Personal Finance 101 tells you to keep your loan repayments at less than 50 percent of your income. If we stretch this rule to the government, the Centre would struggle to stick to it.

The government earns mainly from taxes and spends on various schemes for the economy. It always spends more than it earns and, therefore, runs a deficit every year. For a growing economy such as India, there is no escape from a fiscal deficit. The government borrows from the bond market to bridge this gap.

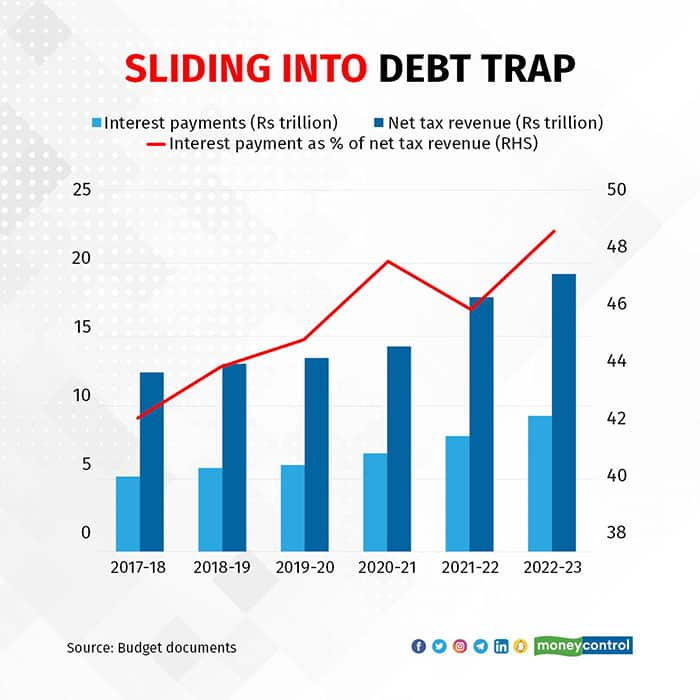

What is detrimental is that the market borrowing is slowly turning unsustainable. As the chart shows, the government will spend nearly half of its net tax revenues towards interest on its past borrowings. Net tax revenues form the bulk of the government's revenue and are fairly stable. Non-tax revenues such as divestment proceeds tend to be lumpy and volatile.

As such, nearly 48.6 percent of its net tax revenues will go towards interest payments on these bonds in FY23. Interest payments are budgeted at Rs 9.31 lakh crore for the next year and the government has assumed a net tax revenue of Rs 19.35 lakh crore. This interest burden is an unproductive expenditure and a result of past borrowing binges.

The Budget has pegged gross market borrowing at Rs 14.95 lakh crore, 43 percent higher than the current year's level. Future interest payments would be even higher. Add to the mix a rising interest rate cycle, and the government's interest payments increase further.

If half of its income goes into interest payments, the government is left with less to spend on the economy. It will need to grow its tax revenue or sell its assets. A prudent way is to restrain high borrowing. The government may not be in a debt trap but it is slowly sliding into one.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.