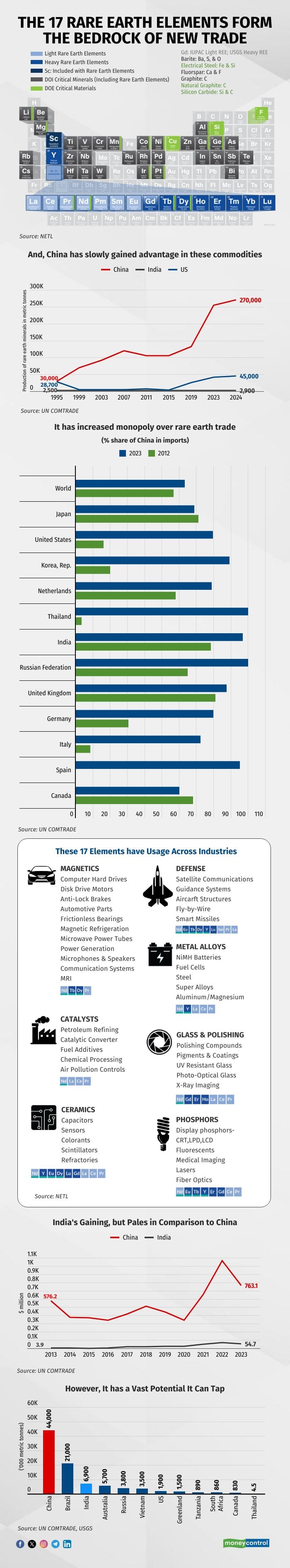

China’s rare-earth elements (REE) trade has risen ninefold over the past three decades, and its control over global supply is now unmatched in modern history, leaving countries such as the US and India completely reliant on Chinese supplies.

India’s capacity has grown by a mere 16 percent in the same period, according to a Moneycontrol analysis of USGS data.

Through years of calculated efforts, China has secured an iron grip on rare earth magnets. It channelled state support and ensured an abundant supply of raw materials from around the world, helping Chinese companies undercut global rivals, decimating industries in the US and other nations by 2010. With competition largely folding, Beijing now wields significant leverage on supply chains.

So, when China curbed exports of rare-earth magnets earlier this year, the ripple effects were felt worldwide across the automotive, electronics, and defence industries. Citing national security concerns, Beijing imposed export controls on “dual-use” materials with potential military applications and required exporters to provide detailed end-use documentation and, in some cases, third-party testing to verify the magnets’ composition.

As China's rare earth production soared, its dominance extended beyond production to global trade. In 1995, China matched the US in the production of these 17 strategic elements. By 2024, it was estimated to be producing six times more than the US, cementing its dominance at the centre of the global rare earth supply chain.

Between 2012 and 2023, its share in global REE exports rose from 56.6 percent to 63 percent. For countries like the US, South Korea, and India, reliance on Chinese supplies has only deepened—China now controls over 80 percent of the rare-earth imports of these countries.

Comparison with India

In India’s case, the share of Chinese REE imports rose from 78.3 percent in 2012 to 96.9 percent in 2023. But it’s not just the raw material trade, China also dominates downstream industries like permanent magnets, which are critical for clean energy, electronics, and defence applications.

Beijing’s restrictions on rare earth exports and permanent magnets, imposed in April 2024, have impacted industries across the world, particularly in the automotive and electronics sectors.

India has made some progress in developing its own REE trade. Between 2013 and 2023, India’s exports of rare earths rose 14-fold to $54 million, though the figure remains modest when compared to China’s $763 million in REE exports.

The USGS data, however, offers a glimmer of hope. India is home to the third-largest known reserves of rare earth elements globally, with 6.9 million metric tonnes—a resource that could underpin future strategic autonomy in critical minerals.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.