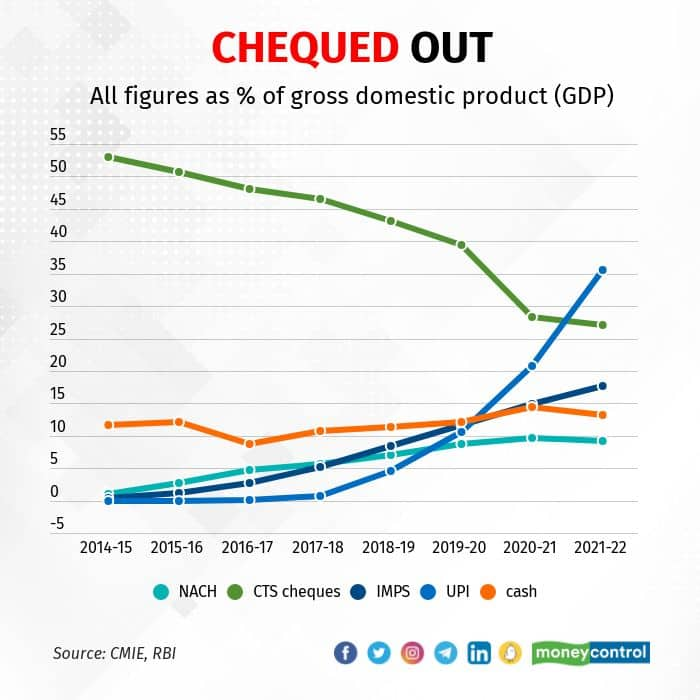

India’s payment system has gone through a transformation in the past decade, and demonetization has hastened the speed of the changes. Even as digital payment systems have grown exponentially, cash still remains a critical component in financial transactions. As a percentage of gross domestic product (GDP), currency in circulation (CiC) or cash with the public is higher now than before demonetization. At the same time, Unified Payment Interface (UPI) has dwarfed all other retail payment systems in terms of transactions and surged ahead. The ratio of UPI transactions to GDP has risen sharply even as cash continues to endure. What has suffered are cheque payments. Cheques have plummeted as a mode of transactions to just 27 percent of GDP in FY22 from as high as 50 percent in FY16. Part of this has been also due to the regulator’s efforts to reduce paper transactions in the economy and nudge even larger transactions towards digital routes. Most digital platforms, from National Automated Clearing House (NACH), national electronic transfer funds (NEFT), mobile phone based Immediate Payment Service (IMPS) and other internet banking modes have been growing fast. That said, UPI’s growth remains the most spectacular. While cheques may slowly recede to the margins of payment, analysts believe cash transactions will persist given the anonymity they give to the user.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.