Larsen & Toubro (L&T) is expected to report strong Q4FY24 results, led by improved construction activity across projects during the quarter, strong demand and robust order book.

Momentum in new orders in international hydrocarbon, mobility and power transmission and distribution businesses will also drive growth. The company is due to announce its Q4 result on May 8.

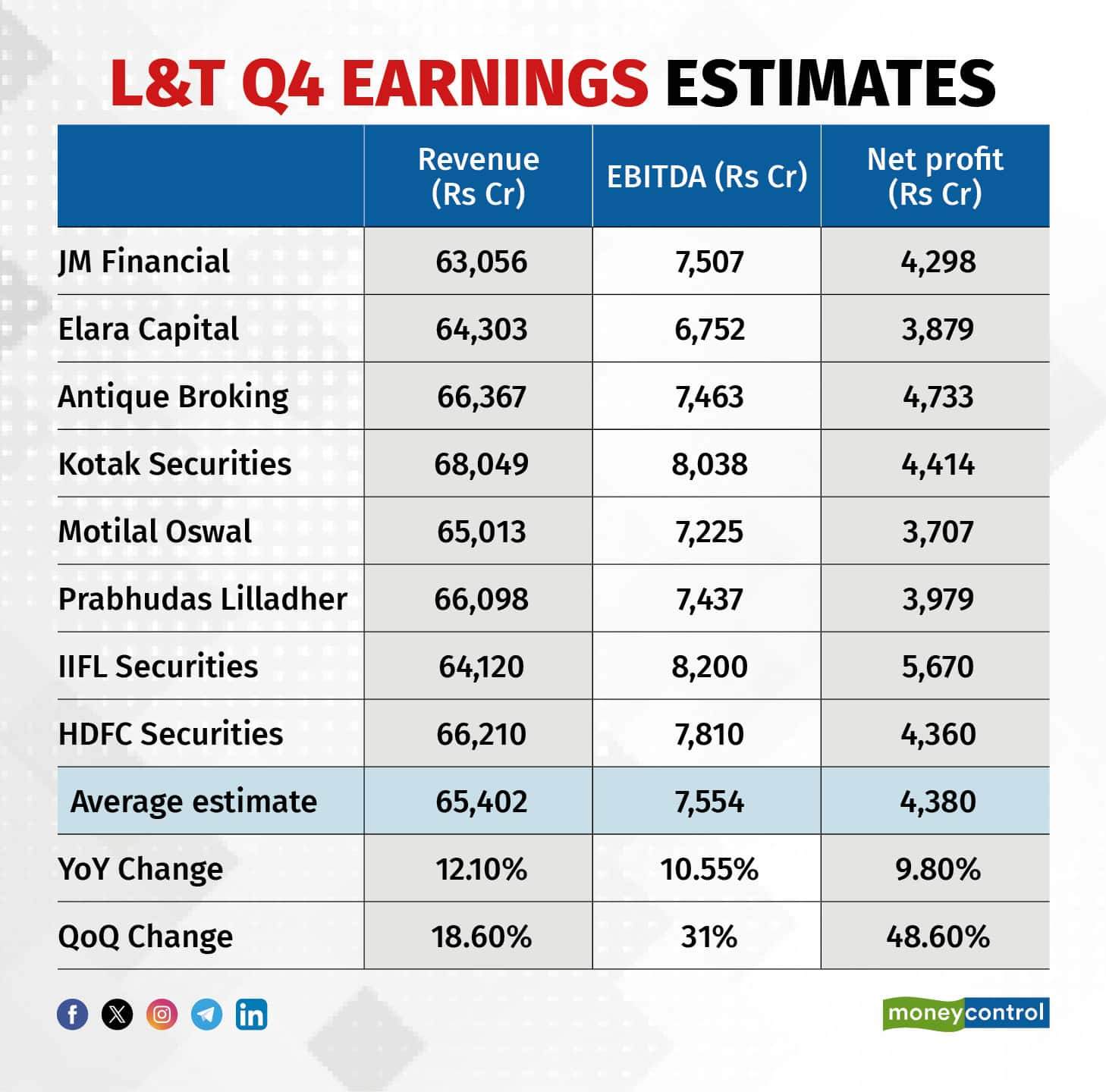

The engineering, procurement and construction (EPC) giant is expected to see its fiscal fourth-quarter net profit rise to Rs 4,380 crore, up 9.8 percent from the year-ago period, according to a Moneycontrol poll of eight brokerage estimates.

The company's revenue is expected to jump 18.6 percent YoY to Rs 65,402 crore. L&T's EBITDA is likely to jump 31 percent on-year to Rs 7,553.9 crore, according to Moneycontrol's poll.

Analysts at Motilal Oswal expect core E&C business EBITDA margin to come in at 9.9 percent, up 70 bps on-year, as legacy orders are near completion. The brokerage noted that for EPC players international ordering activity has been robust, with L&T bagging civil related orders from Saudi Arabia and UAE.

Follow our market blog to catch all the live action

Strong order outlook, margin benefitThe outlook for these geographies is sanguine as crude oil continues to trade above $70 per barrel. “Governments in these countries have laid out a roadmap to pivot away from their dependence on oil, which augurs well for the company in terms of opportunity pipeline,” said Motilal Oswal.

According to Elara Securities, L&T may outperform peers on account of more orders available for execution. Since raw material pricing was benign for Q4, with steel prices down 14 percent on-year and cement prices 2 percent YoY, analysts believe it may prop up the EPC firm's margins despite high competitive intensity.

According to Prabhudas Lilladher, L&T is well-placed to benefit in the long run with strong tender prospects, significant traction in hydrocarbons, renewable energy orders from international markets like Saudi Arabia, and an expected uptick in domestic private capex.

With robust order inflow growth, execution completion of legacy projects, refinancing of Hyderabad metro etc., Nuvama Institutional Equities expects L&T's margins to rise but at a slower pace. “Pickup in core E&C OPMs remains key to L&T,” the brokerage said in its preview report.

Also Read | Brokerages raise Hindalco's target price as subsidiary Novelis beats Q4 estimates

Domestic tender pipeline, margin performance, and the working capital cycle are the key monitorables in the upcoming Q4 earnings. Additionally, attention will be on the execution ramp-up in Saudi projects and the expected pipeline in the Middle East. These factors will provide insights into the company's performance and growth prospects in the near term, said analysts.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.