC revenues. The cut demonstrates Saudi Arabia’s own revenue needs as it seeks to fund its ambitious domestic economic reform agenda — called Vision 2030 — under which plans to invest $3.2 trillion to diversify the Saudi economy by 2030.

The cut also strengthens Saudi Arabia’s position by increasing its available spare capacity, giving the kingdom a unique ability to temper rising oil prices in the future. By cutting output now, OPEC+ may accelerate the timeframe in which the oil market enters a period of structural deficit when demand exceeds supply.

In the long term, the production cut is widely seen as another step in Saudi Arabia’s efforts to strengthen its geopolitical position in the decades ahead by increasing its influence on global oil markets. Given the economic and regional risks, analysts expect more volatility for the energy sector ahead.

Saudi Arabia's Minister of Energy Prince Abdulaziz bin Salman Al-Saud and OPEC Secretary-General Haitham al-Ghais shake hands at the OPEC headquarters in Vienna, Austria. (Image: Reuters)

Saudi Arabia's Minister of Energy Prince Abdulaziz bin Salman Al-Saud and OPEC Secretary-General Haitham al-Ghais shake hands at the OPEC headquarters in Vienna, Austria. (Image: Reuters)

The White House has described the OPEC+ decision as ill-advised under current market conditions and added that the US will work with producers and consumers to manage gasoline prices for Americans.

Goldman Sachs said OPEC's power has increased in recent years as US shale responses to higher prices have become slower and smaller, in part because of pressure on investors to stop funding fossil fuel projects.

The International Energy Agency (IEA) has said that output cuts announced by OPEC+ risk exacerbating an oil supply deficit expected in the second half of the year and could hurt consumers and the global economic recovery.

Consumer countries represented by the IEA have argued that tightening supplies drive up prices and could threaten a recession, while OPEC+ blames Western monetary policy for market volatility and inflation which undercuts the value of its oil.

“We have high inflation, economies potentially going into recession, and this is a situation where you need lower oil prices for a short period of time for the economy to recover,” said Adi Imsirovic at the Oxford Institute for Energy Studies (OIES). “If central banks are no longer able to cut rates in the same way, then OPEC+ may well be responsible for dragging the whole world economy into a recession.”

The IEA saw 2023 demand at a record 101.9 million bpd, up 2 million bpd over a year earlier and on a par with its prediction last month. It also expects global oil supply to fall by 400,000 bpd by the end of the year, citing an expected production increase of 1 million bpd from outside of OPEC+ beginning in March versus a 1.4 million bpd decline from the producers’ bloc.

The cuts, if fully implemented, “would further tighten an already fundamentally tight oil market”, Jorge Leon, senior vice-president at Rystad Energy, said in a research note. The cut could boost oil prices by around $10 per barrel and push international Brent to around $110 per barrel by this summer.

Those higher prices could fuel global inflation in a cycle that forces central banks to keep hiking interest rates, which crimps economic growth, he said.

India, which is dependent on imports for 85 percent of its crude oil needs, may end up with a bigger import bill if prices rise again, which could stoke inflation. The state-run oil marketing companies (OMCs) will continue to record losses and under-recoveries on higher oil prices as they did in the first half of the current financial year on unchanged retail fuel prices.

Even if the government resumes daily retail auto fuel price revisions, consumers in India may not see a reduction in rates as OMCs might not lift the freeze on petrol and diesel prices. If oil prices rise, the spurt will reverse the softening in rates witnessed in the basket of crude oil that India imports.

Prashant Vasisht, vice president and co-head, corporate ratings at ICRA Limited, believes that the OPEC+ cut could potentially fuel inflationary pressures in the economy. “However, upstream oil producers such as ONGC are expected to benefit owing to higher profits and cash accruals though a large part of the same is likely to be shared with the government in the form of special additional excise duties,” he said.

"The downstream sector would be adversely impacted, and the OMCs may start incurring marketing losses on the sale of diesel," he added.

Since India imports more than three-fourths of its crude requirement, a bigger import bill will mean more demand for the dollar and that will widen the current account deficit (CAD) and weaken the rupee. “An increase of $10 a barrel could translate into 40 basis points to half a percent increase in CAD,” said Dhruv Sharma, senior economist with the World Bank.

Notably, OPEC's share of India's oil imports fell at the fastest pace in 2022/23 to the lowest in at least 22 years, as intake of cheaper Russian oil surged, according to Reuters, and the major producers' share could shrink further this year. Russia overtook Iraq for the first time to emerge as the top oil supplier to India, pushing Saudi Arabia down to No. 3 in the last fiscal year.

Data shows India's oil imports with OPEC's share dropping to record lows ever since the country started buying Russian oil after the Russia-Ukraine war. (Graphic Credits: Reuters)

Data shows India's oil imports with OPEC's share dropping to record lows ever since the country started buying Russian oil after the Russia-Ukraine war. (Graphic Credits: Reuters)

The decision by OPEC and its allies to cut production in May could further squeeze OPEC's share in India - the world's third-largest oil importer, later this year if Russian supplies stay elevated.

"Russian crude is already cheaper than the similar Middle Eastern grades and it seems OPEC is harming itself by a reduction in output," said Refinitiv analyst Ehsan Ul Haq.

In March, India shipped in nearly 5 million bpd of oil, marginally higher than the previous month, with Russian oil accounting for about 36 per cent of overall imports, according to Reuter's data.

Read more weekly in-depth articles from Moneycontrol here