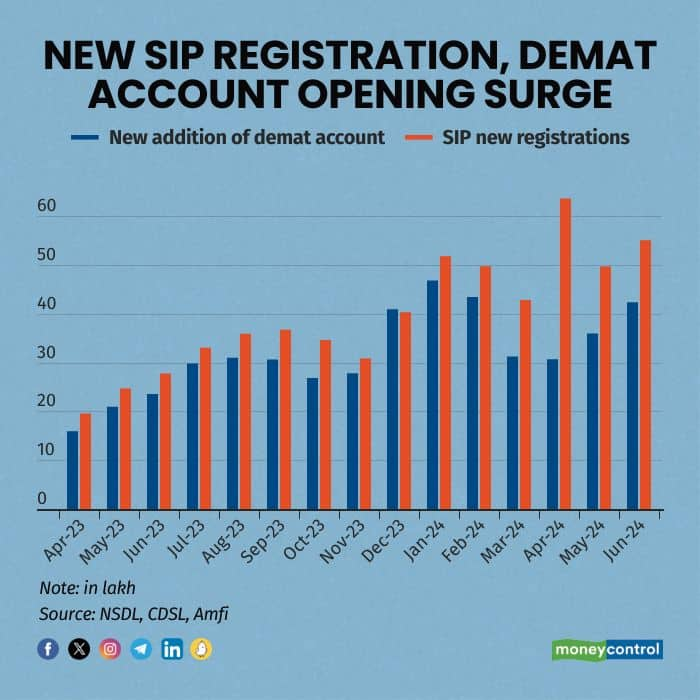

A volatile market that has been making fresh highs does not seem to be deterring the retail investor's enthusiasm for equities, as Systematic Invest Plan (SIP) registrations and demat account openings continue to look upbeat.

Mutual funds have seen a significant increase in both new SIP registrations as well as account closures between January to June. Industry observers say this could be a reflection of mutual fund investors reshuffling their portfolios.

Many investors are moving from small and midcap funds to large cap-focused or newly launched schemes such as defence, multicap, manufacturing, and special opportunities funds, which have attracted substantial investments recently, market experts said.

In the first half of 2024 (January to June), there were over 3.13 crore new SIP registrations and more than 1.78 crore account closures. Additionally, over 2.3 crore new demat accounts were added during this period.

Market watchers say many new investors are comfortable putting in money at current prices despite a general perception that valuations are expensive. Two factors are at play here, one being the fear of missing out (FOMO) as the market hits new highs and the other is the view that any correction would allow them to average their buying cost lower.

This is causing a virtuous cycle where increased inflows are pushing the stock market higher, and in turn attracting more inflows.

Analysts attribute the continued high numbers of discontinued SIPs to several factors: SIPs commonly end after their planned duration of 3 or 5 years, or when investors pause contributions during market highs.

Additionally, a new SEBI rule, effective since April after a January circular mandates stopping SIPs if payments are missed for three consecutive months. This has prompted AMCs to comply by cleaning up inactive SIPs.

Analysts attribute the exuberance in India's markets to the financialization of savings and the facilitation of digital investing, a trend that is driving investments in equities via mutual funds or directly, primarily through SIPs.

Axis Securities in its recent note believes that with the recent market surge, much of the expected growth is now already factored in. They emphasize that strategy and sector rotation will be key to generate returns in excess of the benchmark.

Given recent strong performance by mid and smallcaps, Axis suggests caution regarding their valuations compared to largecaps. They anticipate potential sector-specific corrections in the near term, favouring largecaps.

" We maintained our Mar’25 Nifty target at 24,600 by valuing it at 20x on Mar’26 earnings. Hence, we recommend investors to remain invested in the market and maintain good liquidity (10%) to use any dips in a phased manner and build a position in high-quality companies (where the earnings visibility is quite high) with an investment horizon of 12-18 months", it said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.