On September 17, Finance Minister Nirmala Sitharaman emphasised repeatedly that the Goods and Service Tax Compensation to states will end on June 2022, though never once directly.

Her take was that the current legislation allows for compensation only till June 2022 and that cess collected beyond that would be used to pay back loans in lieu of compensation shortfall.

This is starkly different from what politicians and officials from opposition-ruled states such as Delhi, Bengal and Tamil Nadu told the media after the GST Council meeting in Lucknow.

Delhi Deputy Chief Minister Manish Sisodia and West Bengal minister Chandrima Bhattacharya, who attended the meeting on behalf of Finance Minister Amit Mitra, both said the issue of compensation extension had been referred to a group of ministers formed to look at various GST-related matters.

To be fair, such differences are common in a political federal body like the GST Council. The centre and the opposition states were giving their own perspective on what transpired in the meeting on September 17. And such meetings can get highly technical.

When Sitharaman and Revenue Secretary Tarun Bajaj were asked whether the issue had been referred to one of the two GoMs that had been set up, they neither confirmed nor denied it, but stuck to the centre’s stand.

Sitharaman and Bajaj said that while compensation cess will be collected until March 2026, it will be used to pay back the interest and principal of the Rs 2.69 lakh crore that the centre borrowed and will borrow in 2020-21 and 2021-22, and transferred to states.

Compensation has been one of the sore, sticking points in the GST Council since its inception, and it is very likely that this issue could blow up and cause a fresh rupture in centre-state relations in future Council meetings.

Compensation and COVID-19

When the GST was launched, states had agreed to join the new tax regime provided they were compensated for any revenue loss in the first five years from July 1, 2017 to June 2022.

Section 18 of the Constitution (101 amendment) Act, 2016 and Section 7 of GST (Compensation to State) Act, 2017 permits that the loss of revenue will be compensated to states at the end of every two months for five years. The shortfall is calculated assuming a 14 percent annual growth in GST revenue over the base year of 2015-16.

If compensation is extended, the Acts will have to be amended.

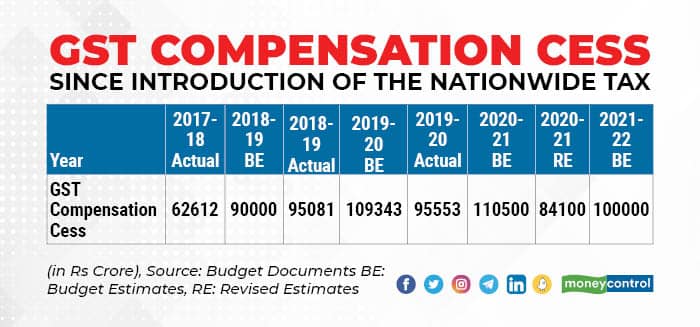

Compensation cess is collected by the centre and then given to the states. As the chart shows, the proceeds under the cess were rising steadily till 2019-20, and then fell as the COVID-19 pandemic hit economic activity. More importantly, cess collections have always fallen short of the budget estimates.

Owing to this, in a series of GST Council meetings last year, it was decided that the states would be compensated for the shortfall due to COVID-19. In 2020-21, the centre borrowed Rs 1.10 lakh crore under a special borrowing window set up by the Reserve Bank of India, which it transferred to states.

This year, the centre will borrow and transfer Rs 1.59 lakh crore. Out of this year’s amount, Rs 75,000 crore has already been borrowed and transferred to states.

Sitharaman has clarified that the cess collected from July 2022 to March 2026 would be used to repay the principal and interest on these loans, and hence will not go into the states’ kitty.

A sticking point

The meetings last year, in which compensation was discussed, were not smooth affairs. They were tense and fractious at times.

In fact, if the grapevine is to be believed, in one of the Council meetings, a finance minister of a BJP-ruled state advised Sitharaman to rein in a senior central government official who was rather forcefully trying to end the discussion on compensation and move on to the next topic.

The finance minister in question, a well-respected figure within the BJP, is said to have advised Sitharaman that in the spirit of cooperative federalism, the discussion on compensation should continue until the Council members, including the opposition states, reach a broad consensus.

Some opposition ministers are said to have even pointed out that her predecessor, the late Arun Jaitley, would have guided the debate using a softer approach, something which did not go well with Sitharaman.

Cut to today, and the central government’s stance on September 17, that the laws only allow for compensation till June 2022, does seem like a reneging on older promises. In the October 2020 GST Council meeting, the centre had in-principle agreed to extend the compensation period. The latest meeting was meant to discuss the ways to do so.

As Moneycontrol had reported earlier, the centre was to present options to states on how to extend compensation beyond June 2022. As per the centre's perspective, the pandemic has hit its finances as much as the states and hence to compensate states at an assumed rate of 14 percent GST growth, something which was decided pre-COVID, may no longer be possible.

While the meeting was going on, sources had confirmed that the centre was presenting an option to continue paying compensation at a rate much below 14 percent, or suggest revenue enhancement measures to states.

However, a top central government official told Moneycontrol after the meeting that the centre gave a presentation to states in which it explained the need to use the cess collections to pay back interest and principal on the compensation shortfall borrowings. The official said that all states understood the situation and had agreed.

Going by the utterances of the opposition states, clearly they hadn’t. This issue has not been settled yet. Watch this space.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.