Finance Minister Nirmala Sitharaman looked to retain the government's focus on capital expenditure by setting aside a mammoth Rs 7.50 lakh crore for the same for FY23. However, questions have been raised about the nature of this target: is it realistic, overstated, or just a huge challenge?

To answer this question, it is best to break down the headline number into its various components and arrive at the exact size of the government's task.

Of the Rs 7.50 lakh crore, a sizable chunk, Rs 1 lakh crore, is an interest-free, 50-year loan to State governments for their capital expenditure, up from Rs 15,000 crore in FY22.

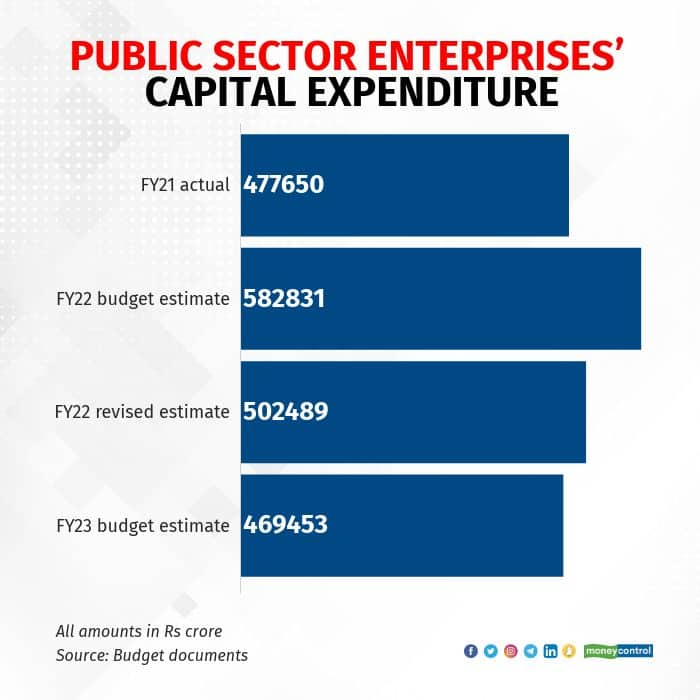

Apart from the Centre's budgetary support, one must also account for the capital resources of public sector enterprises (PSEs). These, called internal and extra-budgetary resources (IEBR), have fallen in FY23.

The Budget pegs IEBR for FY23 at Rs 4.69 lakh crore, down 6.6 percent from the revised estimate and 19.5 percent from the budget estimate for FY22.

The sum of the Centre's gross budgetary support and IEBR, less the interest-free loan to States, results in Central government and public sector capital expenditure of Rs 11.20 lakh crore for FY23 — 2.7 percent higher than the revised estimate but 0.7 percent lower than the budget estimate for FY22.

If the headline number of Rs 7.50 lakh crore seemed daunting, a 2.7 percent increase seems more manageable and perhaps even realistic.

| THE CAPEX BREAK-UP (in Rs crore) | |||

| FY23 BE | FY22 RE | FY22 BE | |

| Centre's capex | 7,50,246 | 6,02,711 | 5,54,236 |

| (+) PSEs' capex | 4,69,453 | 5,02,489 | 5,82,831 |

| (-) interest-free loan to states | 1,00,000 | 15,000 | 10,000 |

| TOTAL | 11,19,699 | 10,90,200 | 11,27,067 |

The budget documents show that the Central government infused Rs 2.23 lakh crore as equity in public enterprises in FY22, with another Rs 22,955 crore extended as loans. For FY23, these numbers are expected to rise to Rs 3.34 lakh crore and Rs 26,489 crore, respectively.

The equity infusions marked out for FY23 include Rs 44,720 crore into the struggling Bharat Sanchar Nigam Limited (BSNL) and Rs 1.34 lakh crore for the National Highways Authority of India (NHAI).

While both these numbers are large and significant, the second is particularly interesting. In FY22, NHAI had raised Rs 25,000 crore from the market through bonds and debentures. For FY23, the Centre will fully fund NHAI. This has played a part in bringing down the IEBR number for FY23.

Of course, some past equity support items don't make a reappearance this time around. Air India Asset Holding Limited had received an infusion of Rs 62,057 in FY22. The government does not have to worry about this anymore. It also hasn't allocated any funds for the recapitalisation of public sector banks and the National bank for Financing Infrastructure and Development.

| Centre's major equity infusions, ex-railways (in Rs crore) | |||

| FY23 BE | FY22 RE | FY22 BE | |

| Air India Asset Holding Limited | 0 | 62,057 | 0 |

| BSNL | 44,720 | 0 | 14,115 |

| National bank for Financing Infrastructure and Development | 0.01 | 20,000 | 0 |

| Public sector banks | 0.02 | 15,000 | 20,000 |

| NHAI | 1,34,015 | 65,060 | 57,350 |

| TOTAL PSE EQUITY INFUSION | 3,34,134 | 3,05,788 | 2,23,253 |

"Touting grants given to States 'for capital expenditure' (which in many cases is not even spent on capital expenditure) as effective capital expenditure of the Centre is nothing but a further exercise in nameplate swapping for claiming capital expenditure somewhere else as your capital expenditure," Garg wrote in a scathing post-budget note last week.

According to Garg, the Centre's infusion of equity into NHAI and BSNL only replaces their own resources. This, the former bureaucrat argued, increases the Centre's capital expenditure but not the overall outlay of the government and PSEs.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!