UltraTech Cement is set to present its earnings report for the first fiscal quarter of FY25 on July 19. Sequentially, India's largest grey cement, ready mix concrete and white cement manufacturer is expected to deliver a subpar performance in Q1FY25 despite a rise in volumes, primarily due to weak prices, and a decline in average realisations that will impact earnings.

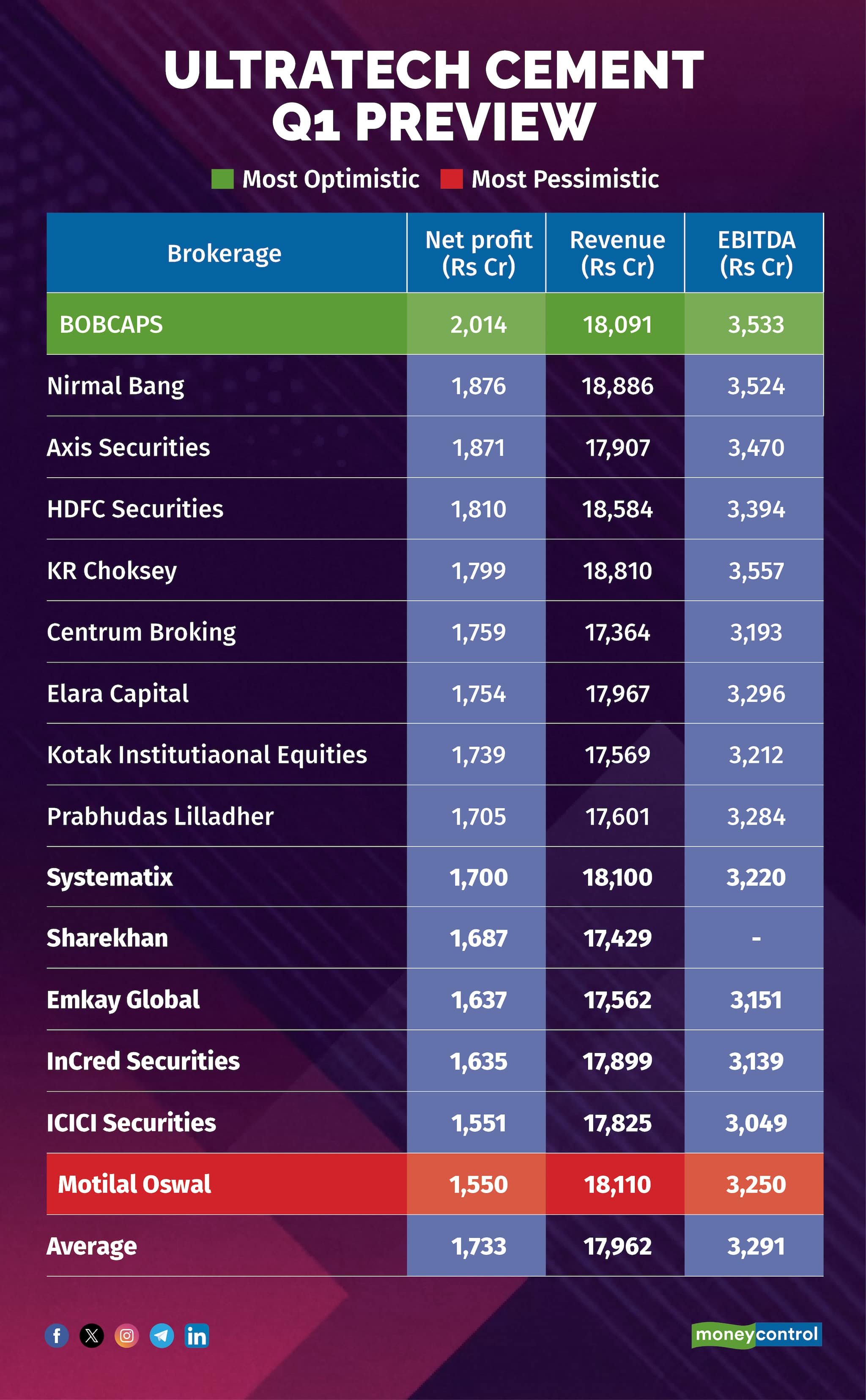

According to a Moneycontrol poll, UltraTech Cement's net profit is expected to slump 30 percent QoQ to Rs 1,733 crore. Revenue is also seen falling 13 percent sequentially to Rs 17,962 crore.

On a year-on-year basis, however, net profit and revenue are seen rising 2.5 percent, and 1.3 percent, respectively.

The most optimistic estimate sees Ultratech Cement's net profit rising 19 percent on-year, respectively. But the most pessimistic projection suggests that net profit might sink eight percent YoY.

What factors are driving the earnings?Demand Slowdown: The slowdown in construction activities during the general elections in April and May adversely impacted cement sales in these months. Scorching heat, labour shortages, and unseasonal rain in some regions further dented demand during Q1FY25.

Muted prices: Cement prices entered Q1F25 with a steep hike announcement in some regions, but with lower-than-historical average demand and a sudden ramp-up of M&As among large players, sustaining any price hike became impossible. Hikes implemented in April were reversed during May and June due to soft demand and stiff competition.

Decline in realisations: According to analysts at Motilal Oswal, blended realization is likely to decline around three percent YoY. Price realisation in cement refers to the average revenue a company earns per unit sold. It helps gauge the average income per ton, with higher realisation indicating better profitability per unit.

High Costs: The cement maker's depreciation/interest expenses are estimated to increase up to eight percent on-year likely causing a negative operating leverage, which occurs when a company's fixed costs are high, causing profits to decline disproportionately as sales decrease.

Combined with lower price realisations, this can significantly hamper net earnings.

According to analysts at BOBCAPS, UltraTech Cement's growth stayed at a higher single digit after a very strong Q4FY24 as the company focuses on retaining prices at relatively better levels than its peers.

"Volume growth of around 8.5 percent is despite strong competition from the peer set. Operating efficiencies likely to move margins into positive territory," it said.

What to look out for in the quarterly show?Analysts will be keeping a close eye on management commentary on the demand scenario amidst a seasonally weak quarter, price sustainability amidst intensifying competition, and consolidation in the sector.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.