Q1 Results 2024 Highlights: M&M Fin net profit jumps 45% to Rs 513 crore

Q1 Results 2024 Highlights: Mahindra and Mahindra Financial Services reported a 45% increase in June quarter net profit to Rs 513 crore, up from Rs 353 crore in the same period last year

-330

July 23, 2024· 22:36 IST

Q1 Results 2024 LIVE: M&M Fin profit jumps 45% to Rs 513 crore

-Mahindra and Mahindra Financial Services reported a 45% increase in June quarter net profit to Rs 513 crore, up from Rs 353 crore in the same period last year

-Core Net Interest Income increased by 15% to Rs 1,932 crore

-Interest Margin narrowed to 6.6% from 7.1% in the previous quarter

-Total Income grew by 20% to Rs 3,760 crore during the reporting quarter

-Assets Under Management increased by 23% to Rs 1.06 lakh crore

-Credit Costs declined to Rs 448 crore from Rs 526 crore in the year-ago period, contributing to profit growth

-330

July 23, 2024· 21:08 IST

Q1 Results 2024 LIVE: United Spirits' profit rises 1.7% to Rs 485 crore

- 1.7% rise in consolidated net profit to Rs 485 crore

- Previous year's net profit for the same quarter was Rs 477 crore

- Consolidated revenue from operations Rs 6,238 crore

- Previous year's revenue for the same quarter Rs 5,808 crore

- Total expenses Rs 5,619 crore

- Previous year's expenses Rs 5,173 crore

-330

July 23, 2024· 20:06 IST

Q1 Results 2024 LIVE: ICICI Prudential Life Insurance profit rises 9% on demand for market-linked policies

Profit nearly 9% up

Profit after tax rose to 2.25 billion rupees ($26.9 million) from 2.07 billion rupees a year earlier.

Demand: Increase driven by strong demand for market-linked products.

Annualised Premium Equivalent (APE) Sales: Grew 34.4% from a year earlier.

APE is a key metric for insurers, indicating the annualised total value of all single premium and recurring premium policies.

-330

July 23, 2024· 19:59 IST

-330

July 23, 2024· 19:53 IST

-330

July 23, 2024· 17:35 IST

Thyrocare Technologies Q1 results LIVE: Net profit up 38.2% YoY at Rs 23.9 cr

-Net profit up 38.2% at Rs 23.9 cr vs Rs 17.3 cr (YoY)

-Revenue up 16.3% at Rs 156.9 cr vs Rs 134.9 cr (YoY)

-EBITDA up 23.4% at Rs 42.7 cr vs Rs 34.6 cr (YoY)

-330

July 23, 2024· 15:54 IST

Bajaj Finance Q1 Results LIVE: Net profit grows 14% on-year to Rs 3,912 crore, misses estimates

Bajaj Finance reported that its Q1 FY25 net profit rose 14 percent on-year to Rs 3,912 crore, missing street expectations. India's largest non-banking finance company's April-June net interest income (NII) grew 25 percent on-year to Rs 8,365 crore. Read more here.

-330

July 23, 2024· 15:50 IST

HUL Q1 Earnings LIVE: Take a look at the key numbers

Net Profit up 2.7% at Rs 2,538 Cr Vs Rs 2,472 Cr (YoY)

Revenue up 1.3% At Rs 15,339 Cr Vs Rs 15,148 Cr (YoY)

EBITDA up 2.4% At Rs 3,606 Cr Vs Rs 3,521 Cr (YoY)

Margin At 23.5% Vs 23.2% (YoY)

Volume Growth At 4%

-330

July 23, 2024· 15:40 IST

Bajaj Finance Q1 LIVE: Net profit up 13.8% at Rs 3,912 cr

- Net Profit up 13.8% At Rs 3,912 Cr Vs Rs 3,436.9 Cr (YoY)

- NII At Up 24.5% At Rs 8,365 Cr Vs Rs 6,718.6 Cr (YoY)

- Gross NPA 0.86% Vs 0.85% (QoQ)

- Net NPA At 0.38% Vs 0.37% (QoQ)

- Provision Coverage Ratio At 56% Vs 57% (QoQ)

-330

July 23, 2024· 15:06 IST

United Spirits Q4: Net profit jumped 88% to Rs 384 crore

Diageo-controlled liquor maker United Spirits Ltd on May 24 reported a standalone net profit of Rs 384 crore in the fourth quarter ended March 2024. The company had posted a net profit of Rs 204 crore.

Revenue from operations increased 10 percent to Rs 6,394 crore from Rs 5,783 crore in the same quarter last fiscal.

-330

July 23, 2024· 14:34 IST

SRF Q1 Earnings LIVE: Net Profit Down 29.8% At Rs 252 Cr

- Net Profit Down 29.8 At Rs 252 Cr Vs Rs 359 Cr (YoY)

- Revenue Up 3.8% At Rs 3,464 Cr Vs Rs 3,338 Cr (YoY)

- EBITDA Down 13.2% At Rs 604 Cr Vs Rs 696 Cr (YoY)

- Margin At 17.4% Vs 21% (YoY)

-330

July 23, 2024· 14:29 IST

M&M Finance Q1 Earnings LIVE: Net Profit up 45.4% at Rs 513 Cr

- Net Profit up 45.4% at Rs 513 Cr Vs Rs 352.7 Cr (YoY)

- NII up 16% At Rs 1,894 Cr Vs Rs 1,634.1 Cr (YoY)

- GNPA Ratio At 3.56% Vs 3.4% (QoQ)

- Net NPA Ratio At 1.46% Vs 1.28% (QoQ)

-330

July 23, 2024· 14:15 IST

Bajaj Finance Q1 Outlook LIVE: What to look out for in the quarterly show?

Analysts will track the management's commentary on sustenance of growth momentum, progress on liberalised remittance scheme that allows Indian residents to remit funds abroad for certain purposes, margin trends, and loan growth outlook.

-330

July 23, 2024· 14:06 IST

Bajaj Finance Q1 Outlook LIVE: Bajaj Finance is expected to maintain healthy asset quality metrics

According to analysts from Emkay Global, Bajaj Finance is expected to maintain healthy asset quality metrics in the quarter ended June. They predict that gross stage 3 assets, which typically represent non-performing loans (NPLs), will remain below 1% at 0.9%. Similarly, net stage 3 assets, which are adjusted for provisions, are expected to be even lower at 0.3%.

These forecasts indicate that Bajaj Finance continues to manage its loan portfolio prudently, keeping its asset quality well-controlled and maintaining a low level of non-performing assets. This is a positive indicator of the company's robust risk management practices and its ability to sustain quality lending amidst economic conditions.

-330

July 23, 2024· 13:37 IST

Bajaj Finance Q1 Outlook LIVE: Analysts at Kotak Institutional Equities expect Bajaj Finance's margins to exhibit a slight expansion

- In Q1FY25, analysts at Kotak Institutional Equities expect Bajaj Finance's margins to exhibit a slight expansion, estimating them to reach 10.4%. This marginal increase is anticipated despite a rise in the cost of funds, as there is also an expected seasonal uptick in yields.

- Comparatively, in the year-ago period, Bajaj Finance recorded a net interest margin (NIM) of 10%. This stability in margins suggests that the company has managed to balance the increase in funding costs with improved yields, maintaining a robust operational efficiency amidst market dynamics.

-330

July 23, 2024· 13:06 IST

Bajaj Finance Q1 Outlook: Bajaj Finance saw 10% on-year growth in new loans booked at 1.1 crore

- In its Q1 business update, Bajaj Finance reported robust growth in key financial metrics. The company booked 10% year-on-year growth in new loans, amounting to 1.1 crore loans. This contributed to a significant 31% increase in assets under management (AUM), reaching Rs 3.5 lakh crore.

- Additionally, Bajaj Finance's deposit book showed strong performance with a 26% year-on-year rise, totaling Rs 62,750 crore for the quarter ended June. These results highlight the company's strong momentum in both lending and deposit-taking activities, underscoring its growing market presence and customer base.

-330

July 23, 2024· 12:26 IST

Bajaj Finance Q1 Outlook: Bajaj Finance projects strong Q1FY25 performance with 34% NII growth and 17% profit increase

Based on the consensus of seven brokerage firms, Bajaj Finance is expected to achieve a 34 percent year-on-year increase in NII, reaching Rs 9,042 crore for Q1FY25 compared to Rs 6,719 crore in the corresponding period last year. Profit figures are also anticipated to rise by 17 percent year-on-year, reaching Rs 4,020 crore in Q1FY25 from Rs 3,437 crore in Q1FY24.

-330

July 23, 2024· 11:52 IST

Bajaj Finance Q1 Outlook: Expected to report strong Q1FY25 results

- India's largest non-bank lender, Bajaj Finance, is anticipated to report strong financial results for the April-June quarter of fiscal year 2025.

- Analysts project a robust performance driven by healthy net interest income (NII) and profit growth, bolstered by substantial credit uptake.

-330

July 23, 2024· 11:35 IST

Torrent Pharma Earnings: Company had reported 57% rise in net profit to Rs 449 crore in Q4

- Torrent Pharmaceuticals Ltd had reported 57 percent rise in its consolidated net profit for March quarter at Rs 449 crore from Rs 287 crore in the year-ago period.

- Revenue grew by 10 percent to Rs 2,745 crore from Rs 2,452 crore a year ago.

- Its earnings before interest, tax, depreciation and amortisation (EBITDA) increased 21 percent to Rs 883 crore.

-330

July 23, 2024· 11:19 IST

HUL Q1 FY25 Earnings: Key focus areas, analysts eye metro and tier-3 town demand

Analysts will keep a close watch on urban and tier-3 town demand, the impact of raw material prices on EBITDA margins, and increasing competition from informal market participants.

-330

July 23, 2024· 11:13 IST

HUL Q1 FY25 Earnings: EBITDA margin slight contraction expected

EBITDA Margins: HUL anticipates gross margins to expand by 120-160 basis points. However, the company's EBITDA margin is expected to contract by 10 basis points primarily due to increased advertising expenditures, higher royalty payouts, and the conclusion of the GSK consignment sale agreement.

-330

July 23, 2024· 11:02 IST

HUL Q1 FY25 Earnings: HUL's segmental performance shows diverse trends: home care grows, beauty declines; tough summer impacts food portfolio

Segmental Performance: HUL anticipates varied performance across its segments, with home care likely to grow by two percent, while beauty and personal care revenues are forecasted to decline due to price reductions. The company's food portfolio, including tea, coffee, and functional nutrition drinks, faces challenges due to a difficult summer season. Analysts suggest that laundry products will perform strongly, whereas out-of-home consumption and sales of hot beverages could be weaker.

-330

July 23, 2024· 10:34 IST

Q1 Results 2024 LIVE: Check out the list of Q1 results today

- Ecoboard Industries

- Dynamic Portfolio Management & Services

- Blue Coast Hotels

- Indoco Remedies

- Welspun Specialty Solutions

- Parag Milk Foods

- MIC Electronics

- InfoBeans Technologies

- Surana Telecom and Power

- Rane Engine Valves

- Saven Technologies

- Next Mediaworks

- Spice Islands Industries

-330

July 23, 2024· 10:31 IST

Q1 Results 2024 LIVE: Check out the list of Q1 results today

- Hindustan Unilever

- Bajaj Finance

- Torrent Pharmaceuticals

- United Spirits

- SRF

- Schaeffler India

- Mahindra & Mahindra Financial Services

- Kajaria Ceramics

- Heritage Foods

- ICRA

- Sharda Cropchem

- Steel Strips Wheels

- Thyrocare Technologies

- ICICI Prudential Life Insurance Company

- ICICI Securities

- DCM Shriram

- Huhtamaki India

- AGS Transact Technologies

- EKI Energy Services

- Associated Stone Industries

- Garg Furnace

-330

July 23, 2024· 10:20 IST

HUL Q1 FY25 Earnings Preview LIVE: HUL sees segment growth amidst muted Q1FY25 demand

- Hindustan Unilever (HUL), despite significant segmental volume growth in 75 percent of its business, is expected to experience muted overall demand in Q1FY25, as reported by brokerages.

- Underlying volume growth is projected to remain in single digits, reflecting the broader economic challenges and consumer behavior shifts. Looking ahead, Motilal Oswal anticipates HUL to enhance its volume growth trajectory in FY25 and FY26, underscoring the FMCG major's strategic initiatives amidst evolving market dynamics.

-330

July 23, 2024· 10:00 IST

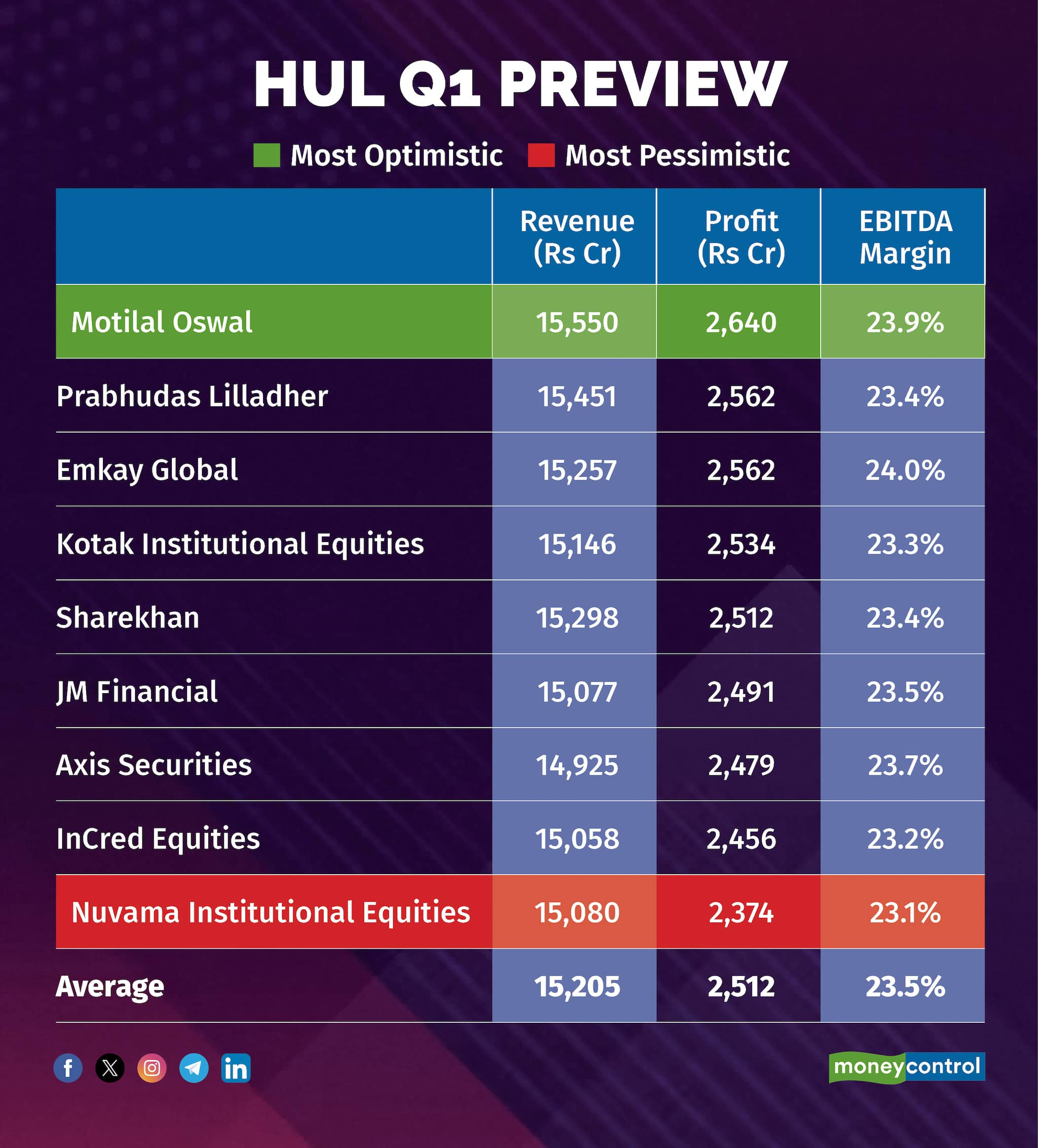

HUL Q1 FY25 Earnings Outlook: Analysts brace for volatility amidst divergent estimates

Earnings estimates of analysts polled by Moneycontrol are in a narrow range, and any positive or negative surprise may trigger a sharp reaction in the stock. The most optimistic estimate sees India’s largest consumer staples firm HUL’s net profit jumping five percent on-year, but the most pessimistic projection suggests that net profit might sink five percent, such has been the divergence.

-330

July 23, 2024· 09:49 IST

Q1 Results 2024 LIVE: Hindustan Unilever to report steady Q1 FY25 results amidst challenging environment

Hindustan Unilever (HUL), India's FMCG giant, is expected to announce its Q1 FY25 earnings on July 23, amidst a backdrop of intense heatwaves and stable commodity prices. Analysts predict a marginal one percent year-on-year increase in revenue, reaching Rs 15,205 crore. Net profit is anticipated to remain stable at Rs 2,512 crore, compared to Rs 2,500 crore reported in the same quarter last year. The company's resilience in maintaining profitability amid external pressures underscores its strategic positioning in the FMCG sector.

-330

July 23, 2024· 09:26 IST

Good morning, readers! Welcome to Moneycontrol's comprehensive coverage of Q1 results today. HUL, Bajaj Finance, Torrent Pharma are among the 34 companies that will announce their results today. Stay tuned for LIVE Updates!