Tata Motors Ltd has entered the top ten most valued global automotive firms, the first Indian company to do so, thanks to a continued stock surge.

The stock has risen over 50 percent this year and over 101 percent in 2023, with a market cap of $51 billion, the highest among Indian auto companies.

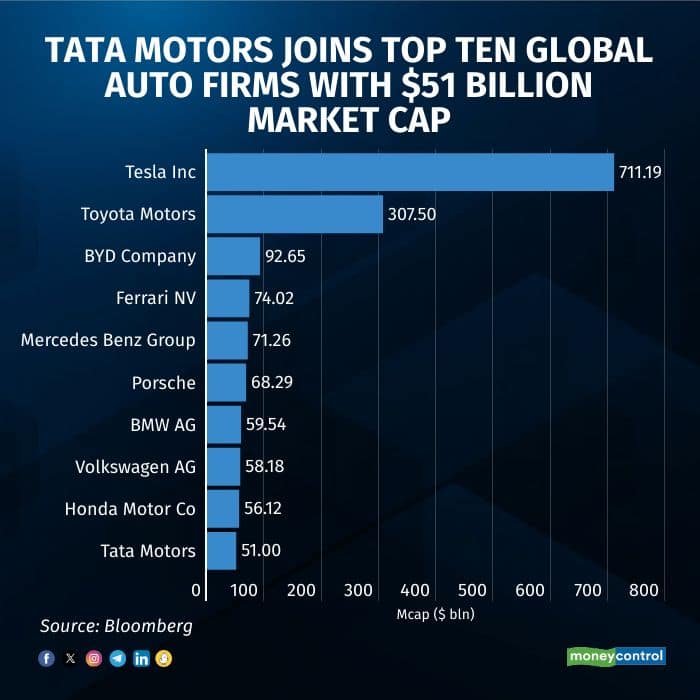

Globally, Tesla Inc leads with a market cap of $711.19 billion, followed by Toyota Motors with $307.50 billion and BYD Company with $92.65 billion. Ferrari NV ranks fourth at $74.02 billion market cap, followed by Mercedes-Benz Group ($71.26 billion), Porsche ($68.29 billion), BMW AG ($59.54 billion), Volkswagen AG ($58.18 billion), and Honda Motor Co ($56.12 billion).

Tata Motors' market cap surpasses that of Stellantis NV ($50.64 billion), General Motors ($49.74 billion), Maruti Suzuki India ($48.36 billion), Mahindra & Mahindra ($43.41 billion), Ford Motor Co ($43.1 billion), Hyundai Motor ($37.88 billion), and KIA Corp ($32.29 billion).

Tata Motors' stock has tripled in three years, driven by high expectations for its passenger vehicles. The company has turned around remarkably, with Jaguar Land Rover (JLR) on a profitable growth path. In India, Tata Motors leads in electric cars and has shifted its portfolio towards utility vehicles. However, its EV business has yet to break even at the EBITDA level, and continued investment in EVs requires strong sales.

Analysts note that Tata plans to launch new EV models and aims for 50 percent of volumes from EVs by 2030, which could create significant value. Despite complexities in the passenger vehicle business, JLR will continue to generate a large portion of revenues and earnings, facing competition amid its EV transition.

Analysts further said as semiconductor chip challenges for JLR ease, supply has improved, reducing the order backlog and allowing the company to serve more customers. Demand remains strong and an expanding order book, with new models set to boost volumes further.

In its recent note, Nomura said it maintains a 5 percent volume CAGR for FY25-27F and expects EBITDA margins to hold at around 11.5 percent due to strong demand. A guidance upgrade from flat to negative growth for FY25F is possible, with e-buses potentially driving more upside.

On India PVs it said despite signs of weakness in industry PV and EV demand, the upcoming launches of Curvv (on August 7) and Harrier EV in FY25F should support volumes. Market share is projected to remain stable at 14%, with a target of 18-20% by FY30F.

Recently, Tata Motors said that its plan to demerge into two entities is welcomed by analysts. Post-demerger, Tata's PV business will include the domestic EV segment and Jaguar Land Rover (JLR), offering investment opportunities in both domestic and global premium markets. Sharekhan believes this move allows investors to tap into mass-market PV growth, potentially challenging Maruti Suzuki's dominance.

All eyes are on Tata Motors' earnings release on August 1. A poll of 16 Bloomberg analysts forecasts revenue of Rs 1.09 trillion, while 11 analysts predict a net profit of Rs 5,310 crore. Currently, the stock has 24 buy ratings, 6 hold ratings, and 5 sell ratings, according to Bloomberg.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.